The past year was punctuated by a series of extreme peaks and troughs. In spite of that, however, there is an assured collective acceptance of Bitcoin, one that is palpable. 2020 particularly was dominated by numbers and growth. Here are a few highlights,

- Crypto’s collective market cap increased by 284%

- Bitcoin Year to Date spike was as high as 272%

- Crypto-Derivatives Trading Volume Average in 2019 was 62.4 billion; Q1 2020 crossed $2 trillion, smashing the 2019 average by 314%

- Bitcoin Active Addresses % change – 125%

The list goes on and on, but we are not here for the accolades. When speaking about a transitional change (a coming-of-age from 2017), the perspective of crypto-traders or Bitcoin investors has evolved drastically over the past three years. From a point of high risk and high volatility in 2017, how will crypto-traders look at the market in 2021?

Speaking of Volatility and Bitcoin Velocity

Back in 2017, before and after the bull run, volatility was a major concern for traders. It was always an ‘expect the unexpected situation’ with Bitcoin and the rest. The Volatility Index indicated the same, but the end of 2020 has been different.

If the spike in VIX is observed for cases 1, 2, and 3, it can be seen that the price faced a massive decline right after and BTC could not sustain a trading range at its highs. However, during its recent bull run, VIX remained at a lower level, in spite of Bitcoin crossing $20k. Result? BTC continued to consolidate above its previous all-time high.

