Yield farming is a popular topic in the DeFi space for some time now. We know you may have many questions regarding yield farming – What is it? Why is it generating so much buzz?

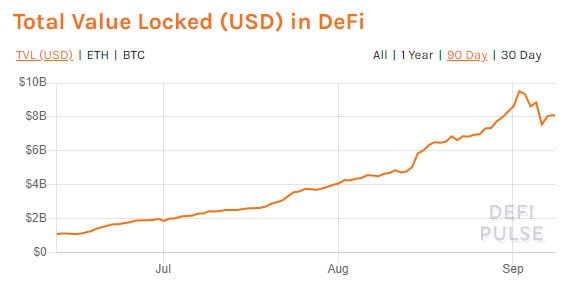

Let’s start with a simple statistic. In 2020, the DeFi space is so far growing at a rate of 150% in terms of total value locked (TVL) in dollars. In comparison, the crypto market capitalization has so far grown at a rate of only 37%.

Many experts give credit to yield farming for the astounding growth of the DeFi space this year. The progress is because of the concept of liquidity farming. It involves both investors and speculators as they supply liquidity to platforms providing lending and borrowing services. In return, the lending and borrowing platforms pay high-interest rates to them. They also receive a part of the platforms’ tokens as incentives.

The current stars of the DeFi space are the liquidity providers. They are referred to as yield farmers. Compound (COMP), Curve Finance (CRV), and Balancer (BAL) are among the leading names.

Compound: The First To Initialize the Liquidity Farming Craze

It all began with the live distribution of Compound’s COMP token on June 14th. COMP is the governance token of Compound. The live distribution of COMP token was very successful. It helped the platform reach $600 million in total value locked (TVL). It was the first time for any DeFi protocol to overtake MakerDAO on the leaderboard of DeFi Pulse.

The distribution of COMP was followed by that of Balancer’s BAL token. Balancer had launched its protocol rewards incentive program in May. They started the live distribution of their BAL token within a few days after COMP. It was also very successful. They were able to reach a figure of $70 million in TVL.

Even though the ongoing yield farming crazy began with COMP, this has been a part of DeFi even before that.

It was Synthetix that came up with the concept of protocol token rewards. Synthetix introduced the concept in July 2019. They were rewarding the users providing liquidity to sETH/ETH pool on Uniswap V1 with token rewards.

Yield Farming – The Answer for DeFi’s Liquidity Woes

What’s the primary concern in the DeFi space? The answer is liquidity. Now, you must be wondering why do the DeFi players need money? For the starters, banks also have a lot of money, and yet they borrow more to run their day-to-day operations, to invest, and so forth.

In DeFi, strangers on the internet provide the required liquidity. Hence, DeFi projects attract HODLers with idle assets through innovative strategies.

Another thing to consider is that some services require high liquidity to avoid serious price slippage and better overall trading experience. Decentralized exchanges (DEX) are a prime example.

Borrowing from users is proving to be quite a popular option. It may even rival the options of borrowing from debt investors and venture capitalists in the future.

So, What is Yield Farming?

To draw a comparison with legacy finance, yield farming could be described as depositing money in a bank. During the years, banks have traditionally paid out different interest rates to those who keep their money in deposits. In other words – you receive a certain annualized interest for keeping your money deposited in a bank.

Yield farming in the DeFi space is similar to this. Users lock their funds with a specific protocol (like Compound, Balancer, etc.), which then lends it to people who need to borrow at a certain interest rate. In return, the platform would give those who lock their funds rewards and sometimes also share a part of the fees with them for providing the loan.

The earnings that lenders receive through interest rates and fees are less significant. The units of new crypto tokens from the lending platform takes the cake when it comes to real payoff. When the crypto lender’s token value rises, the user will make a larger amount of profits.

What’s the Relationship Between Yield Farming and Liquidity Pools?

Uniswap and Balancer offer fees to liquidity providers. They offer it as a reward for adding liquidity to the pools. Both Uniswap and Balancer are DeFi’s largest liquidity pools, as of writing these lines.

In Uniswap’s liquidity pools, there is a 50-50 ratio among the two assets. On the other hand, the liquidity pools at Balancer allows up to eight assets. It also offers custom allocations.

The liquidity providers receive a share of the fee earned by the platform every time someone trades through the liquidity pool. The liquidity providers of Uniswap have seen excellent returns because of the recent increase in the DEX trading volumes.

