Japan’s central bank, unlike China, isn’t petrified of capital outflows or investment through cryptocurrency.| Source: Shutterstock

By CCN Markets: Japan’s central bank has reaffirmed the country’s position as one of the world’s most progressive countries with regards to Bitcoin and other cryptocurrencies.

According to the Nikkei Asian Review, a senior Bank of Japan official has stated that the apex financial institution is comfortable with Bitcoin as well as the technology behind it. Per the official, the Bank of Japan’s pro-crypto stance is helped by the fact that the country suffers no capital outflow concerns:

Because of their fear of capital outflows, the Chinese see every financial asset as the enemy. But we don’t worry about outflows. We are in love with the technology behind it and we are in touch with the technology community.

Why Japan promotes Bitcoin

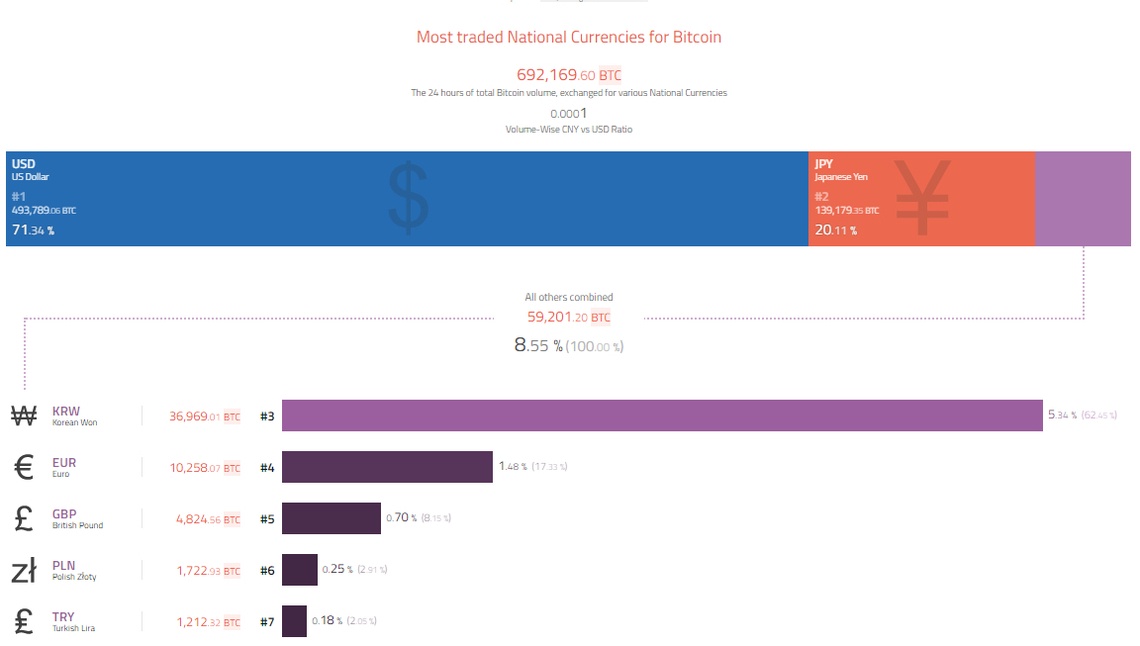

The Japanese publication further quoted the central bank official as saying that “We promote bitcoin but only with controls”. While this might appear radical coming from a central banker, Japan has managed to use its progressive crypto stance to an advantage resulting in a vibrant sector. For instance, the Japanese Yen has been the second-most traded national currency for Bitcoin after the U.S. dollar for a long time.

Per Coinhills, the Japanese yen is used in 20.1 percent of all fiat-to-Bitcoin and/or Bitcoin-to-fiat exchanges globally. This is despite the global use of the yen as a reserve currency being just five percent.

The Japanese Yen is the second-biggest traded national currency for Bitcoin | Source: Coinhills

Pioneer in national cryptocurrency exchange regulation

Among other firsts relating to cryptocurrencies achieved in Japan, the Far East country has pioneered the regulation of crypto exchanges at a national level. Japan has also led in making a distinction between the various cryptocurrencies available. Last year in spring, Japan’s financial regulator, the Financial Services Agency, directed all crypto exchanges in the country to delist privacy coins such as Augur, Dash, Monero and ZCash.

[embedded content]

Some of the recent actions Japan has taken that demonstrate its progressive crypto stance includes placing cryptocurrencies on the agenda of a G-20 meeting in June. The Far East country is also involved in efforts to develop a global payments network for cryptocurrencies. This would be akin to SWIFT (that is used by banks and other financial institutions around the world) but this time for cryptocurrencies.

Japan Bootstraps Regulated SWIFT-Like Global Crypto Payments Network https://t.co/UYkxoLOcNr

— CCN Markets (@CCNMarkets) July 18, 2019

The initiative which was mooted last month is intended to be functional in a couple of years.

This article is protected by copyright laws and is owned by CCN Markets.

The post appeared first on CCN