Bitcoin is often called “digital gold” because just like gold, Bitcoin is a valuable, scarce resource that’s resistant to inflation.

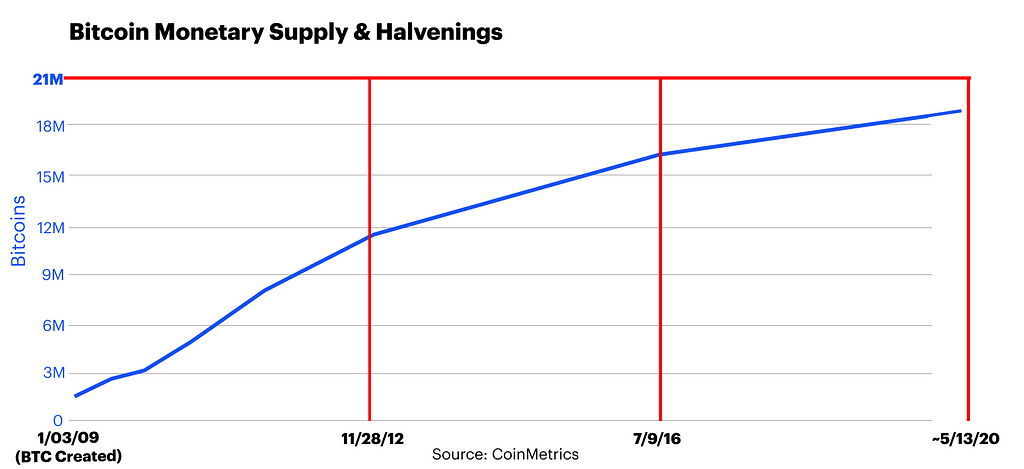

But unlike gold, Bitcoin is digital — it can be sent globally almost as easily as sending an email — and its scarcity is known — while it’s estimated that one could fit all the gold ever mined into a box that is only 65 feet wide, there’s no way of knowing for sure how much gold is still in the Earth. Bitcoin, on the other hand, has a finite supply of only 21 million bitcoin, with only around 3 million left to be mined.

But what gives Bitcoin its scarcity? Just like gold, Bitcoin is also mined, but this is done electronically by a global network of computers competing to verify bitcoin transactions. The reward for participating in this virtual mining is Bitcoin. 12.5 new bitcoins, to be exact, and this reward is given out about every 10 minutes. But this May 2020, this reward will be halved to 6.25 new bitcoins created every ten minutes. This event is known as the Halving.

Approximately every four years, the bitcoin mining reward, also known as the “block reward” is halved. And so on and so forth until all 21 million bitcoins are mined, estimated to happen around the year 2140. It’s impossible for more Bitcoin to ever exist.

This is contrary to fiat currencies, where more money can be printed at the discretion of the government or central bank, potentially leading to inflation.

Because of Bitcoin’s Halving, with less supply being made available over time, Bitcoin is designed in a way where it’s more likely to increase in value rather than decrease like fiat currencies. This feature of Bitcoin’s protocol is what makes Bitcoin more scarce over time, and scarcity is one of the reasons why Bitcoin is sought after by millions of people.

Want to learn more about bitcoin? Visit coinbase.com/what-is-bitcoin and download the Coinbase app to buy bitcoin easily and securely.

What is the Bitcoin Halving? was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

The post appeared first on The Coinbase Blog