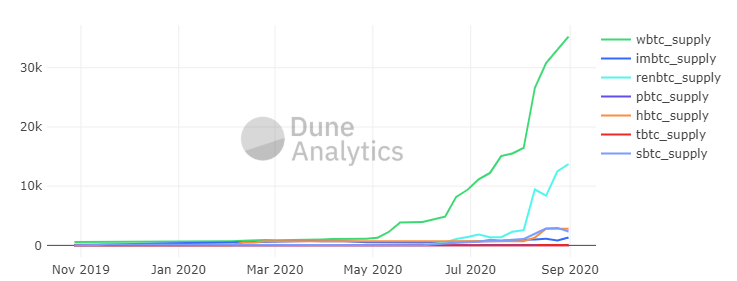

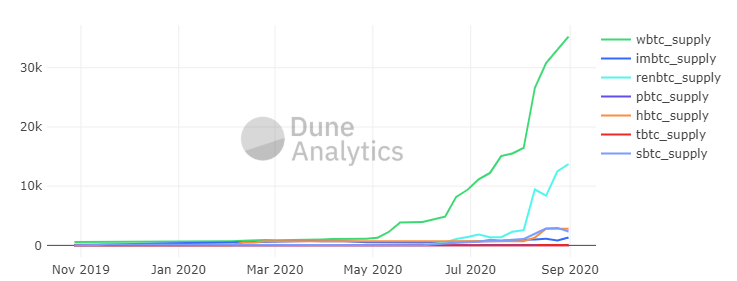

Wrapped BTC aka WBTC locked in DeFi has hit a new high of 33,762 WBTC. At bitcoin’s current price this puts the total value of WBTC to about $400 million. The implications of this are many and the key factors are addressed in this article.

Defi and Bitcoin

With DeFi mania increasing every day it truly feels like a pre-bull run. To add to this, bitcoin decided to accompany this trend by surging to over $11,950. Although there are plenty of DeFi coins in the ecosystem that can make a huge profit, bitcoin has a special place due to its nature and popularity.

Source: Dune

The first major implication is with regard to the value that bitcoin, and indirectly, WBTC brings to DeFi when the bull run is in full force. The value of 33K WBTC locked in DeFi will see a significant boost when bitcoin hits its previous all-time high. In addition to this, more cash will flow from retail to every sector of crypto, and that includes DeFi.

Not only will this further DeFi platforms but the underlying tokens with strong fundamentals and this will mainly be due to FOMO.

The second reason why WBTC will overpower every other bitcoin product on DeFi is simply due to the fact that BitGo supports WBTC. It is clear that DeFi is still in an early stage and losing money to sketchy smart contracts is high. With WBTC there is a potential for recourse with BitGo’s help.

Although one would be sacrificing decentralization to BitGo’s ‘custody’ and shield oneself from DeFi’s buggy smart contracts. Considering how often this can happen, WBTC could be a blessing in disguise.

Another important implication is that WBTC is far greater than renBTC, the latter has been facing flak lately on Twitter since the ren team is solely responsible for approximately 13,300 BTC that are locked in exchange for renBTC.

The post appeared first on AMBCrypto