New data reveals Bitcoin’s true value is way less than you probably think – but that’s not necessarily a bad thing for BTC. | Source: Shutterstock

New data reveals Bitcoin’s true value is way less than you probably think – but that’s not necessarily a bad thing for BTC. | Source: Shutterstock

Bitcoin’s reported $172 billion market cap may be a point of pride for cryptocurrency enthusiasts everywhere, but how accurate is it as a measure of Bitcoin’s worth?

Not much.

In fact, new data from CoinMetrics suggests the true Bitcoin price amounts to far less than we’re led to believe.

Bitcoin: ‘Market Cap’ Diverges Wildly From ‘Realized Cap’

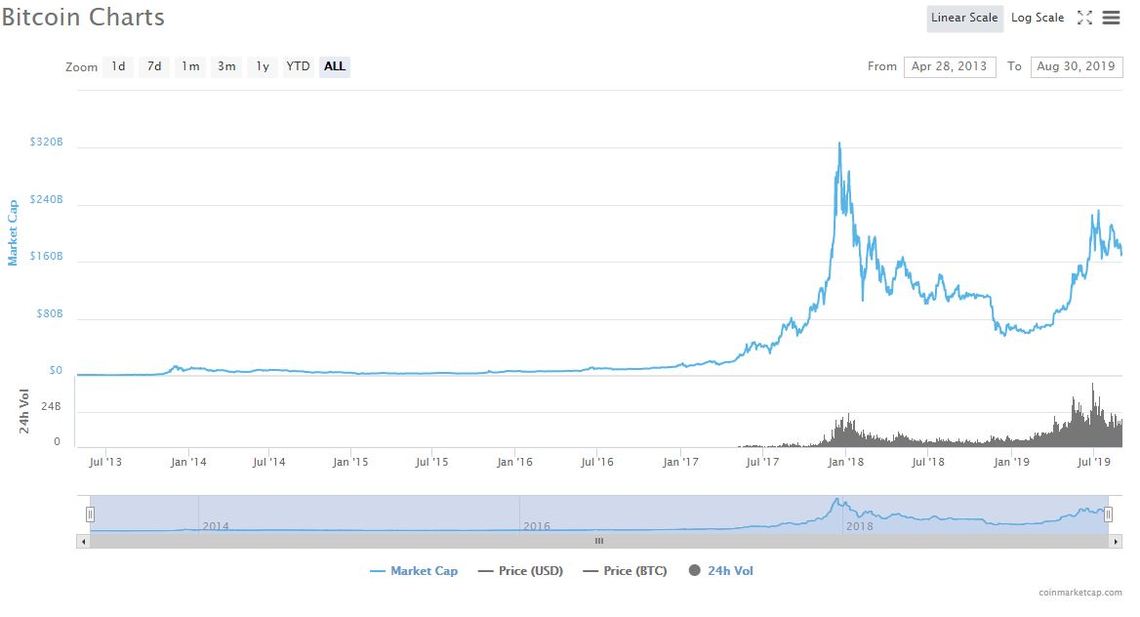

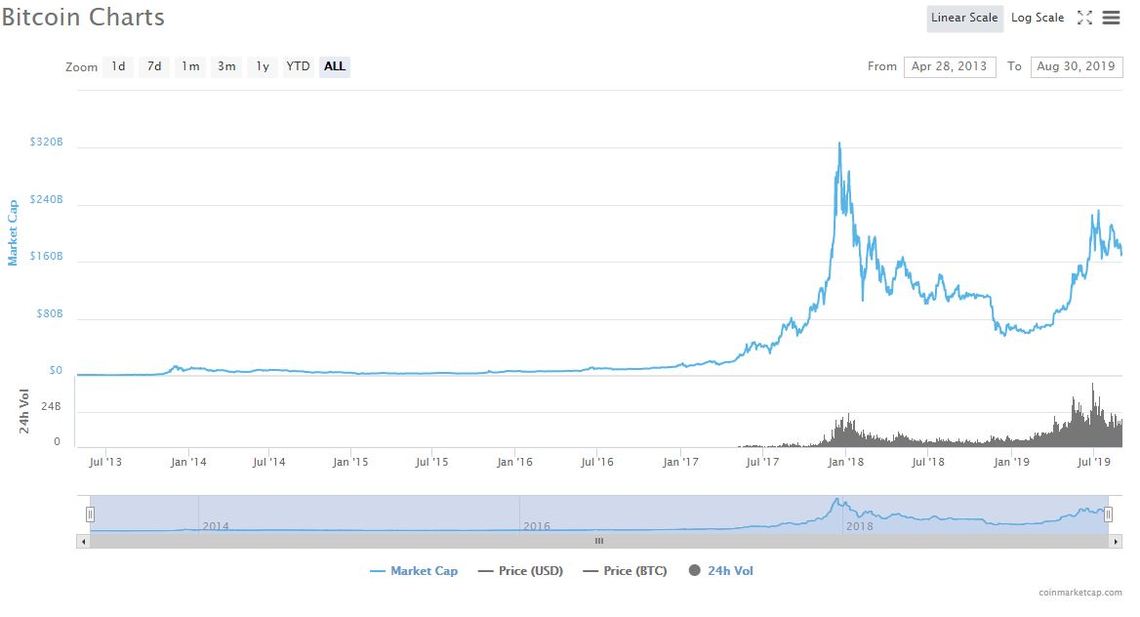

The market cap of Bitcoin is calculated by multiplying the number of coins in circulation by the current coin price. Hence 17,905,500 BTC at $9,605 per coin results in a market cap of $171.9 billion as I write this.

Bitcoin’s nominal market cap is $171 billion, but it might be worth much less. | Source: CoinMarketCap

Bitcoin’s nominal market cap is $171 billion, but it might be worth much less. | Source: CoinMarketCap

But this method assumes all coins have the same market value, when in fact most were bought at different times – and at radically different prices.

