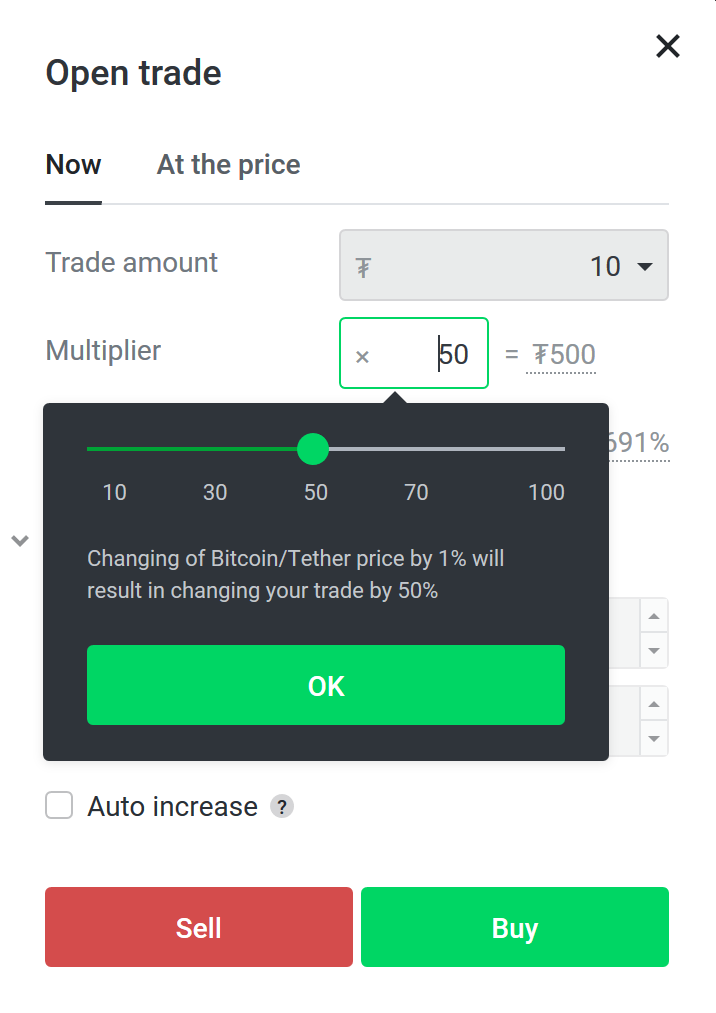

When it comes to choosing a cryptocurrency exchange, the vast majority of both budding and experienced traders alike tend to settle for the first option. This, however, is rarely the best choice.In the past decade, cryptocurrency exchanges have gone through a revolution of sorts, with numerous new cryptocurrency exchanges launching with features that even major industry players find it difficult to rival.One of these burgeoning upstarts is known as StormGain, a trading platform that offers premium features, including institutional-grade security and AI-based trading indicators. Likewise, BitMEX and Deribit are also great choices—albeit for more advanced traders.Missed OpportunitiesAlthough Bitcoin and numerous other cryptocurrencies have experienced meteoric growth in recent years, this growth hasn’t been without its interruptions. In fact, since early 2018, many cryptocurrencies have been on a stark downtrend, with the vast majority of cryptocurrencies losing significant value between then and now.Fortunately, several cryptocurrency derivatives platforms provide users the opportunity to short the market, which essentially means traders can speculate that an asset will decline in value. This gives traders the opportunity to easily profit during a declining market. While trading on the short side using cryptocurrency derivatives can be profitable alone, it is possible to drastically increase this profitability by trading on leverage, which is the process of temporarily borrowing funds to increase exposure to the market.However, though the ability to trade on margin was previously reserved for only the most advanced traders, there has been great strides made in terms of usability in recent years. Now, traders of all experience levels can benefit from up to 100x leverage at platforms like StormGain and BitMEX.This essentially means that if a trader opens a 10 BTC short position using 100x leverage, and the market subsequently crashes by 5%, this trader will have earned 500% profit. This also has the added benefit of essentially doubling the number of potentially profitable trading opportunities, since traders can go both short and long on derivatives trading platforms—with or without leverage.Hidden Costs Are a ProblemWhile many exchanges attempt to offer competitive trading fees, low maker and taker fees are just two of several costs to consider when choosing a cryptocurrency exchange.Another important consideration is the spread—which is the difference between the lowest ask price and the highest sell price on a platform. A tight spread indicates that a market order will be filled at close to market value, whereas a large spread can lead to market orders being filled at worse than expected rates.Because of this, although many exchanges charge trading fees between 0.1% to 0.25%, when you also factor in the spread (which can be as high as 10%), this can lead to significantly reduced profitability when trading. Likewise, a lack of liquidity, which results in a high spreads can also leave traders vulnerable to market manipulation, since the order books are often too thin to absorb any attempts to alter to price dynamics of the market.

