Yesterday bitcoin observed the second largest negative difficulty adjustment [-16.05%] of all time. The most recent one was after the bitcoin halving when difficulty dopped by -14.56%. There is one interesting connection between these negative adjustments and it will affect not just the miners but also traders.

This article talks about what that is and what to expect.

A blast to the past

Bitcoin’s difficulty adjustment mechanism is perhaps one of the best inventions by Satoshi Nakamoto. The mechanism isn’t complex by any means yet a crucial factor in keeping the bitcoin ecosystem well oiled and working.

Difficulty Adjustments are necessary so that the mining scene doesn’t get overcrowded. It does so by upping the difficulty required to mine so that only the new, improved, and efficient machines are in play while the older, less efficient machines cannot compete.

This also keeps the mining reward being spit out by the blockchain remains at a stable rate. By doing so, the deflationary model of bitcoin is preserved.

The connection between difficulty and price

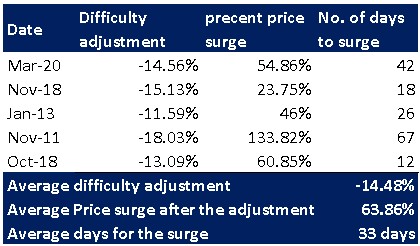

So, far, we’ve had 6 major difficulty adjustments greater than -10% and for each of these, the price almost always surges.

From the table, we can see how true the price surge is after a negative difficulty adjustment of greater than -10%. Any surge between two to ten weeks was recorded for these adjustments and it was found that the highest surge [of 133%] was in 2011 for the largest difficulty adjustment in a matter of two months.

Considering how yesterday’s difficulty adjustment was the second-largest, the implications of this on price might reflect just that. Moreover, bitcoin has been facing problems since it hit $14,000 and hasn’t been able to scale. Hence, this adjustment might just be the blessing in disguise needed for bitcoin.

Additionally, bitcoin is 29% away from its ATH and this surge due to difficulty might just push bitcoin to its former glory in the next 33 days.

Disclaimer

Past performance isn’t an indicator of future performance, hence, care should be advised. Moreover, bitcoin’s narratives are evolving, hence, things might change.

The post appeared first on AMBCrypto