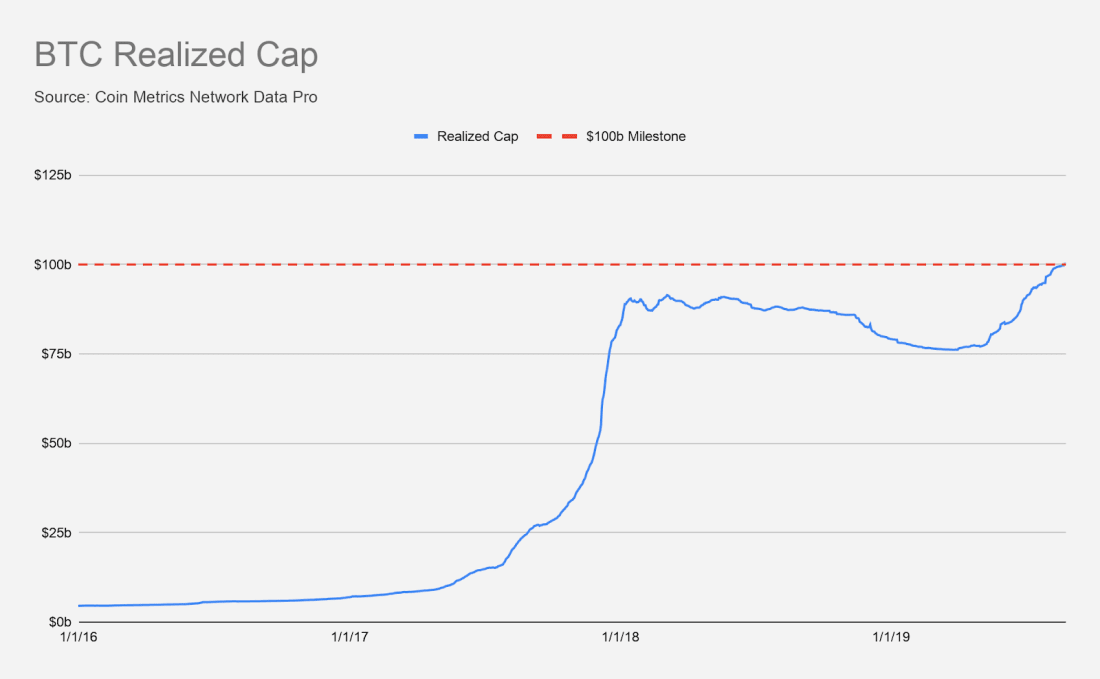

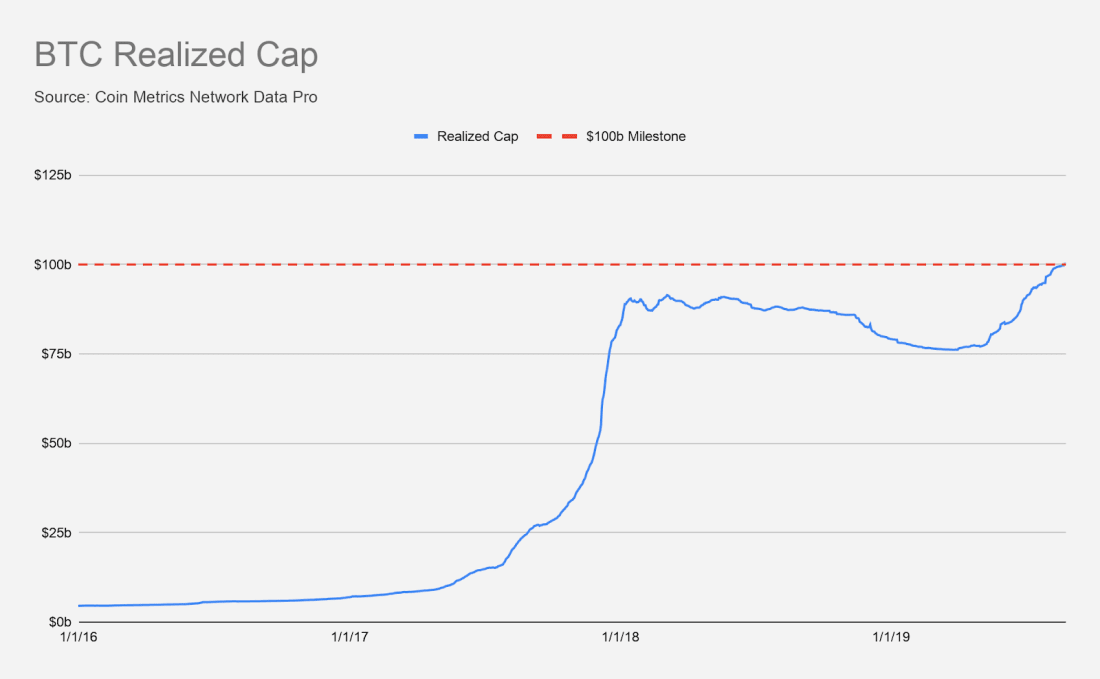

According to CoinMetrics, “Realized cap” takes this into account, rather than quote a price that values nearly 18 million coins – many of which are lost forever – based on what the last one traded for:

“Realized cap, on the other hand, values each coin at the time it was last exchanged. So if a coin was last touched for $2,500 in 2017, that particular coin would be priced at $2,500 instead of the current market price.”

Using this method reveals Bitcoin’s total realized market cap to be just $100 billion – a 41% reduction on what’s displayed on CoinMarketCap.

In fact, Bitcoin’s realized cap only just crossed the $100 billion barrier on August 25th. That’s right, the “realized Bitcoin price” just hit a new all-time high, even though BTC is nominally worth less than half of its December 2017 peak.

Bitcoin’s realized cap only just crossed the $100 billion barrier – a long way off its $171 billion market cap. | Source: CoinMetrics

Bitcoin’s realized cap only just crossed the $100 billion barrier – a long way off its $171 billion market cap. | Source: CoinMetrics

These calculations use the last time a coin was transferred to calculate the price it was purchased at, so there is still room for error.

However, it’s not all bad news, because the same data shows that Bitcoin is slowly drawing closer to its true value.

BTC Sellers Are Disappearing Fast

The chart below shows the distribution of holders ordered by the price range at which they bought Bitcoin. As you can see, the largest weighting of holders can be found in and around the $10,000 range.

In August 2019, most Bitcoin holders are found to have bought in close to, or below, the $10,000 price point. | Source: CoinMetrics

In August 2019, most Bitcoin holders are found to have bought in close to, or below, the $10,000 price point. | Source: CoinMetrics

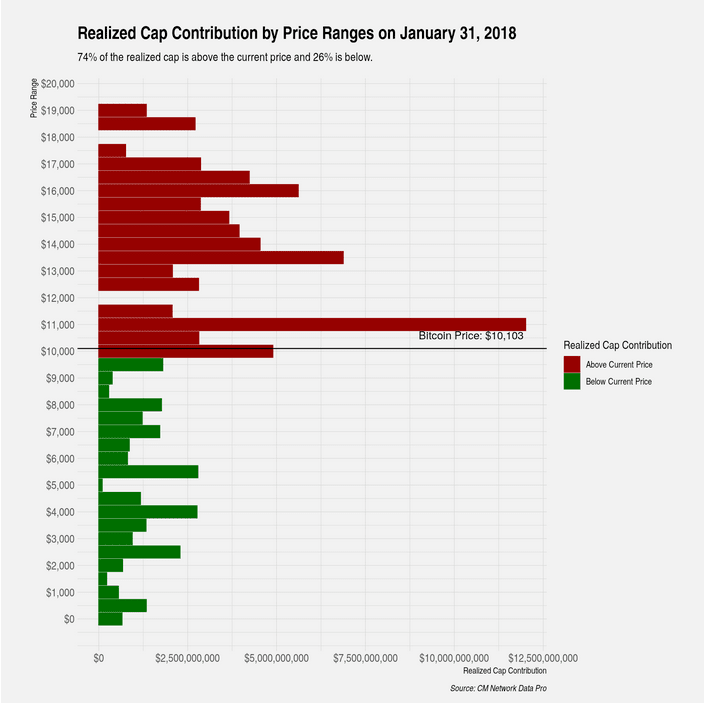

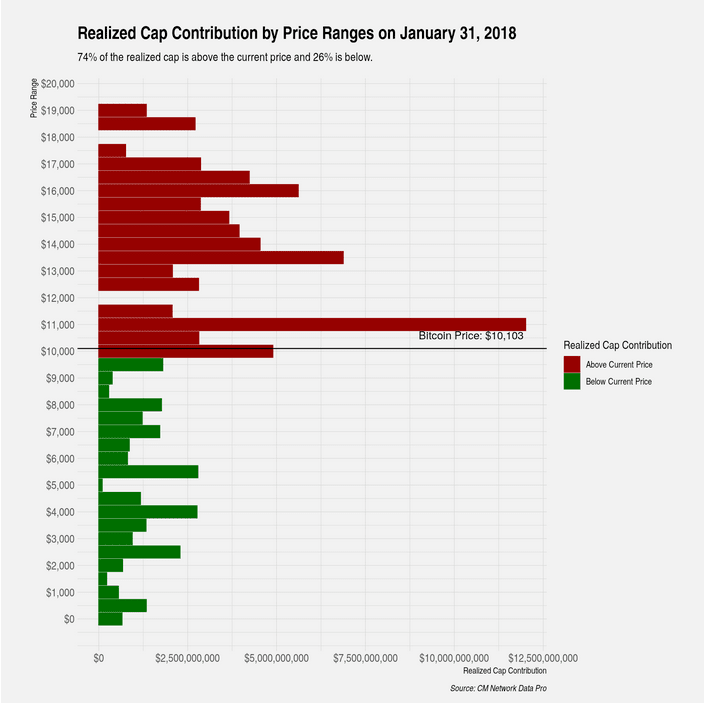

However, this wasn’t always the case. As recently as January 2018, the majority of coin holders were those who had bought in closer to the $20,000 range, as seen below.

As recently as January 2018, most Bitcoin holders were those who had bought in above the $10,000 price point, closer to the $20,000 peak. | Source: CoinMetrics

As recently as January 2018, most Bitcoin holders were those who had bought in above the $10,000 price point, closer to the $20,000 peak. | Source: CoinMetrics

The reduction in those red bars over the past 18 months is a sign that many high-priced holders have sold off their assets.

This is good news for Bitcoin’s price stabilization since it means the majority of those who are most likely to sell have already done so.

Click here for a real-time Bitcoin price chart.

The post appeared first on CCN