VanEck, New York-based investment management company, recently published a report regarding Bitcoin and its role in the market. By outlining the digital asset’s benefits, the paper showcases its potential to serve as an investment instrument and as a store of value.

Even 1% Bitcoin Can Raise The Portfolio

Founded in 1955, VanEck is a global investment firm that offers investment options in ETFs, Mutual Fund Management, hard assets, precious metals, and more. Recently, the company published a report that compares how different sorts of institutional investment portfolios performed from early 2012 to the end of 2019.

Out of six possible scenarios, three include a small portion of Bitcoin. In fact, the best performing portfolio contains 58.5% equity, 38.5% bonds, and only 3% of the largest cryptocurrency. According to the report, it produced a cumulative return (CR) of over 200 points and an annualized return (AR) of 15.13%.

However, if BTC is extracted, the results would be dramatically less – CR of 110 and AR of less than 10%.

Bitcoin Compared With Investment Portfolios. Source: vaneck.com

Moreover, even a small Bitcoin allocation of 0.5% or 1% could raise the yearly returns with as much as 2%. This may not come as a surprise when one looks at how BTC performed during the last decade.

As Cryptopotato reported, the top cryptocurrency by market cap delivered an unprecedented ROI of 8,900,000%. Furthermore, it dramatically outperformed the biggest stock gainer from the S&P 500, which was Netflix, with 4,177%.

Additionally, the paper indicates that the popular S&P 500 Index, tracking the stock performance of 500 large companies listed on U.S. stock exchanges, is second on that list. During the same period, the S&P delivered a cumulative return of 190 points and an annual return of 14.42%.

Bitcoin As A Store Of Value

VanEck’s paper also examines the largest cryptocurrency as a store of value.

It reasons that Bitcoin and gold possess monetary value because they are scarce and durable. Even though it’s unknown the exact quantity of gold in the world, it’s well-established that there’s a finite supply. Contrary, the largest cryptocurrency is uniquely pre-programmed, and only 21 million bitcoins will ever exist.

The precious metal’s physical form is another benefit according to the report since it can be converted into coins, bars, etc.

Bitcoin, on the other hand, shines due to its digital and decentralized nature, strong privacy characteristics, and “is a bearer asset that can be memorized, making it especially useful in authoritarian regimes.”

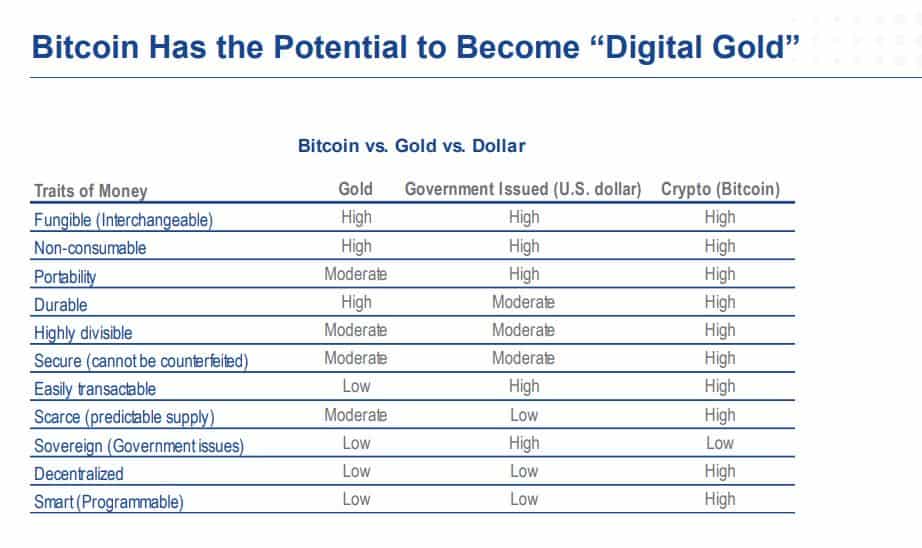

Aside from comparing gold with Bitcoin, VanEck adds a government-issued fiat currency (such as the U.S. dollar) in the mix. The paper examines them in eleven categories, including portability, security, divisibility, and more.

Bitcoin VS Gold Vs USD. Source: vaneck.com

As the largest cryptocurrency outperforms the other two assets in almost all categories, the report concludes that; “Bitcoin has the potential to become “Digital Gold.”

The post appeared first on CryptoPotato