Ethereum is currently undervalued and is poised to increase in the long-term, potentially reaching market cap parity with Bitcoin, some analysts claim.

Ethereum Might Be Bullish In the Long-Term

As Ethereum is getting closer to its 5th anniversary, some market onlookers are waiting for its revival, especially amid the context of the awakening altcoin season.

On Monday, John Lilic, who works for blockchain firm ConsenSys, reminded the crypto community that Ethereum is slowly but steadily moving towards market cap parity with Bitcoin, citing an older tweet that he made on January 5.

As of today, Bitcoin’s market cap figure exceeds $170 billion. Ethereum is in second position with less than $27 billion. However, at the beginning of the year, the discrepancy was even wider in favor of Bitcoin, so it seems that the oldest cryptocurrency is losing ground indeed.

Lilic noted that the market cap of Bitcoin is now 6.3 times larger than ETH, compared to 10 times at the beginning of the year. The amount of fees generated by Bitcoin dropped to 80% compared to total fees on Ethereum, after generating twice as much as Ethereum in January.

“ETH is undervalued and we are headed towards market cap parity,” he concluded.

Updated thread since Jan 5

The mkt cap of $btc is now ~6.3x that of $eth. The amount of fees generated by #bitcoin is now ~4/5th’s that of #Ethereum. The price of ETH has appreciated ~37% against BTC so far in 2020. ETH is undervalued & we are headed towards mkt cap parity. https://t.co/MjwmwqtobL pic.twitter.com/ExeMVBgPeg

— John Lilic (@JohnLilic) July 13, 2020

Other Metrics Also Point to Undervalued ETH

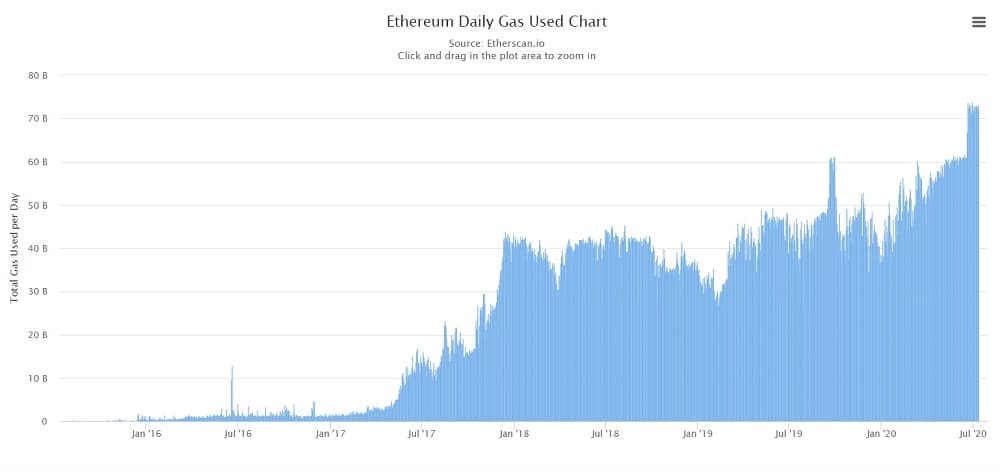

Before Bitcoin supporters start laughing, they should look into other metrics that suggest ETH might be undervalued. One of the key indicators that the Ethereum network is being currently used more than ever is Gas usage.

On Ethereum, gas is burned for every transaction made on the network’s decentralized applications (dApps) – for instance, when trading on decentralized exchanges or playing NFT games. The point is that the higher the gas usage is, the more demand for Ethereum dApps, which is a positive sign for the long-term price of ETH.

The amount of gas used on Ethereum hit an all-time high at the beginning of July and is now fluctuating around that peak.

At the end of May, German crypto research firm Blockfyre mentioned gas usage along with three other metrics as clear signs that ETH was undervalued.

1) We charted several progress indicators for Ethereum against its price development since its genesis.

Besides other factors, the following 4 indicators have caught our interest the most.

We feel comfortable to state that Ethereum is significantly undervalued at current prices pic.twitter.com/RezhESApZk

— Blockfyre (@blockfyre) May 26, 2020

On top of that, Bitcoin has got all the attention due to the halving and its safe-haven status, which might have caused some overvaluation, even below $10,000. Investors should probably also pay attention to the ETH 2.0, the upgrade that may change the network forever.

However, the chances are that Ethereum might never reach market cap parity with Bitcoin, as it is threatened to be collectively overtaken by other tokens, including ERC20 ones, such as LINK and VeChain.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato