Defi is seeing quite a bit of improvement with over 15,000 BTC locked in. Another reason for Defi taking off is the success of the Compound platform’s Comp token. At press time, over 85,560 Comp tokens have been distributed to users. With each token priced at $160, this value comes up to $13.6 million at press time. However, Comp token did hit a high of $385, hence this value is not adjusted.

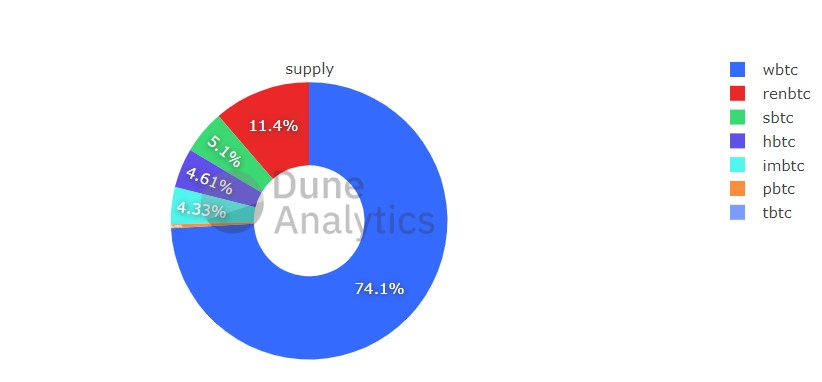

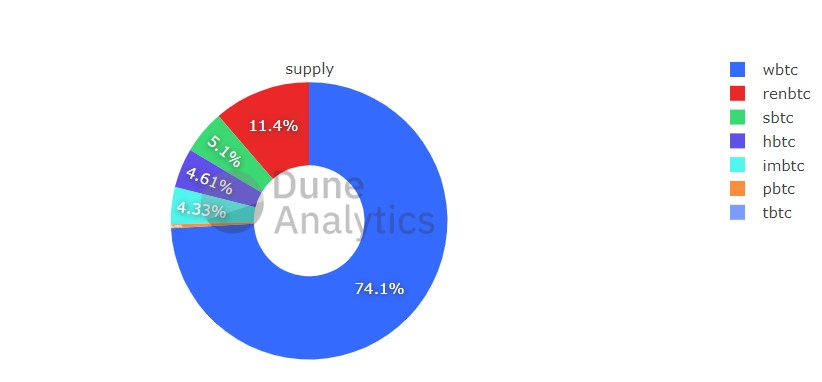

Regardless, the topic of this article surrounds the Bitcoin locked in ETH and how this could be the next token that will earn the most Comp token for yield farmers. Out of the total of 15,000 BTC, the WBTC constitutes about 74% of the total BTC locked.

Source: Dune Analytics

From the above chart, it can be seen that WBTC holds the most value since its being actively used/traded in Defi. As of July 14, the WBTC traded volume came up to 333 BTC while the rest of them were in single digits. This shows the demand for WBTC on ETH and most importantly in Defi.

At the moment fewer people are shorting Comp below $160, which is 10x the value since its listing. Furthermore, this value seems to be holding for now. The Defiant’s newsletter stated,

“While COMP’s surge may prompt speculation that it’s rallied too far, the reality is that there are no signs of anyone shorting the token that spurred the yield farming craze in decentralized platforms.”

In fact, the yCOMP-AUG20, an ERC-20 token expiring August 20 that allows holders to short COMP, has had zero trading volume in the last 4 days.

Comp earning assets

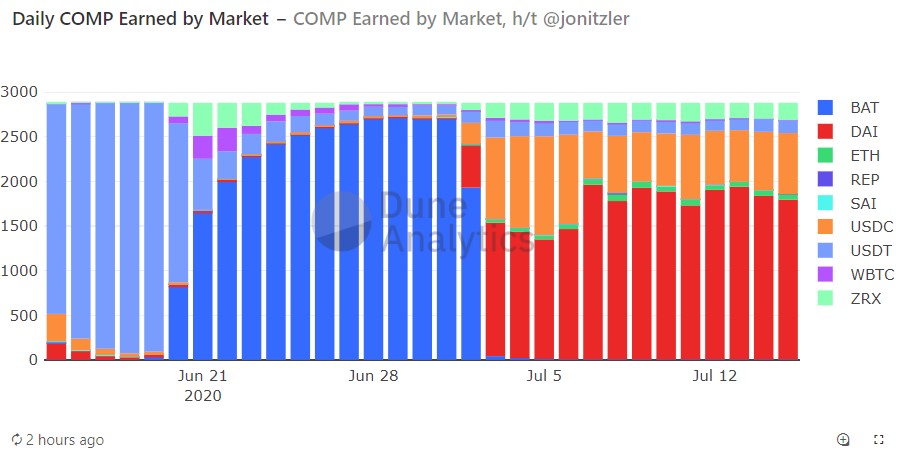

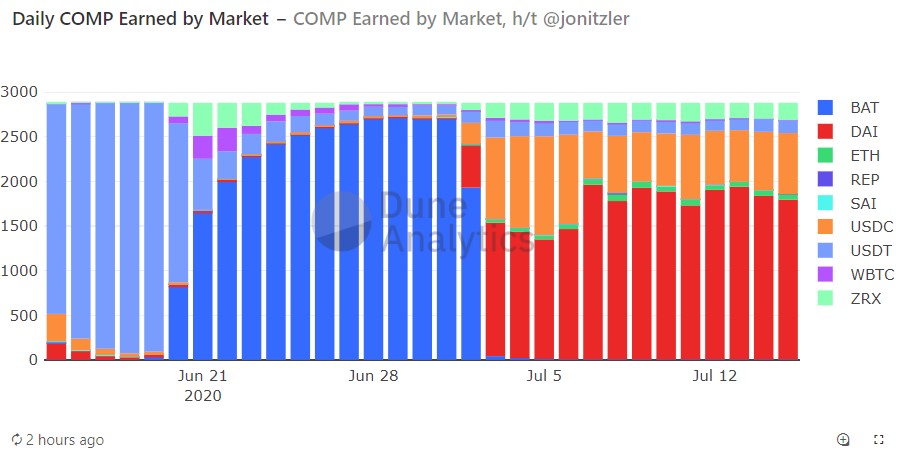

Source: Dune Analytics

The above chart shows the daily comp earned by the market. From the chart, it can be seen that USDT was earning the most Comp during the launch, however, since then it has moved to Brave’s reward token BAT and USDC for some time. However, at press time, Ethereum-based stablecoin – DAI earns the most Comp.

Dai gaining prominence was inevitable and was supposed to happen, especially considering the centralized nature of stablecoins, which were highlighted after Centre’s USDC blacklisted an address with $100,000 USDC to help with the law enforcement. With the Bitcoin bull run around the corner, this period of low volatility could help BTC gain Defi’s users and help it regain its volatility. WBTC hence is likely to be the next asset that could be earning the most Comp.

The post appeared first on AMBCrypto