With the defi and the yield farming frenzy spreading like wildfire, it feels like the start of a bull run. A number of parallels can be drawn between the upcoming rally and the 2017 bull run.

But are we ready for the next bull run?

As addressed in the previous article, there are three aspects to answer the question. We have to take a look at:

- The crypto populace

- Blockchain networks

- Exchanges

The first two points were addressed in-depth in the previous article and this article focuses solely on exchanges and if they are ready.

The cryptocurrency ecosystem has a great many centralized exchanges like Binance, Coinbase…the list goes on. However, almost all of these exchanges have either suffered a shutdown/outage or a hack. Some have experienced both.

Incidents surrounding cryptocurrency exchanges are varied; from Bitfinex’s two large hacks to the death of Gerald Cotton and the eventual bankruptcy of the Quadriga. Hacks and stolen bitcoins date far back to 2011, with the earliest hack leading to the loss of 25,000 BTC. The user who stored his bitcoins on a pc wrote on Bitcoin Forum “I just got hacked“.

To say the least, exchanges have been a point of failure when it comes to protecting funds. The past is proof that exchanges could yet again be the target of such hacks, should the bull run begin in full force.

Exchanges

To this day, most exchanges face downtime when bitcoin becomes volatile. This occurs despite having more than 2 years to develop and stress-test systems. Exchange shutdown has become a frequent occurrence. Take, for example, Coinbase, and its multiple shutdowns even with a small move of 10% in bitcoin, or when Kraken and other US exchanges shut down during the weekend crash on 10 May 2020.

In February, Binance, the well-known exchange shut down trading for six hours due to system maintenance and in March, both Gemini and BitMEX faced a downtime.

Despite being almost 3 years into the bear market, exchanges seem to have remained the same. The decentralized, pseudonymous nature of crypto that makes it appealing to the mass, also attracts hackers alike.

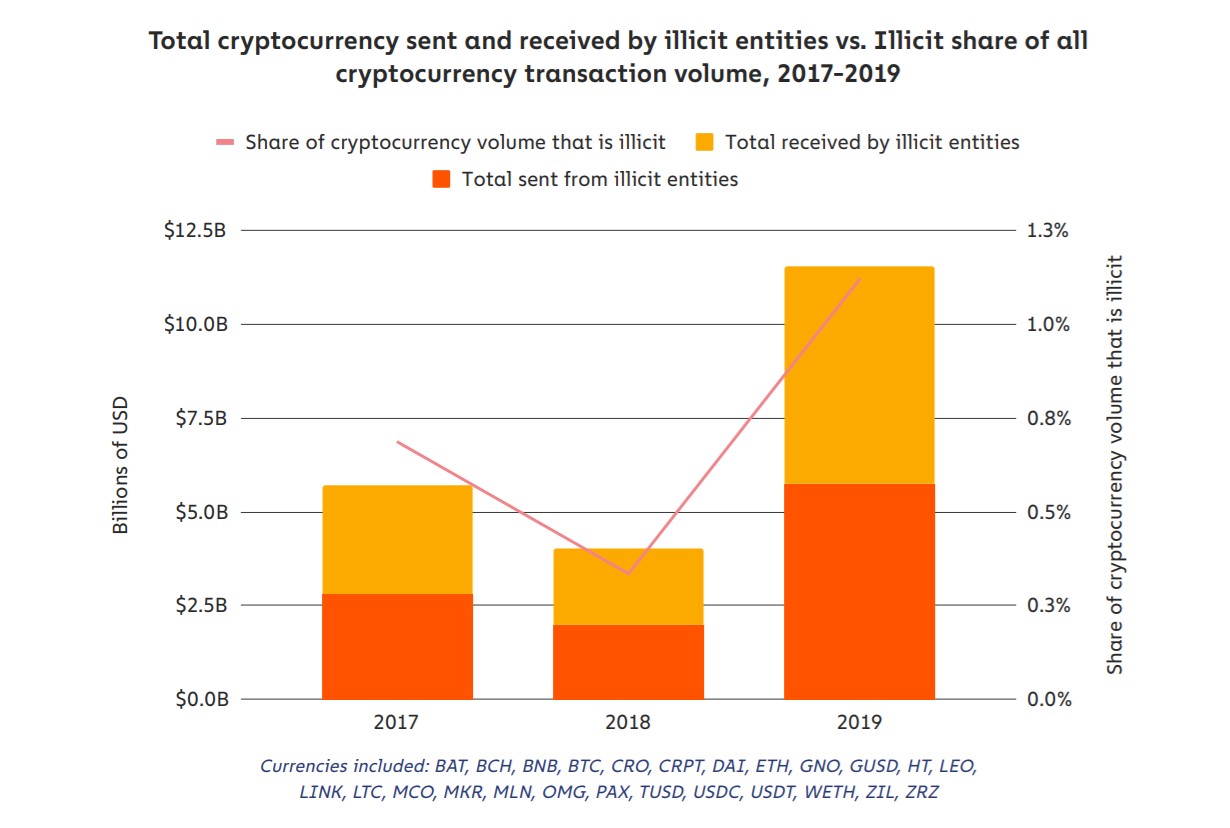

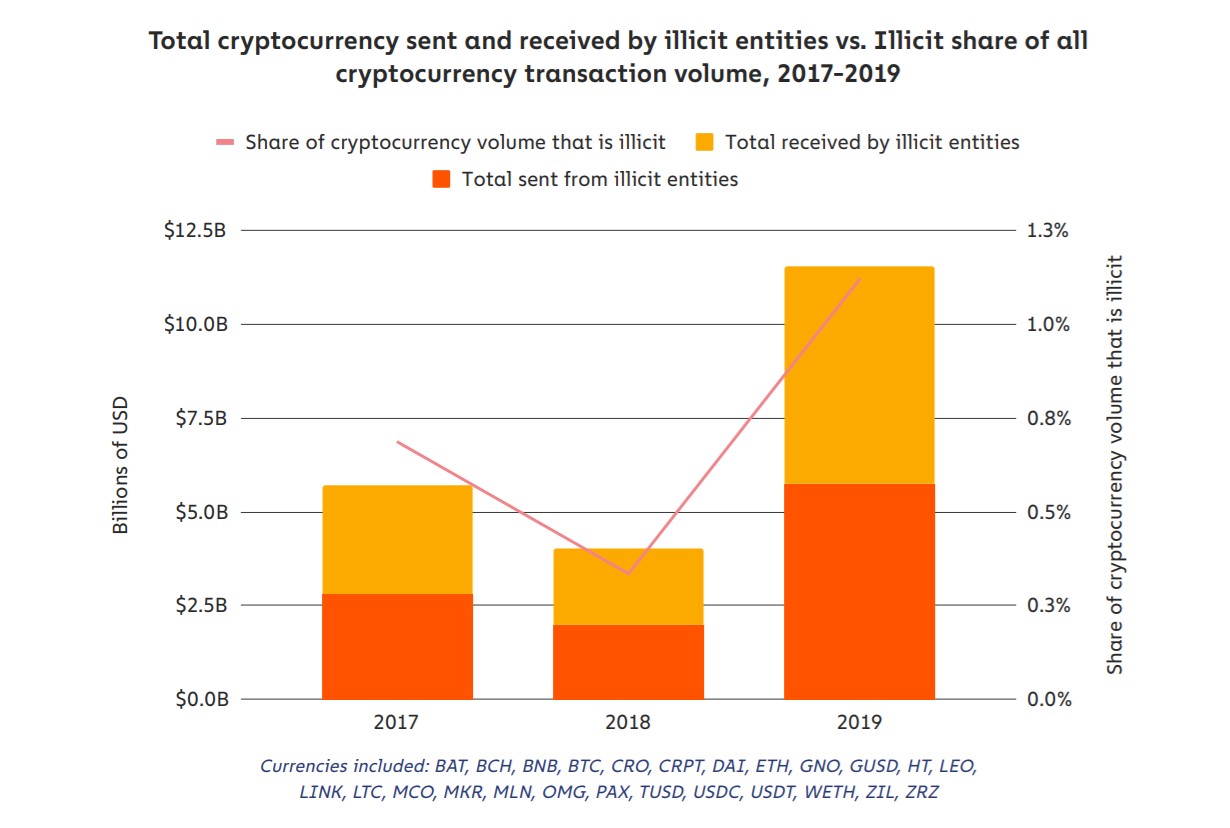

Source: Chainalysis

As of 2020, illicit cryptocurrency transactions have risen, both in total value and as a share of all cryptocurrency activity. In fact, illicit transactions have a small share of all cryptocurrency activity at just 1.1%.

