The most recent Bitcoin rally was good, even though we did not hit $16,000 or go beyond it. This was a much-needed pump after the much-anticipated Bitcoin halving and the Black Thursday crash back in March. However, an interesting takeaway from the rally, if one were to look closer, was the identity of who helped with the said rally.

More importantly, who drove the recent rally?

Was it retail? High net-worth individuals? Institutions?

One thing that needs to be understood here is that Bitcoin is largely a retail market and hence, retail will always be a force that needs to be factored in. However, while retail has played its part, this rally seems to have been fueled by high net-worth individuals, with the same confirmed by using on-chain data.

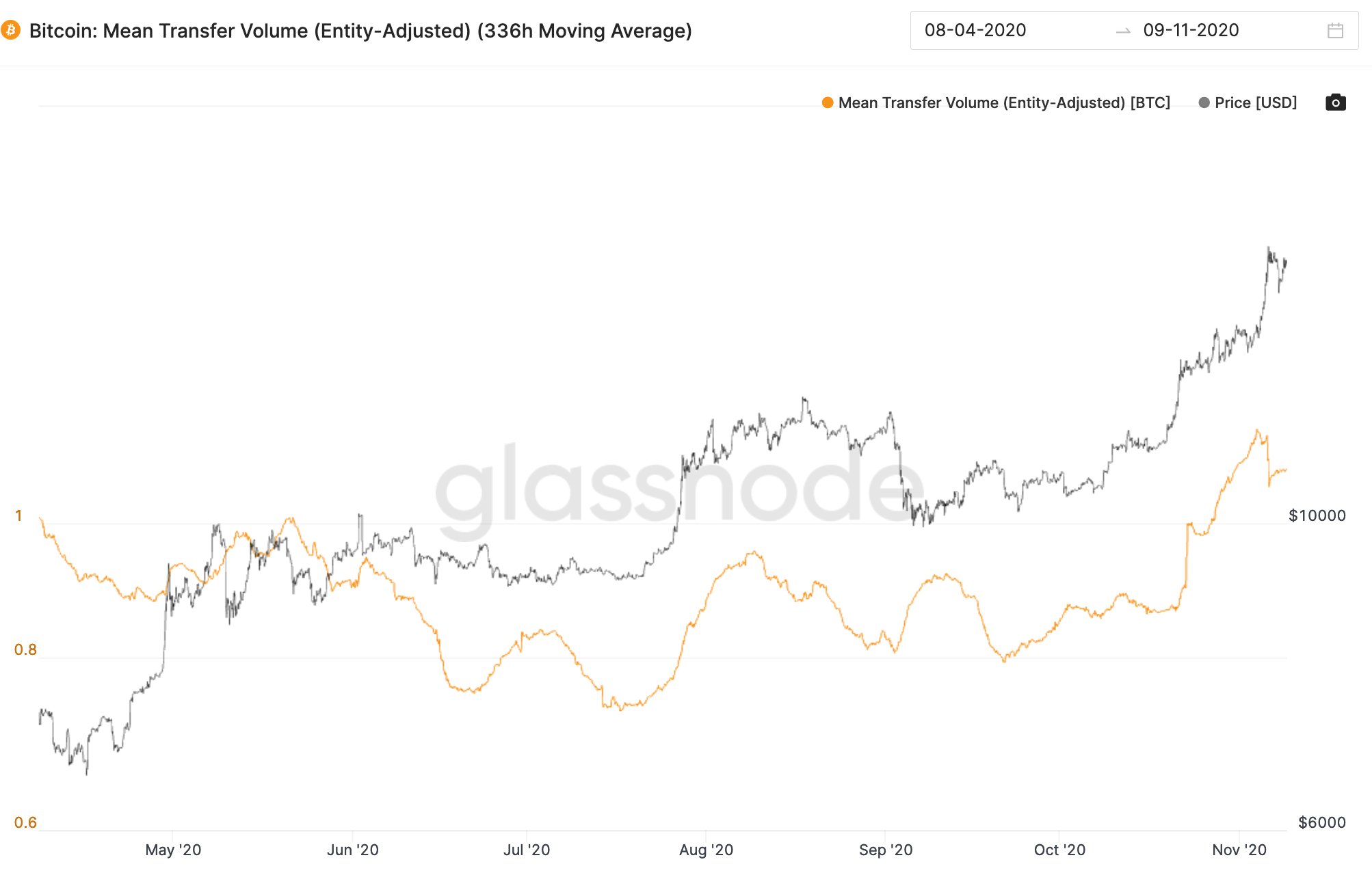

Bitcoin Mean Transfer Volume

Source: Glassnode

Bitcoin’s mean transfer volume measures exactly what it says, the average value transferred on-chain.

Lately, this has been on the surge, pointing to more and more participants coming in. Since this is not just the total value transferred on-chain, this metric gives a sense of the type of investors – high network individuals.

The chart shows that the activity of these users increased rapidly during the recent market surge.

