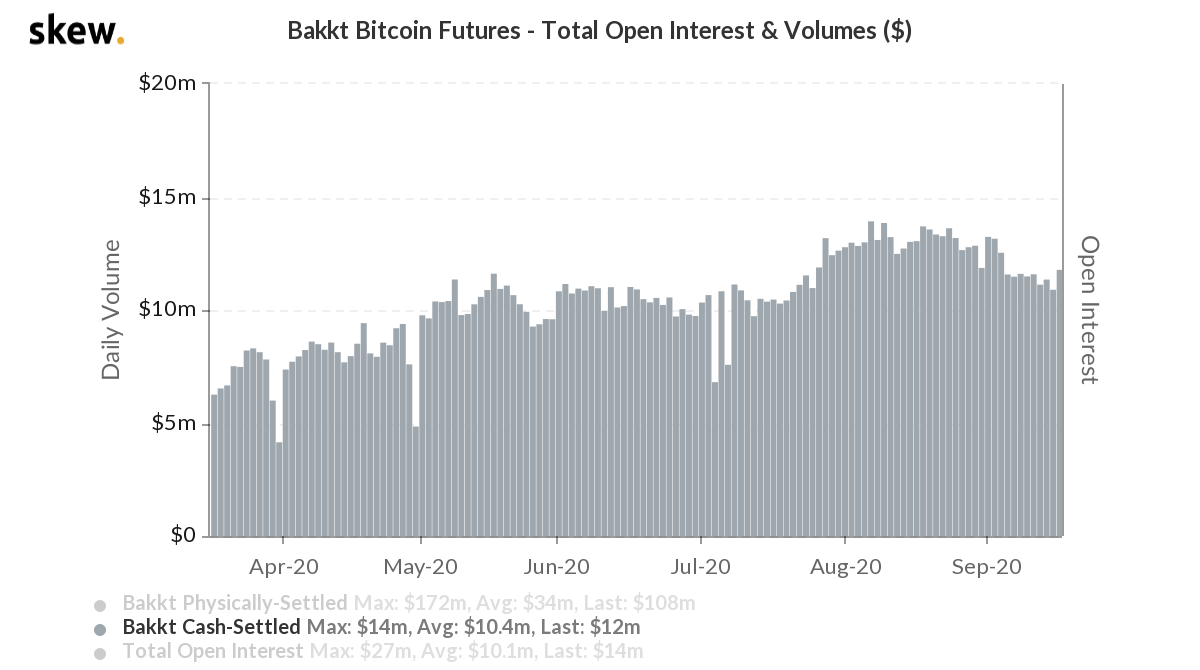

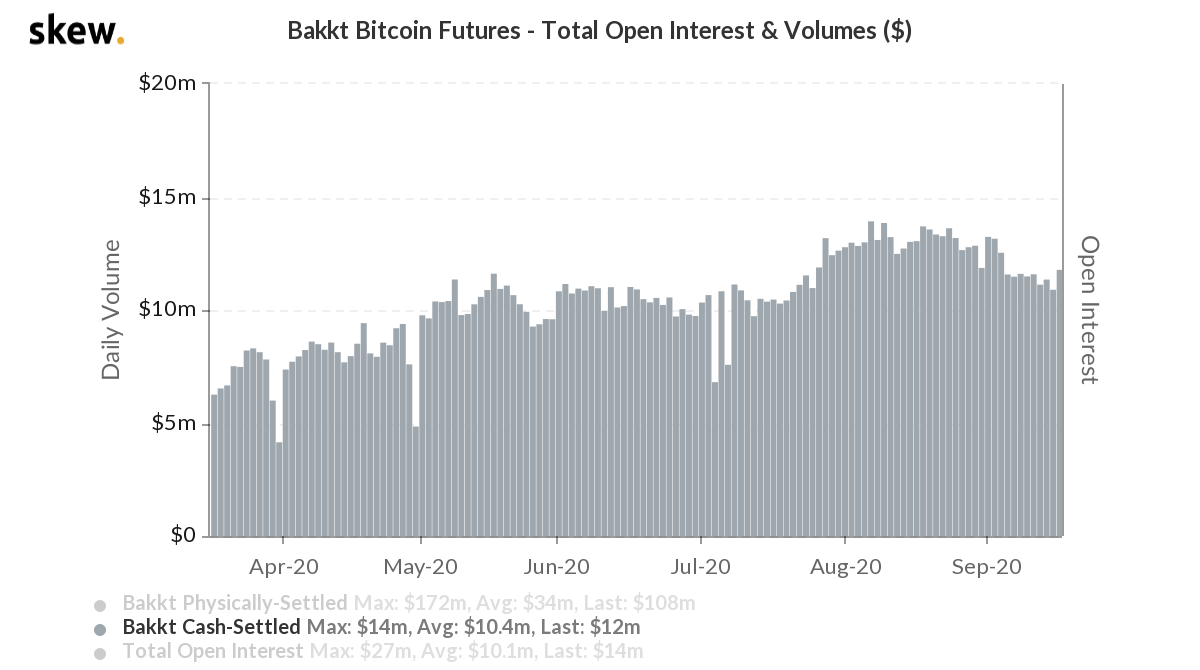

Bakkt’s cash-settled Bitcoin futures were launched in December 2019 on popular demand. Physically settled Bitcoin futures exposed traders to the risk of holding the asset and didn’t exactly fly among derivatives traders.

