On 19 March 2024, we announced that we are upgrading our trading technology and noted important changes to our API and Cross Margining system. As mentioned, we have started gradually moving all trading accounts to the new system. We expect this process to take approximately 3 weeks and will announce once the migration is completed.

The team wanted to take a moment to explain some of the changes you may notice during the account migration process and most importantly: some of the benefits you will experience.

Notable changes will include updates to the position table, the Wallet page, and our Cross Margining system.

Please note that you will not need to take any direct action during this migration.

Display Changes to Expect During the Migration

As we move your accounts to the new system, you may notice changes to some of the numbers on your BitMEX trading terminal and Wallets page.

Updates to Displays on the Trading Terminal

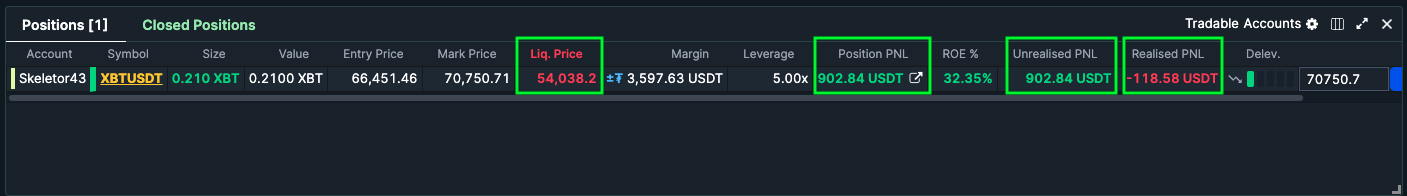

The following fields on the Position table may change (and eventually will across all accounts):

- Unrealised PnL will become the same as Position PnL.

- Liquidation Price will move closer to Mark Price (explained further in detail below).

- Realised PnL may decrease (and Unrealised PnL will increase by the same amount).

The following fields will not change:

- Size

- Entry Price

- Leverage

- Position PnL

We have also changed the Total value displayed in the top right corner of the trading terminal. It now shows the Margin Balance which represents your total equity in the exchange (it previously showed the Wallet Balance which can still be found on the Wallet page and is Margin Balance minus unrealised PnL).

Avail continues to show the Available Margin.

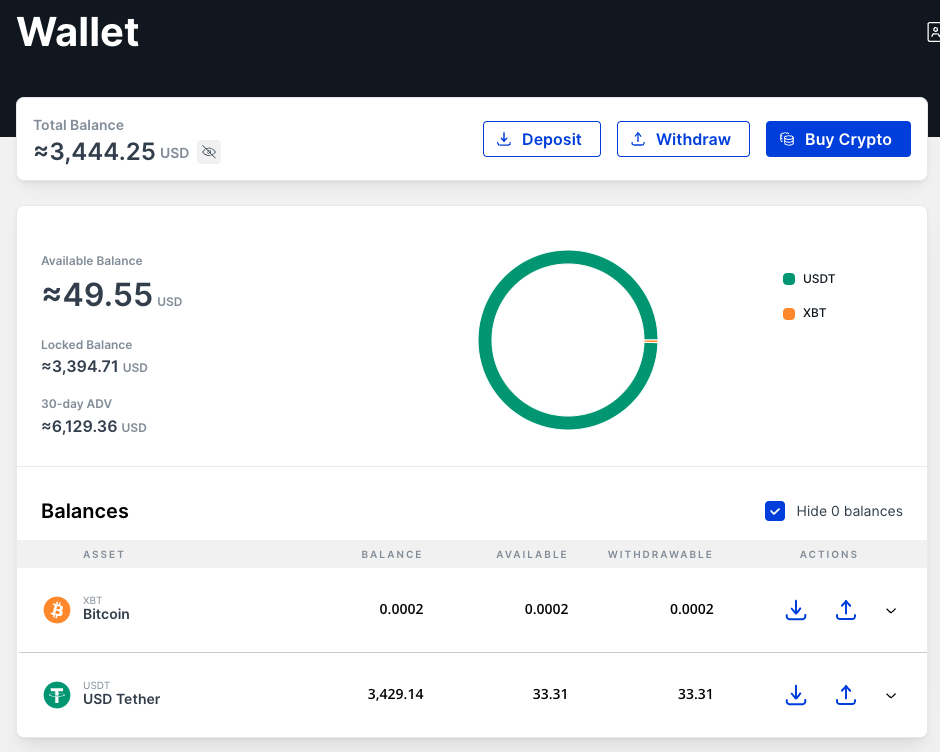

Updates to Displays on the Wallet Page

Aside from the changes you may see on your BitMEX trading terminal, we have also made updates to the Wallet page.

In particular, we’ve tidied up how the columns are displayed:

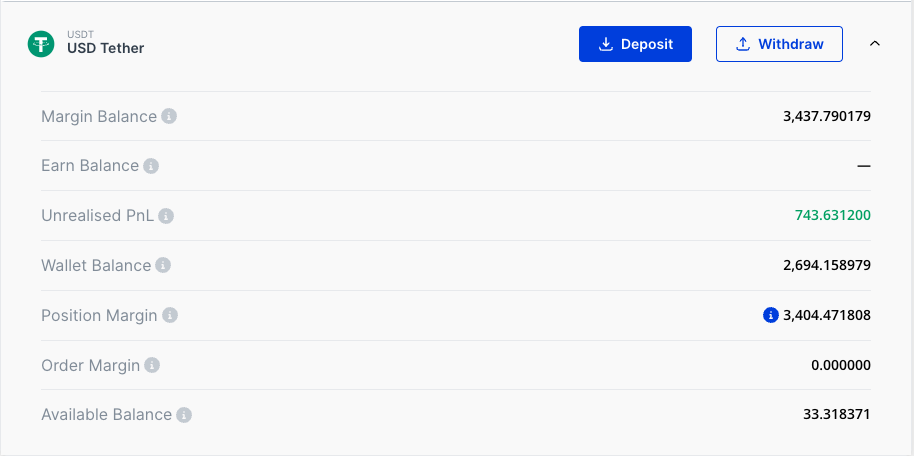

- BALANCE shows what you are worth in each asset (your “mark to market”).

- AVAILABLE shows your balance available to trade derivatives.

- WITHDRAWABLE shows how much you can withdraw, or use for Spot or Convert.

You can also expand each asset (e.g. USDT) to view other details such as Wallet Balance. You can hover over each field’s information icon for a detailed explanation.

Changes to our Margining System for a Better Trading Experience

We have updated how our Cross Margining system works to provide a better trading experience. These changes are also responsible for some of the display changes mentioned above (e.g. liquidation prices being closer to Mark Price). Below is a full overview of what you can expect as a result of the update.

Unrealised PnL can be shared between positions in Cross Margin.

This means that there is no need to realise PnL in one position to support other positions using Cross Margin on the same account with the same settlement currency. During the migration process, for open positions with Cross Margin and PnL realisation enabled, any profit that has been auto-realised will be reversed out into unrealised PnL so you will see a decrease in realised PnL and a corresponding increase in unrealised PnL.

Under Cross Margin, only the Maintenance Margin is locked.

As only the Maintenance Margin is now locked, you can incrementally load up bigger positions. However, please remember to keep an eye on your liquidation prices!

Under Cross Margin, the margin is continually shared across all open positions until there is not enough to cover the required Maintenance Margin.

When this happens, all Cross Margin positions in that account and settlement currency will be liquidated at the same time.

One big advantage is that the new Cross Margin does not increase the probability of liquidation and in most cases it reduces.

However, unrealised profits in a position are not protected like they were in our old system. If you don’t want a position to share margin, you can set it to Isolated Margin or use a Sub Account.

As our liquidation now works differently, changes to the display of liquidation prices have been made.

Liquidation prices are always moving when trading under Cross Margin. In our old system, we show a liquidation price which assumes every position can use all the Available Margin.

In our new system, we use fractional allocation to show a liquidation price that assumes positions share the Available Margin according to their Maintenance Margin.

This is why, when we migrate your account, the displayed liquidation prices will move closer to the current Mark Price.

Please note this does not mean you are more likely to get liquidated – this is just a more realistic view of what could happen.

The changes will also be reflected on your trading charts if you choose to display your liquidation prices there.

Got Questions?

As we understand this may be a big change for some users, here is a list of answers to some commonly asked questions.

Can I use my unrealised PnL for everything?

While unrealised PnL can be used as margin for derivatives positions, only realised balances can be withdrawn, transferred, or used to trade Spot or Convert on BitMEX.

What if I just want to use Isolated Margin?

The experience for positions using Isolated Margin will be identical to the existing BitMEX experience. Please make sure to set your margin to Isolated if you do not wish your positions to share margin.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. You can also follow us on Twitter, or read our blog and site announcements for the absolute latest.

In the meantime, if you have any questions, please contact Support who are available 24/7.

Related

The post appeared first on Blog BitMex