In-depth

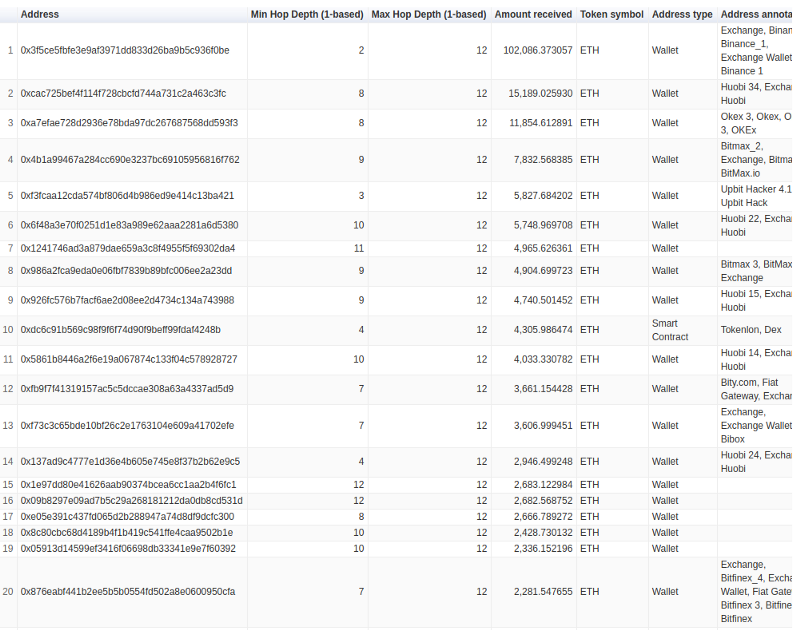

Take, for example, in 2019 where hackers stole $283 million worth of cryptocurrencies in 11 hacks. Out of the 11 hacks, a Korean exchange, Upbit was hacked to a tune of $48 million.

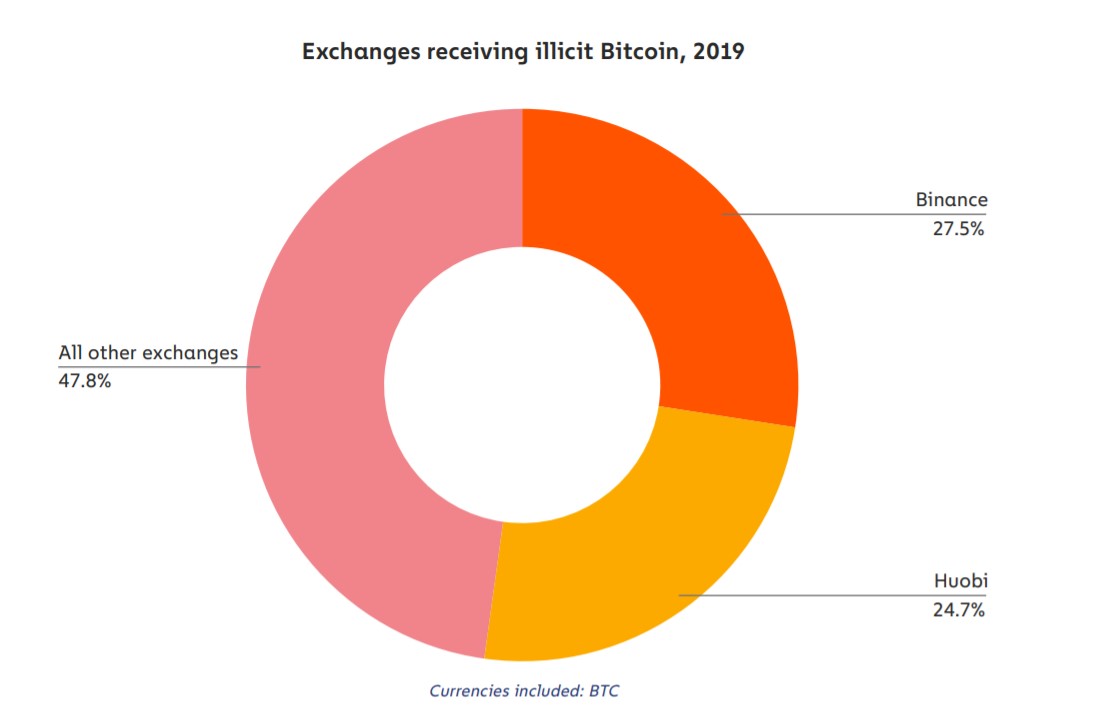

An individual investigation posted by Bitquery showed that the hacked funds were tracked to multiple exchanges but the ones that stood out were Binance and Huobi. Other exchanges like Kraken, BitMEX, Liquid, etc were also involved in receiving the funds.

Perhaps, Binance and Huobi stood out since they are the popular Asian exchanges with good liquidity. Regardless, the point is that exchanges play a huge role during and even after the hacks. While some exchanges agree to block the hacked transactions others do not play such an active role.

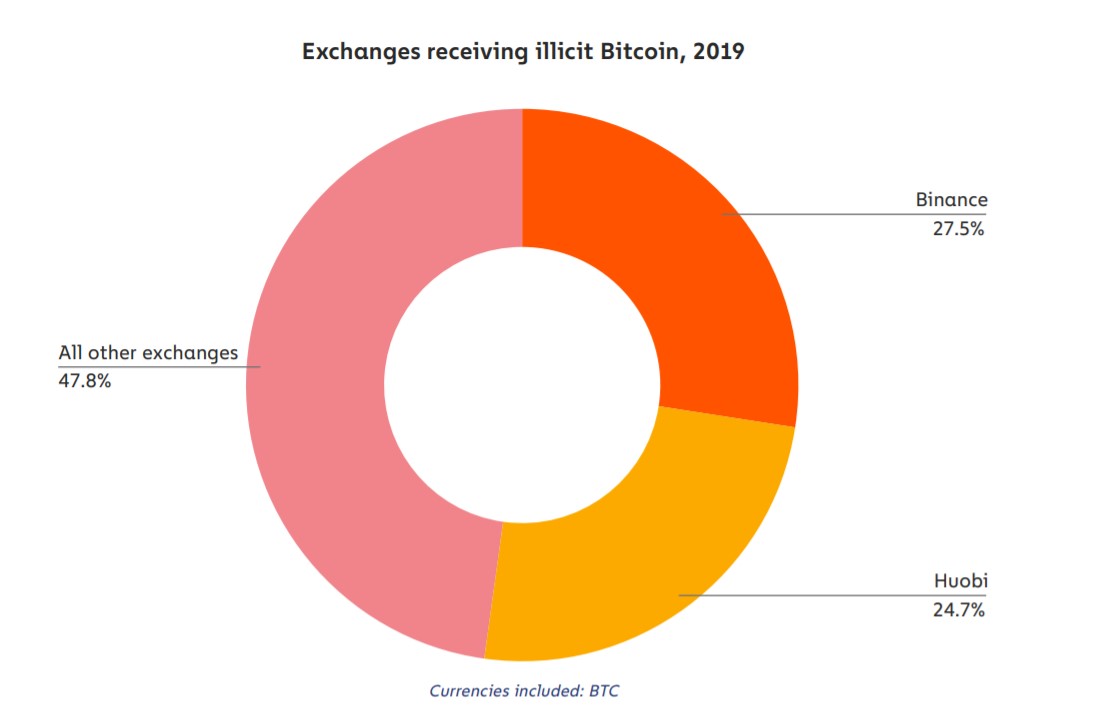

Source: Chainalysis

Chainalysis’ report also arrived at the same conclusion. The go-to for hackers as of 2019 were Binance and Huobi. Together the exchanges contributed to receiving more than half of all illicit transactions. This is surprising considering both exchanges have KYC regulations.

In particular, Chainalysis stated that there were 810 accounts that received almost $819 million worth of Bitcoin from criminal sources in 2019. Even though it was identified that most of these accounts are related to OTC brokers, there’s no way of shutting them down. In fact, OTCs could facilitate the majority of all cryptocurrency trade volume as estimated by Kaiko.

Moreover, the PlusToken scam has caused a major impact on the price of bitcoin considering the scam tokens being dumped on exchanges. The scam that siphoned about 20,000 BTC and 790,000 ETH has since been moved to different exchanges and sold off.

In addition to hacks, there are problems with the throughput of exchanges. BitMEX exchange has shut down on multiple occasions, with the most recent one during the March crash. Although the reason behind “shut down” may vary, the fact that remains is that it’s the new norm.

The new bull run will stress-test the exchanges on their ability to,

- handle and on-board the FOMOing users

- handle pumps and crashes

The most recent crash on August 2 caused Binance and many exchanges to auto-deleverage a lot of trades. FTX, BitMEX, and other exchanges also suffered a similar fate during the crash.

Hence, it should be sufficiently clear that exchanges have a lot to improve and are presently not ready to handle the next bull run or the next hack, whichever comes first.

The post appeared first on AMBCrypto