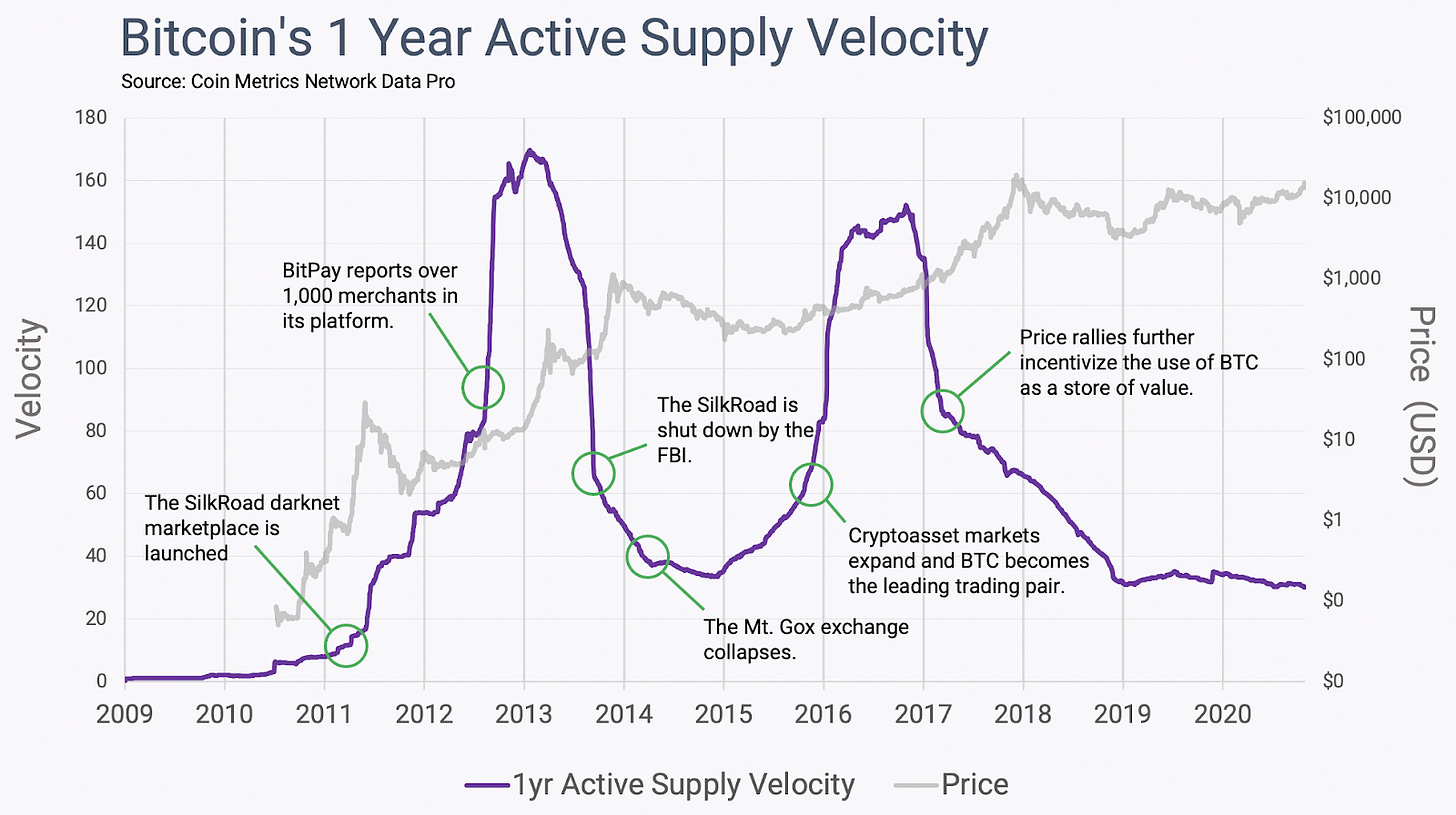

Another important metric that defines the evolution of Crypto-traders is Bitcoin’s 1-year Active Supply Velocity chart. Velocity measures the number of times an average unit of supply has been transferred. The attached cycle highlights the uncertainty early adopters and traders faced, in comparison to the newer ones.

Since 2019, a successful precedent and better understanding of the digital asset industry has led to controlled FUD, as a result of which, traders are currently better equipped with the knowledge to navigate through the market.

Open the Institutional Floodgates

Traders from 2020 are fortunate to witness the injection of institutional capital. Before the 2017 bull run, CBOE and CME BTC Futures were just beginning to hit the markets. There was no relevant liquidity, let alone optimism, for a successful market ahead.

It was all in an experimental phase, one where traders would literally need to go in with the expectation of losing most of their capital.

Not anymore. CME, one of the largest derivatives exchanges in the world, recorded a new all-time high in Open Interest. OI represents the total value of the outstanding contracts that haven’t been settled. CME’s Bitcoin product is significant because it is accessible to multitudes of retail and institutional traders across the world at the moment.

The improving derivatives instruments have given Bitcoin and other assets exposure, something that was unheard of in 2017. For a trader entering the market in 2020, identifying value in crypto-assets will be much easier, unlike 3 years ago.

Against the Odds, Bitcoin displayed its mettle

With the previous factors, there was a layer of commonality. Each condition evolved and become positive for Bitcoin over time, and all of it mostly relied on market maturity and eventual growth in interest.

However, 2020 threw a curveball at Bitcoin in the form of a pandemic which might have been its strongest test yet. Since 2009, the larger economic landscape had avoided any underlying concerns of inflation. The narrative was flipped when the COVID-19 pandemic crippled the economy during a world-wide lockdown. The traditional market faced its largest depreciation since the 1980s and Bitcoin’s valuation crumbled amidst financial uncertainty.

Dropping under $4000, skeptics were quick to write off Bitcoin’s capability to recover in an inflation-heavy environment. No points for guessing what happened next.

Not only was Bitcoin the first major asset to bounce back, but it also continued to hold a higher position after every bullish rally. Crypto-traders, new and old, paid attention to Bitcoin’s resilience. With a valuation of nearly $29k at press time (New ATH, that’s right!), it is safe to assume Bitcoin passed with flying colors.

Traders thinking ahead in 2021

So, putting things in context, a lot has changed between 2017 and 2020 for crypto-traders. Unlike the previous allure of ‘get rich quick’ sentiment with cryptos, the digital asset class has evolved into a more definite and trustable unit in the trading industry.

In 2021, it is not a gamble to invest in Bitcoin and other cryptocurrencies, as was the case in post-December 2017. Traders are currently identifying injection of smart money, and an organic institutional presence in the digital asset market. While the asset class remains volatile as ever, it is important to note that other assets such as the S&P 500 and Dow Jones have been more volatile than BTC in 2020.

The post appeared first on AMBCrypto