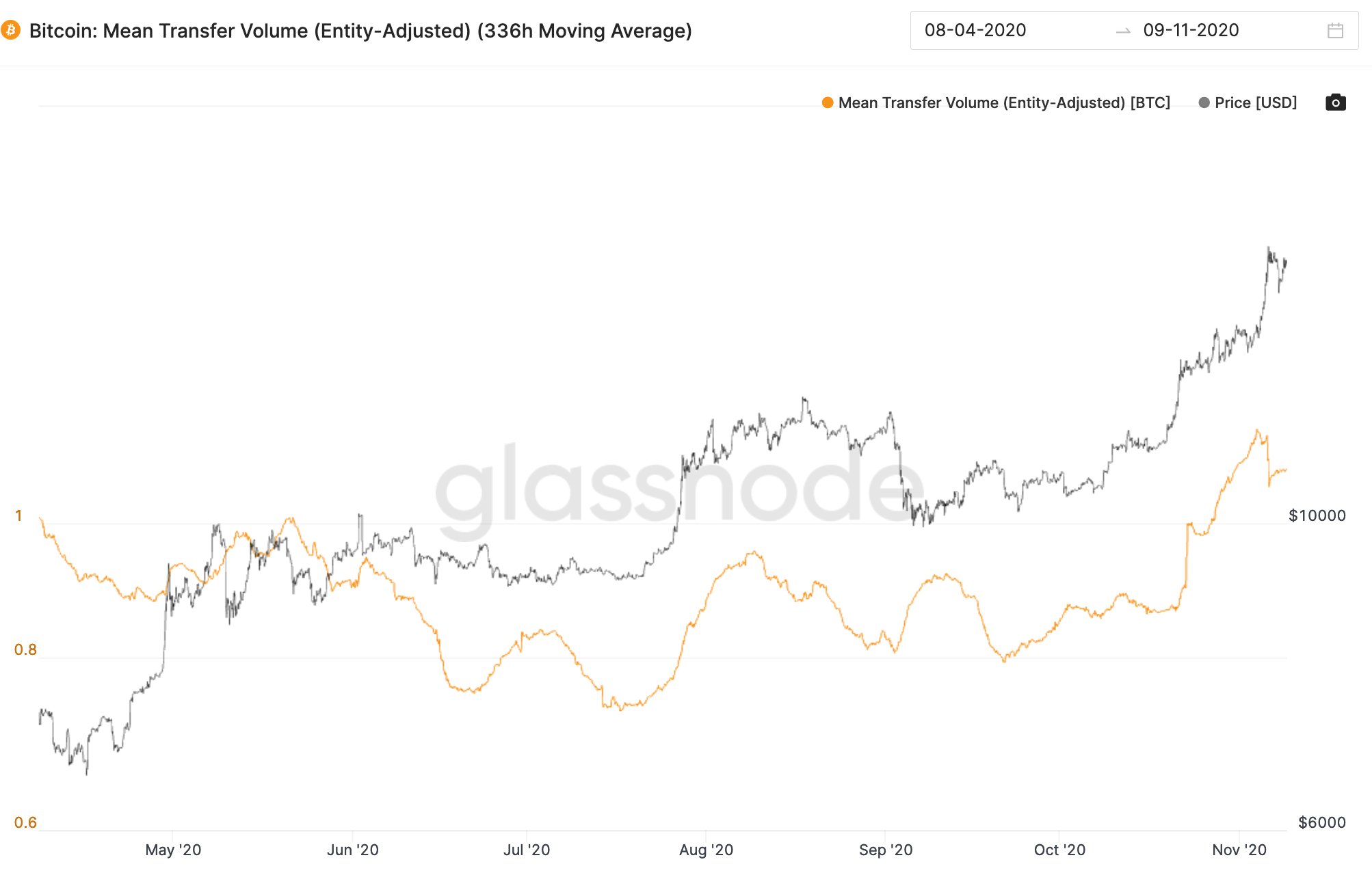

Rate of investors

Source: Glassnode

The attached chart highlights the new investors coming into the market. Adding this information to the above shows that these investors are brand new, meaning new money is entering the market.

Both these metrics inform how the recent rally wasn’t a fluke as it was supported by volume and backed by real, on-chain data.

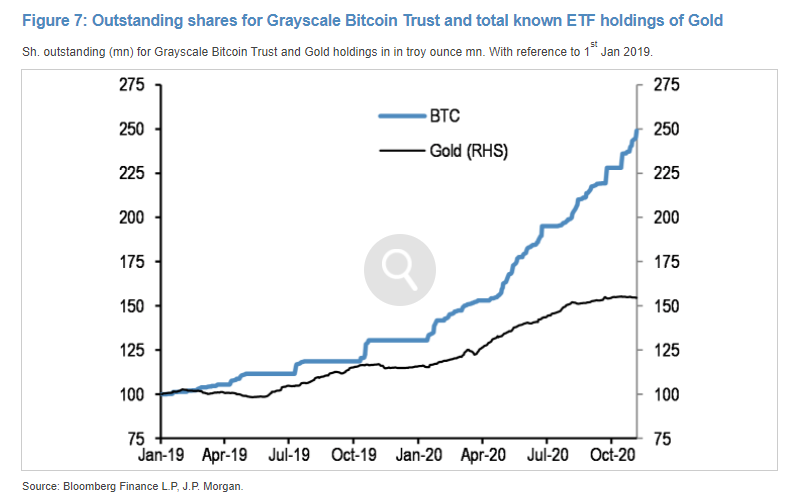

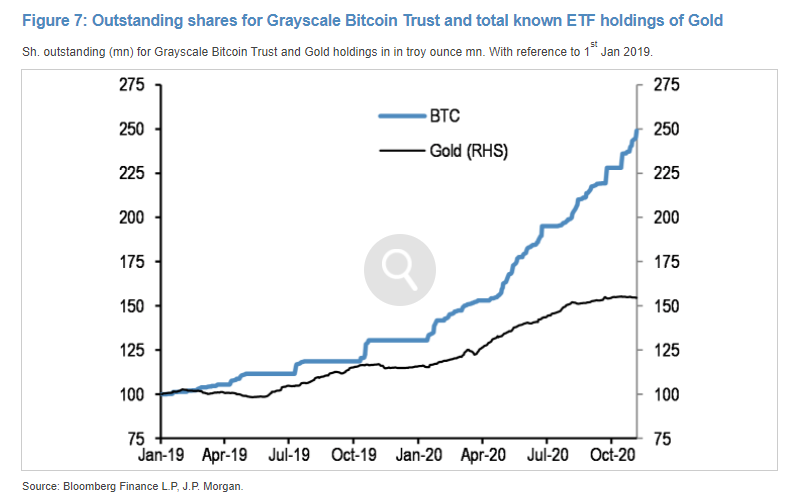

When also considering the decreasing Gold ETF shares and increasing Grayscale ETF shares, it all comes back around, a full circle per se.

Source: Twitter

Interestingly, the same was observed by a recent JP Morgan report, one that argued people might be leaving Gold ETFs for Bitcoin.

“…This contrast lends support to the idea that some investors that previously invested in #gold ETFs such as family offices, may be looking at #bitcoin as an alternative to gold.”

The post appeared first on AMBCrypto