China’s long-fabled “cryptocurrency” launch is finally on the horizon.

According to Bloomberg, People’s Bank of China (PBoC) payments department deputy director Mu Changchun confirmed at the China Finance 40 Forum that the country’s cryptocurrency is nearing its release following a year of research and development.

Given Beijing’s history of antagonism toward decentralized cryptocurrencies, what does the impending launch of a PBoC-approved digital currency mean for bitcoin?

China’s ‘Crypto’ Play Is About Restricting Freedom

[embedded content]

China, which has had strict capital controls in place for many years to restrict the outflow of the depreciating Chinese yuan, is expected to use the PBoC-issued cryptocurrency to exercise even stronger control over the national currency.

By utilizing a centralized blockchain network or a system modeled after the blockchain, replacing cash in circulation with a digital asset would enable the PBoC and the government of China to better monitor -and control – the flow of the yuan.

Cash – by nature – is anonymous in that it is difficult for the authorities to scrutinize offline transactions made in a peer-to-peer manner. A digital system would ease the process for regulators to oversee so-called suspicious transactions.

However, whether it can truly be described as a cryptocurrency remains a separate issue as a blockchain protocol, as seen in the structure of the Bitcoin network, often demonstrates a certain level of decentralization through the presence of nodes and open-source communities.

Regardless, China’s so-called “crypto” project is about restricting freedom – not enhancing it.

‘Digital Yuan’ Won’t Stunt Demand for Bitcoin

In recent months, reports have indicated that major cryptocurrencies, including bitcoin and tether (USDT), have seen rising inflows from China.

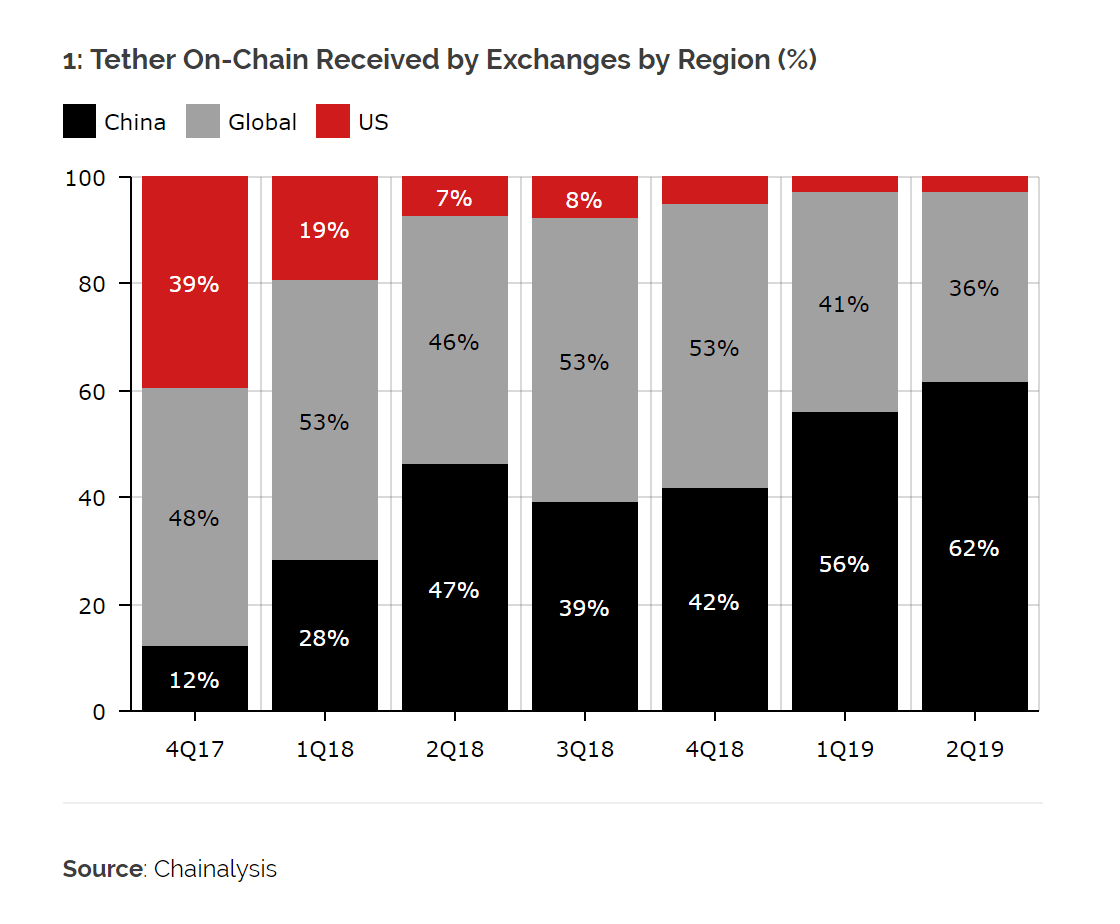

Crypto research firm Diar stated that 62 percent of tether’s on-chain volume in the second quarter of 2019 came from China.

“Data provided to Diar by blockchain analysis firm Chainalysis highlights the magnitude of Chinese Tether demand with over $16Bn received by exchanges based in that market in 2018. This year the number has already surpassed an outstanding $10Bn, setting the stage for the biggest year yet. 2019 to date flows into exchanges catering primarily for Chinese traders beat the $7Bn of all the transactional value for 2017,” the report read.

The popularity of bitcoin in China reflects the growing interest in BTC as an alternative store of value. It’s clear that Chinese crypto users view BTC as a store of value – not an everyday payment tool – because efficient digital currency system platforms like Alipay and WeChat have already onboarded hundreds of millions of users in the region.

As such, the nation-backed cryptocurrency is highly unlikely to impose any impact on China’s stance towards bitcoin – or stunt investor demand for BTC.

Safe haven asset narrative

Still, it’s not clear whether bitcoin has definitely proven its value as a safe-haven asset.

Throughout August, as the bitcoin price slightly declined, the volume of the asset decreased, and its premium in major markets like China and South Korea dropped.

In South Korea, a major cryptocurrency market that accounts for a relatively large portion of global bitcoin volume behind the U.S. and Japan, bitcoin is trading at a rate that is lower by more than one percent when compared to the global average price.

With increasing geopolitical risks and intensifying conflicts across the globe, analysts expect traditional safe havens like gold to outperform. Bitcoin has a chance to prove similar resilience.

The post appeared first on CCN