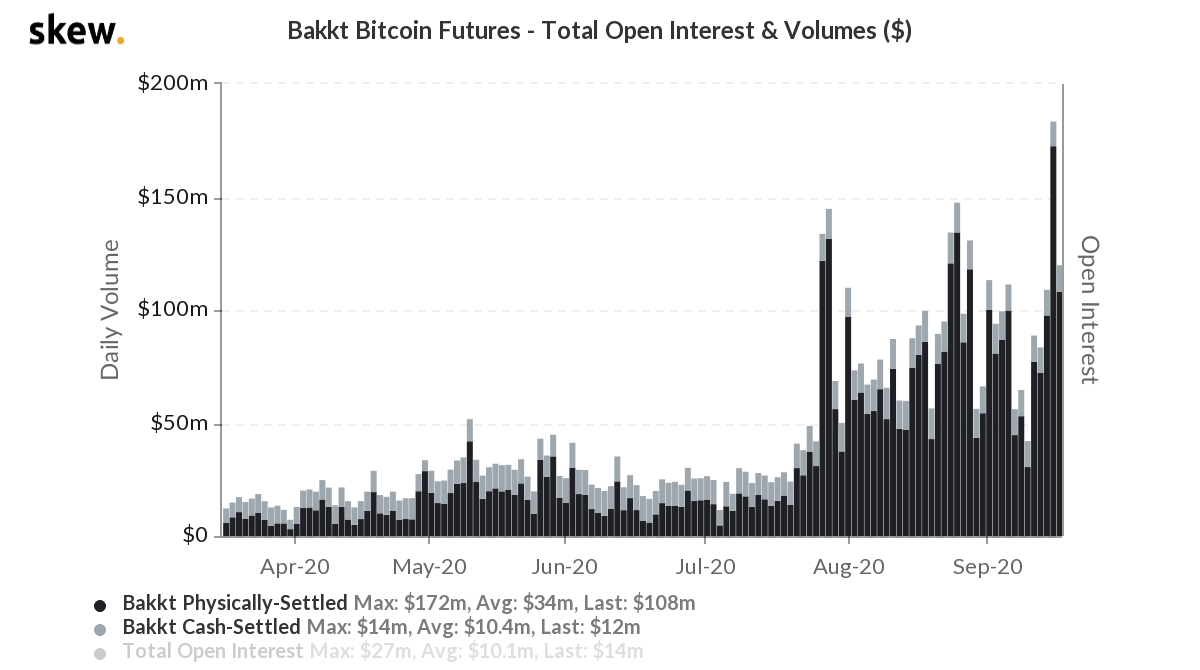

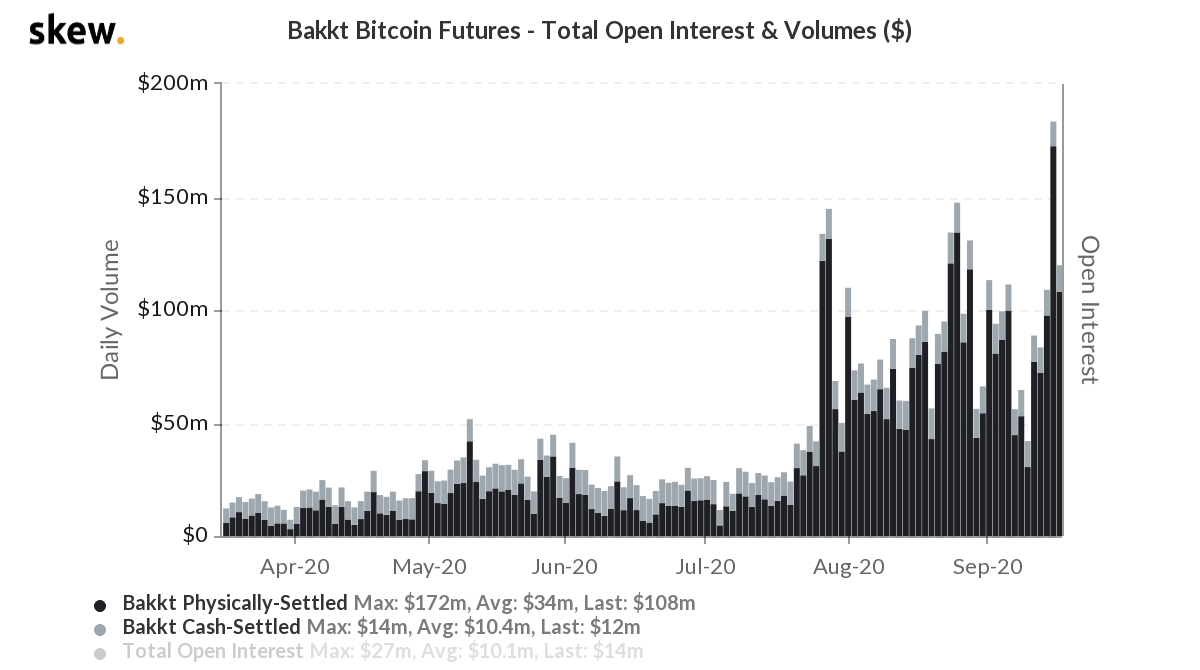

Despite the initial roadblocks, cash-settled Bitcoin futures have doubled in volume in the past six months. What’s interesting is that it has maintained a consistent trading volume.

Source: Skew

This chart is more consistent than cash-settled futures volume on CME or aggregate across top derivatives exchanges, based on data from skew.

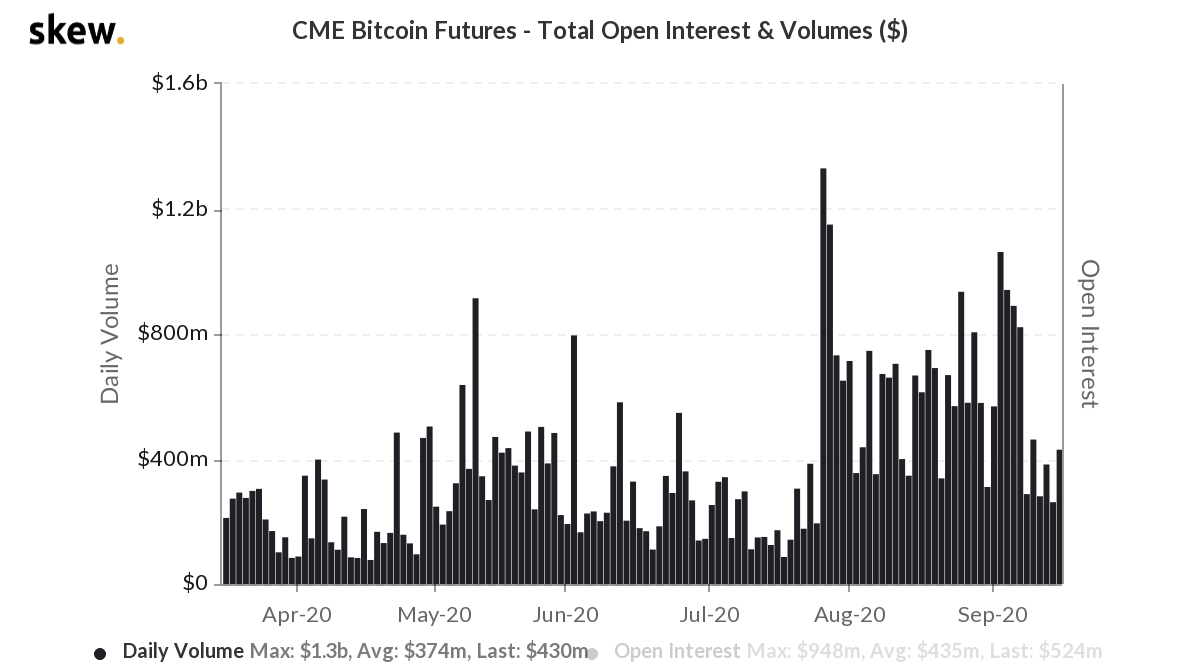

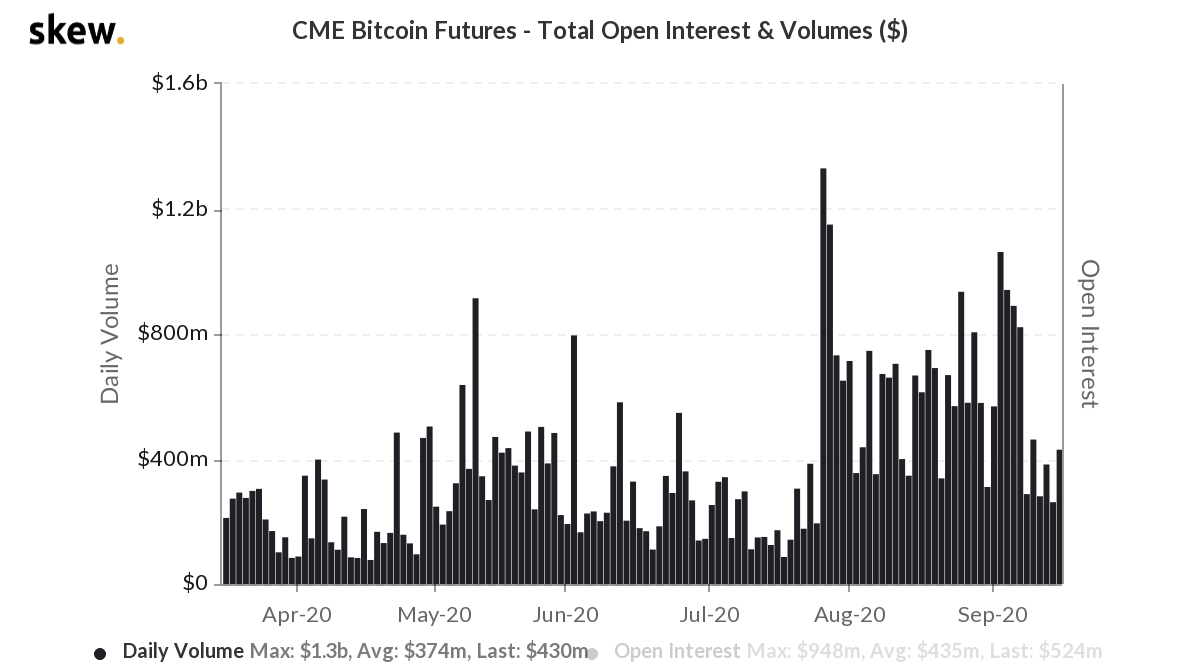

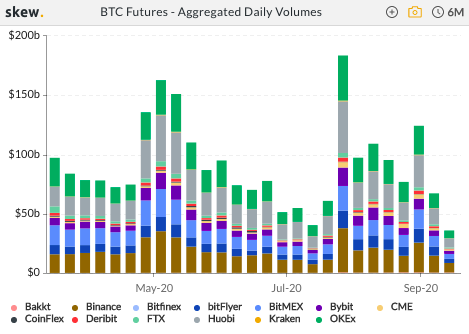

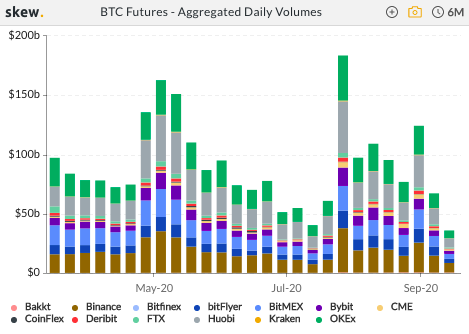

Source: Skew

The aggregate daily volumes on top exchanges and CME show significant drops. Among top reasons, the most popular one is the general perception that cash-settled futures can be manipulated quite easily, as they settle using a formula taking prices from some third party spot market with potentially thin volumes, rather than simply delivering the underlying at expiry.

Source: Skew

Derivatives traders maintain accounts on spot and derivatives exchanges. They take long/short positions in the cash-settled futures on derivatives exchanges and during settlement they use their wallet balance on spot markets to move the reference price up/down, and this is the value captured by Derivatives exchanges and used in their settlement formula.

This manipulation is possible only because of low liquidity on spot exchanges from where price reference is drawn. Once these traders receive their profit from cash settlement they unwind their position on spot exchanges. While this manipulation is difficult to trace, there is a sharp move right before the scheduled settlement and this is clearly visible in the CME chart. However, this is not evident in cash-settled Bitcoin futures on Bakkt.

On Bakkt, the growth is consistent for the past six months. However, Bakkt’s chart for physically-settled Bitcoin futures has a different growth trajectory.

Source: Skew

Volume picked up in the last week of July 2020 and it has been consistently above $80 million, crossing $100 million a few times. Cash-settled futures have been more popular compared to physically-settled futures and there is consistent growth in the former. This shows that Bitcoin futures contracts on Bakkt have consistently performed for the past 6 months and the demand for the same is consistent on the exchange.

Bakkt Bitcoin futures contracts may be the only ones that aren’t manipulated and the only ones that has doubled in volume with consistent growth in the past 6 months.

The post appeared first on AMBCrypto