Ever since cryptocurrencies gained popularity as an asset class, tax regulations surrounding it have been problematic and complex for most users. While the US has taken proactive steps to bring greater clarity with regard to the regulatory and compliance-related aspects of crypto, the intricacies of compliance and the consequences of failing to comply remain a burden for most crypto users.

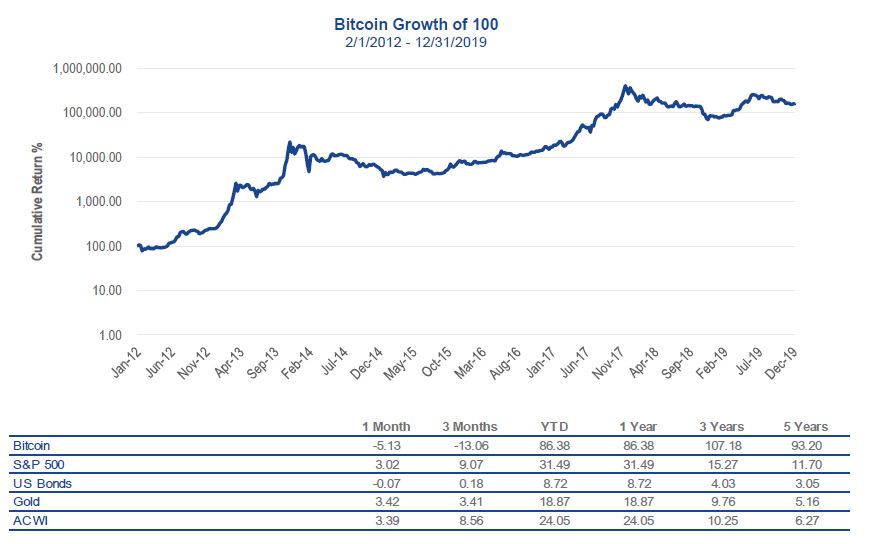

A week ago, Bitcoin went past the $10,000 mark and has stayed there for the most part. Many in the traditional financial sector agree that Bitcoin is a valuable asset that has been performing quite well even in comparison with assets like gold. A recent VanEck report highlighted how Bitcoin outperforms traditional asset classes particularly in long term periods such as 3 and 5 years.

Source: VanEck

Given the increase in the adoption of digital assets and many institutional investors cultivating a more favorable approach towards digital assets like Bitcoin, many believe the US tax policy continues to remain ambiguous and harrowing.

In a recent episode of the Untold Stories Podcast, Crypto Tax Fixer – Clinton Donnelly spoke at length regarding the IRS’ recent inclusion of the section which requires taxpayers to declare whether ” you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?” The new Schedule 1 that was recently announced, while aimed to bring in clarity to the regulation, has also been criticized for the ambiguity that surrounds it, with regard to the next steps for taxpayers.

Donnelly highlighted that at the moment, regulations aren’t really in-place that will help taxpayers declare accurately all their trading activities to the IRS.

He elaborated

“That’s where we’re headed and I think for a couple of different factors, there’s been an international regulation in the US so they’re doing it. They’re going to force all US crypto exchanges to comply with all banking and brokerage regulations, which means that at some point in the future, you’ll get a Form 1099-B just like you do from a brokerage statement, listing all your trades, what you bought it full circle. It’d be very easy for your tax returns. Then it’s not, we’re not there yet.”

However, Donnelly also highlighted that as more people begin to use crypto, US regulators will have to streamline all crypto and compliance processes drastically.

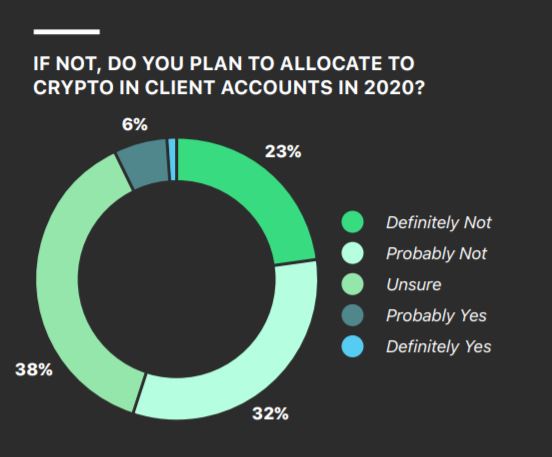

At present, insights from a recent Bitwise survey suggest that around 45% of financial advisers are open to advising clients to invest in crypto-assets in 2020. With such adoption on the horizon for digital assets, the IRS’ approach may be problematic in the long run, adversely affecting the industry and the users.

Source: Bitwise

Regarding the legal and complicated procedures that go into filing crypto taxes, Donnelly emphasized how complicated things have become. He pointed out ” A good crypto tax return involves not just general tax preparation skill. You have to have an accounting skill to do the reconciliation of all the trades, you also need to have the legal skills because the Anti-money laundering forms are very much law-oriented. And when I do a tax return, I call it a great crypto tax return.”

The post appeared first on AMBCrypto