Exploring Curve Finance: Complex Yield Farming Made Easy

Curve is one of the leading DEX liquidity pools. It was built to provide an efficient way of trading stablecoins. As of now, Curve supports USDT, USDC, TUSD, SUDS, BUSD, DAI, PAX, along with the BTC pairs. Curve leverages automated market makers to enable low slippage trades.

The automated market makers also help Curve in keeping the transaction fees low. It has been in the market for only a few months now. Yet, it is already ahead of many other leading exchanges when it comes to trading volume. The performance of iCurve has been stronger than some of the top names among the yield farming industry.

As of now, it is ahead of Balancer, Aave, and Compound Finance. Curve is the top choice amongst most of the arbitrage traders as it offers a lot of savings during the trades.

There is a difference between the algorithm of both Curve and Uniswap. Uniswap’s algorithm focuses on increasing the availability of liquidity. Whereas, the Curve’s focus is on enabling minimum slippage. Hence, Curve remains a top choice for the crypto traders with a high volume trading.

Understanding the Risks of Yield Farming

Impermanent Loss

There is a reasonable chance of losing your money in yield farming. For specific protocols such as Uniswap, automated market makers can be quite profitable. However, volatility can cause you to lose funds. Any adverse price change causes your stake to reduce in value, relative to holding the original assets.

The idea is simple, and it’s only possible when you’re staking tokens that aren’t stablecoins because this way, you are exposed to the volatility in their price. In other words, if you stake 50% ETH and 50% of a random stablecoin to farm a third token, if the price of ETH drops sharply, you might end up losing more money than you would have if you simply market bought the token that you are farming.

Example: You stake 1 ETH (priced at $400) and 400 USDT to farm YFI while its price is $13,000 (the example is not based on existing liquidity pools.) Your daily ROI is 1%, meaning that you should earn about $8 worth of YFI every day for your $800 initial investment. However, because of severe market volatility, the price of ETH drops to $360, and you’ve lost 10% of your ETH while earning, let’s say, $8 of YFI. If you had market bought $800 of YFI instead and its price didn’t move, you would have preserved your value.

The concept dubbed “Impermanent Loss” is explained at length in this article by Quantstamp.

Smart Contract Risks

Hackers can exploit smart contracts, and there are many examples of such cases this year. Curve, $1 million compromised in bZx, lendf.me are only a few examples.

The DeFi boom has led to an increase in the TVL of nascent DeFi protocols by millions of dollars. Hence, attackers are increasingly targeting DeFi protocols.

Risk Within the Protocol Design

Most of the DeFi protocols are at a nascent stage, and hence, there is a possibility of gaming the incentives. Take a look at the recent events of YAM Finance, where an error in the rebasing mechanism caused the project to lose over 90% of its dollar value in just a few hours. Although, the development team had clearly disclosed the dangers of using the unaudited protocol.

High Liquidation Risk

Your collateral is subject to the volatility associated with cryptocurrencies. The market swings can also put your debt positions at risk. Thus, it may become undercollateralized. You may also have to face further losses because of inefficient liquidation mechanisms.

DeFi Tokens are Subject to the Bubble Risk

The underlying tokens of yield farming protocols are reflexive. Their value may increase with an uptick in its usage. This reminds the early days of the 2017 ICO boom. We all know how it ended. The DeFi boom might be different; however, most of the projects enjoy the hype and not their utility in reaching higher than expected market caps.

Rug Pulls

It’s important to keep in mind that on platforms such as Uniswap, which is at the forefront of DeFi, anyone is free to pull their liquidity off the market at will unless it’s locked through a third-party mechanism.

Additionally, in a lot of the cases, if not in most of them, the developers are in charge of huge amounts of the underlying asset and they can easily dump these tokens on the market, leaving investors with a sour taste. The most recent example comes from what was touted as a promising project called Sushiswap where the lead developer dumped his tokens worth millions of ETH, crashing the price of SUSHI by more than 50% in an instant.

Conclusion

Yield Farming has become the latest trend among crypto enthusiasts. It is also attracting many new users to the world of DeFi.

Yet, one must not forget that there are serious risks associated with it. Impermanent loss, smart contract risks, and liquidation risks are a major concern to be accounted for.

Even though it might be particularly profitable, it’s important to consider these challenges and only use capital that you can afford to lose.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato