Bitcoin futures open interest on CME has dropped following the drop in spot prices across exchanges. However, the drop started on September 15, with a recovery last week, and it has continued. Though open interest and trading volume on derivatives exchanges doesn’t have a direct impact on the price, it has an impact on institutional investors and retail traders on derivatives exchanges. The recent drop to $10 billion has led to 13 times sell liquidations on BitMEX compared to buy, and there is increased pressure on the sell-side.

But why is the open interest on derivatives exchanges dropping? And where are institutional investors headed with their plans? HODLing my be one of the reasons, however, institutional investors who accumulated Bitcoin at the $8k level may be inclined to sell in the following weeks. $8k level has been considered the fair price for Bitcoin based on data from coinfairvalue.

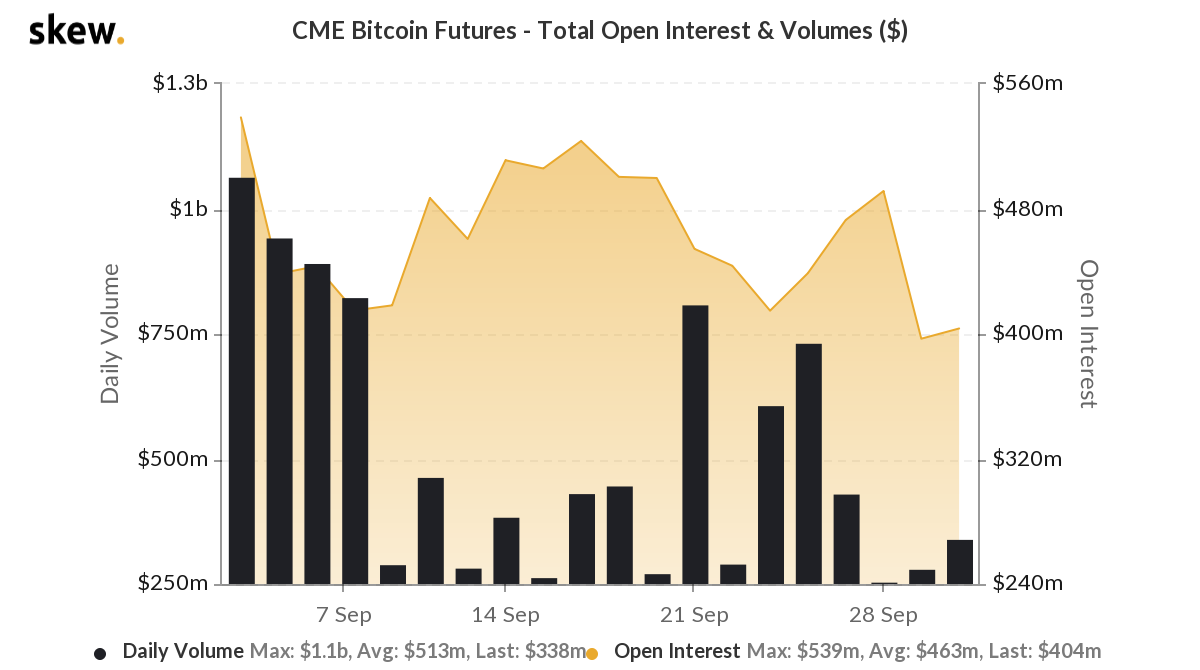

CME’s charts have recorded a drop in trade volume for the entire month of September, with the exception of a few days of increased trade before the options expiry.

Source: Skew

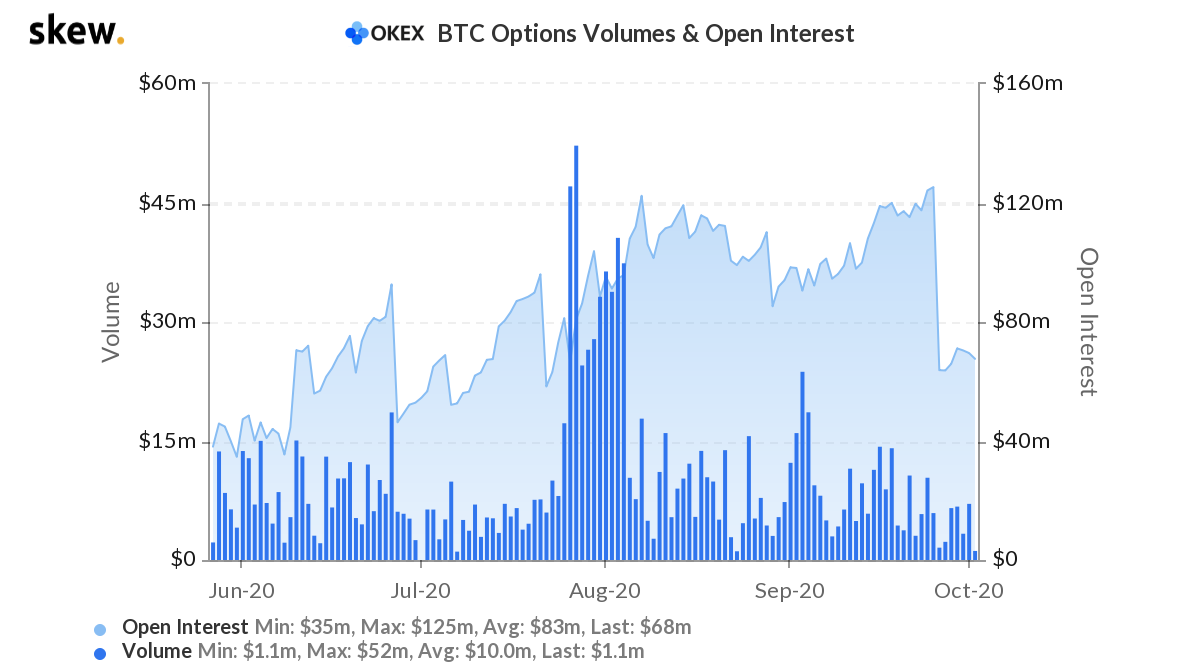

Similar activity levels are observed on exchanges like OKEx, Bybit and Huobi Futures. On OKEx open interest dropped in the last week of September and volume is below $15 million for the entire month of September.

Source: Skew

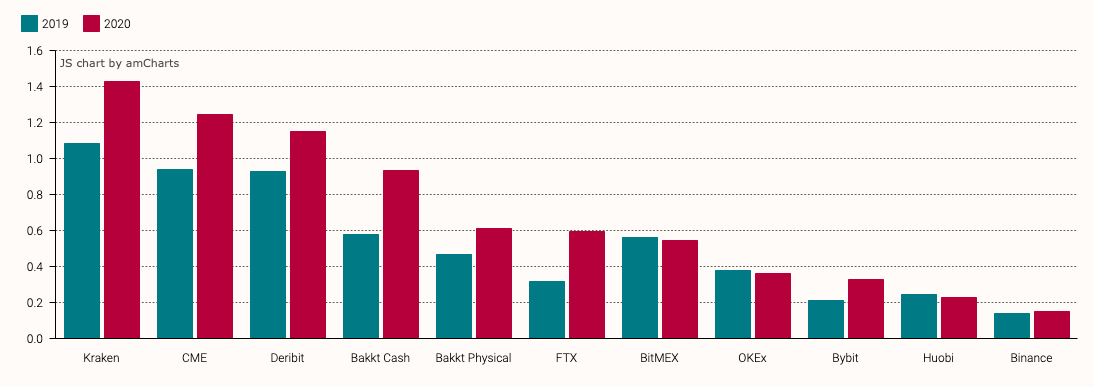

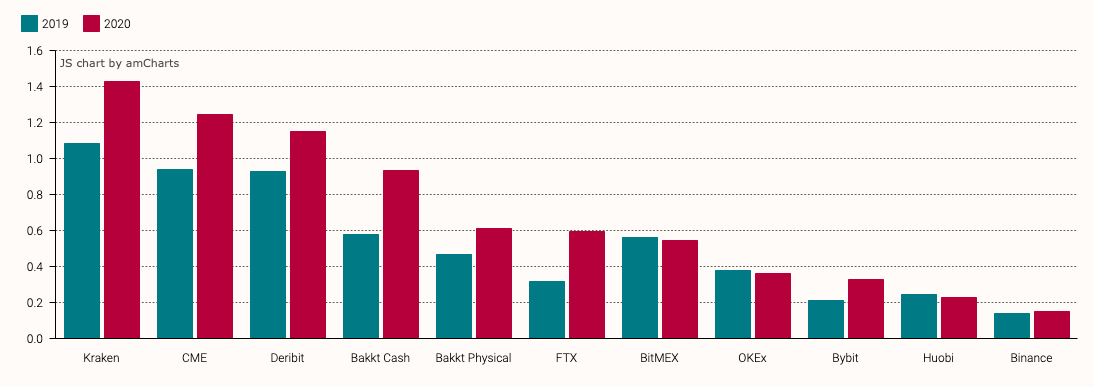

Where is institutional interest, if not on derivatives exchanges? There has been an increase in the HODLing activity since the beginning of 2020. This stems from the insight that retail and institutional traders on exchanges like Binance close their positions much faster than exchanges like CME or Deribit.

Source: Zubr Research Report

There is a rise in this trend in 2020 and the gap in open interest and trade volume has widened considerably on derivatives exchanges like CME, Bakkt, and Deribit. There may be a reversal in trend if institutional investors brought HODLed Bitcoin to exchanges. In the recent past, Bitcoin supply to exchanges has dropped considerably on both spot and derivatives exchanges. If this changes, and the inflow of BTC on exchanges increases, there may be an increase in trade volume on spot and derivatives exchanges. Bitcoin futures’ trading volumes hit over $4 trillion in 2019 and a high percentage of this growth came from institutional investors on CME and Bakkt. Looking at the charts, it is evident that institutional investors on both CME and Bakkt have adopted a long-term outlook and are not directly affected by the short term price swings.

Correlation of traded volume is similar on most spot exchanges however it differs on CME owing to institutions. So the recent drop in Bitcoin’s price may or may not increase speculation or open interest on derivatives exchanges. There is a possibility that institutions continue in HODL mode, for now, waiting this one out. In this case, there may be a further drop in both open interest and trade volume on CME.

The post appeared first on AMBCrypto