[PRESS RELEASE – Please See Disclaimer]

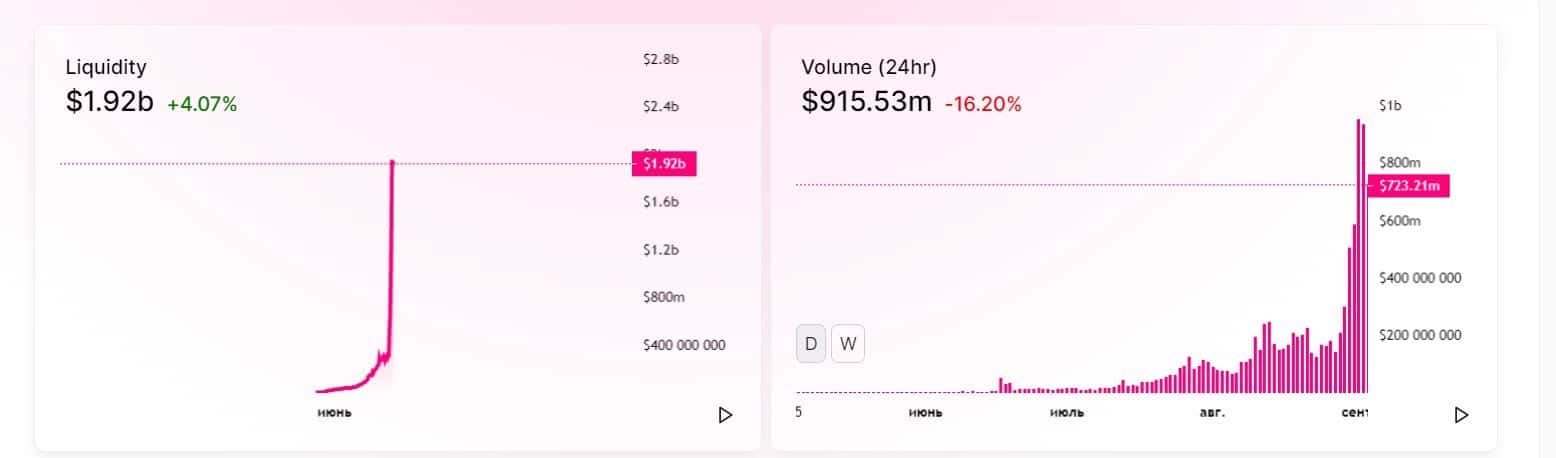

Decentralized finance activity continues to push related services to new records. This time, Uniswap became the first decentralized exchange protocol to exceed the 1 billion mark in 24 hours.

According to the tracking portal CoinGecko, Uniswap is the third largest platform in terms of adjusted trading volume, including centralized ones, second only to Binance and OKEx.Trading volumes are surging on Uniswap and other so-called decentralized cryptocurrency exchanges, challenging established venues like Coinbase while driving up fees and congestion on the Ethereum blockchain.

But is all that good with Uniswap?

Uniswap has been helping us to make trading on the basis of Ethereum for quite a long time, but still many people are in no hurry to move here from the usual centralized exchanges. Stuck transactions, huge Gas fees, and last but not least, manual trading.

How to build your strategy? How to monitor the pool price and liquidity? How not to miss the right price? And many other questions continue to discourage users from switching from centralized exchanges to DEX exchanges.

Thanks to Ethereum’s Uniswap protocol, UniDApp will help get rid of some of these problems. UniDApp platform will provide the user with an opportunity to access such tools as order aggregation, liquidity chart, planning of sales and purchases, analytics, scheduled automatic notifications. For this task, UniDApp will provide a simplified interface that will connect to the Uniswap API.

The popularity and importance of Uniswap are growing every month, which is also facilitated by the simplification of the process of connecting websites and mobile applications to the protocol and interacting with it using the JavaScript SDK. The SDK is regularly maintained with its source code fully transparent and accessible via GitHub, this allows outside observers to validate the code and this best shows the open policy of Uniswap.

The growth and spread of Uniswap will directly affect the demand and development of the UniDApp project, since with it users will be able to on-chain state for liquidity, token values, and exchange rates, and initiates real-time feeds to the dashboard where automated trading can then take place.

Telegram https://t.me/unidapp

Website https://unidapp.app

Twitter https://twitter.com/UniDApp

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato