With China making significant strides in crypto and blockchain development, the US Intelligence apparatus is reportedly worried about the US falling far behind its current economic rival.

From crypto mining to central bank digital currencies (CBDCs), there is a popular narrative that Beijing controls vast swaths of the emerging digital economic landscape. A dismissal of the value proposition of digital assets has seen the US seemingly far behind the curve in terms of crypto innovation.

Crypto Arms Race: The Next Theater in the Sino-American Trade Tussle

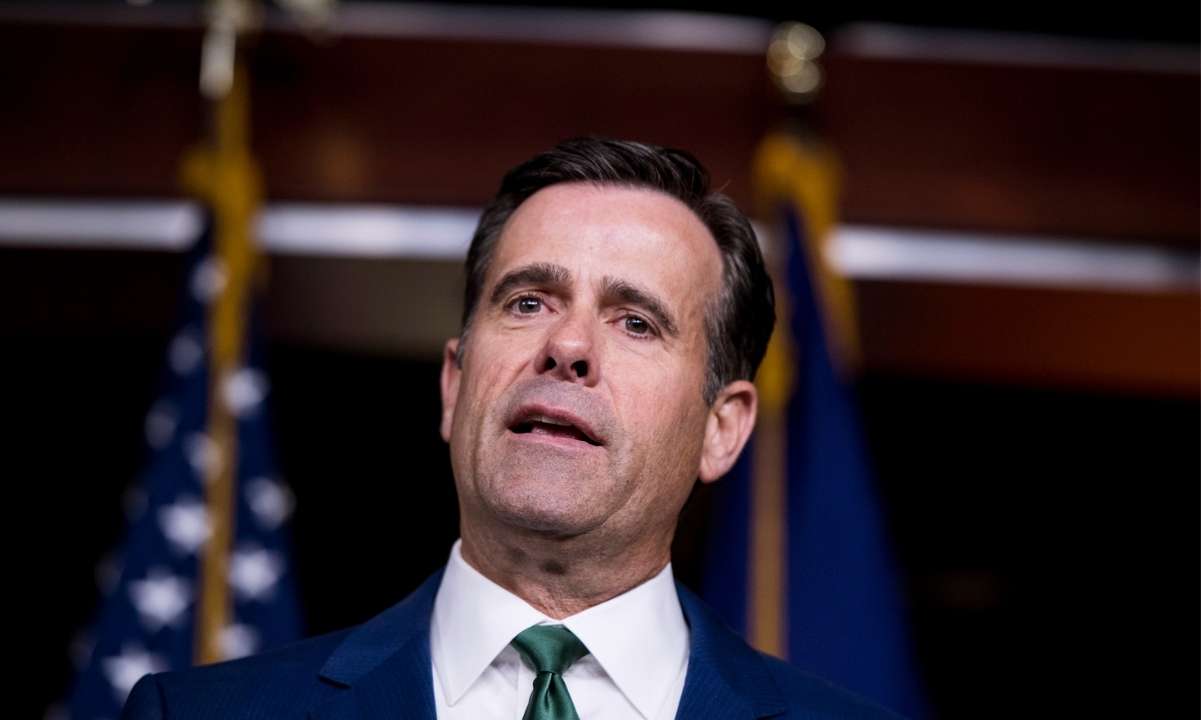

According to the Washington Examiner on November 24, China’s digital yuan seems to pose a national threat in the United States. In a letter by the U.S. Director of National Intelligence John Ratcliffe to Jay Clayton, Chairman of the U.S. Securities and Exchange Commission (SEC), the top intelligence official, expressed worry about China’s accelerated CBDC efforts and how it could be difficult for U.S.-based firms to keep up the pace.

Ratcliffe’s letter also noted China’s dominance in the crypto mining sector. Data from the Cambridge Bitcoin Electricity Consumption Index (CBECI) reveal that China controls 65.08% of the global bitcoin mining market.

China has continued to be progressive with its planned CBDC project. Different parts of the country, along with several institutions, have trialed the digital yuan. Shenzhen conducted a lottery which saw 10 million yuan (about $1.5 million) airdropped to 50,000 winners. Also, the city of Suzhou is planning to test the digital yuan on Black Friday.

The CBDC project could contribute to China’s efforts at internationalizing the yuan for cross-border payment. If China’s digital yuan is used internationally, it could pose a serious threat to the U.S. dollar hegemony.

Regulators Need to Balance Consumer Protection and Innovation Concerns

Commenting on the threat face by the U.S, Ratcliffe informed the Washington Examiner, stating:

“Competing with China is a serious enough challenge without U.S. regulators getting in the way. So our regulatory regime must support American innovation, otherwise American companies are going to be put at such a profound competitive disadvantage that we could permanently lose this race.”

Ratcliffe’s comments echo many of the criticisms levied by US crypto and blockchain stakeholders against regulators in the country. Indeed, several commentators have bemoaned the patchwork of State and Federal regulations that they say are contributing to stifling digital asset innovation in the US.

However, China is by no means a crypto utopia. Back in 2017, the Chinese government rocked the cryptocurrency space by announcing blanket bans on trading and token sales. Over the next three years, several agencies have taken to extend the scope of this prohibition, with authorities currently shining the spotlight on the virtual currency and telecoms industry as part of a clampdown on money laundering.

Featured image courtesy of NBC News.

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO35 code to get 35% free bonus on any deposit up to 1 BTC.

The post appeared first on CryptoPotato