While trading on the short side using cryptocurrency derivatives can be profitable alone, it is possible to drastically increase this profitability by trading on leverage, which is the process of temporarily borrowing funds to increase exposure to the market.However, though the ability to trade on margin was previously reserved for only the most advanced traders, there has been great strides made in terms of usability in recent years. Now, traders of all experience levels can benefit from up to 100x leverage at platforms like StormGain and BitMEX.This essentially means that if a trader opens a 10 BTC short position using 100x leverage, and the market subsequently crashes by 5%, this trader will have earned 500% profit. This also has the added benefit of essentially doubling the number of potentially profitable trading opportunities, since traders can go both short and long on derivatives trading platforms—with or without leverage.Hidden Costs Are a ProblemWhile many exchanges attempt to offer competitive trading fees, low maker and taker fees are just two of several costs to consider when choosing a cryptocurrency exchange.Another important consideration is the spread—which is the difference between the lowest ask price and the highest sell price on a platform. A tight spread indicates that a market order will be filled at close to market value, whereas a large spread can lead to market orders being filled at worse than expected rates.Because of this, although many exchanges charge trading fees between 0.1% to 0.25%, when you also factor in the spread (which can be as high as 10%), this can lead to significantly reduced profitability when trading. Likewise, a lack of liquidity, which results in a high spreads can also leave traders vulnerable to market manipulation, since the order books are often too thin to absorb any attempts to alter to price dynamics of the market. Beyond this, many exchanges are not forthcoming when it comes to demonstrating the true cost of using the platform, making it difficult to determine exactly how much is lost as commission when trading, which can lead to customers paying over the odds for services that are available elsewhere for less.As such, it is important that traders do their own research when it comes to determining which exchange has the fee schedule that suits them best—paying particular consideration to the typical spread on popular trading pairs.Not Just Beginner FriendlyOne of the major ways cryptocurrency exchanges attempt to capture new users is by promising to be ‘beginner-friendly’—ergo ideal for newer users that aren’t likely to make use of advanced trading features.However, by targeting newer users, these exchanges often forgo development of the tools necessary for more advanced traders to deploy more specific trading strategies. In time, beginner traders progressing to a more intermediate level may quickly find their needs outgrow the features available on the exchange.Because of this, it is important to choose an exchange platform that features all the tools necessary to execute advanced trading strategies, but gives traders the option to pick and choose which features they need and when.By choosing an exchange that has all the tools they might ever need, they can be sure they have room to grow as a trader. Whether this is StormGain, ByBit or some other rapidly developing exchange, it is important that traders choose a platform that works for them—both now, and for the foreseeable future. The post appeared first on NewsBTC

Beyond this, many exchanges are not forthcoming when it comes to demonstrating the true cost of using the platform, making it difficult to determine exactly how much is lost as commission when trading, which can lead to customers paying over the odds for services that are available elsewhere for less.As such, it is important that traders do their own research when it comes to determining which exchange has the fee schedule that suits them best—paying particular consideration to the typical spread on popular trading pairs.Not Just Beginner FriendlyOne of the major ways cryptocurrency exchanges attempt to capture new users is by promising to be ‘beginner-friendly’—ergo ideal for newer users that aren’t likely to make use of advanced trading features.However, by targeting newer users, these exchanges often forgo development of the tools necessary for more advanced traders to deploy more specific trading strategies. In time, beginner traders progressing to a more intermediate level may quickly find their needs outgrow the features available on the exchange.Because of this, it is important to choose an exchange platform that features all the tools necessary to execute advanced trading strategies, but gives traders the option to pick and choose which features they need and when.By choosing an exchange that has all the tools they might ever need, they can be sure they have room to grow as a trader. Whether this is StormGain, ByBit or some other rapidly developing exchange, it is important that traders choose a platform that works for them—both now, and for the foreseeable future. The post appeared first on NewsBTC