Grayscale is by far, the most popular investing company in the U.S with its popular investment tool – Grayscale Bitcoin Trust [GBTC]. It is obvious that Grayscale Investment hasn’t had a serious competitor for a very long time and this has caused the company and its investors to enjoy a monopoly over crypto investments.

Although SEC and the concerned regulatory bodies have rejected a Bitcoin ETF for the longest, there are alternative products for institutional investors and Grayscale is at the forefront of it, at least in the U.S.

The previous article addresses how this lack of competition has caused the premium to increase, which now averages at 27% on the NAV. While there are rules that prevent people from dumping the GBTC shares immediately to protect investors, this has inexplicably caused the premium to sustain.

Also, to be fair, Grayscale’s GBTC is helping retail get exposure to bitcoin, however, at a hefty premium. This hefty premium is basically due to the demand at the retail side and the inability for retail to invest in GBTC at NAV.

This is mainly due to the SEC’s rule on who can invest in risky investments like GBTC.

Regardless, this has caused institutions to take advantage of the dual nature of GBTC shares and enjoy the premium, after waiting for six months. From an institution’s perspective, there are risks to this type of investment, a risk that could go either way considering the volatile nature of bitcoin.

The perfect example is 3 Arrows’ investment, which was discussed quite publically and speculated on how this investment went through. Considering 3 Arrows’ investment, it expects the premium to stay relatively high, at least until six months, when it can unload their investment onto the general public aka retail.

SEC’s change to “Accredited Investors”

The SEC has changed one important aspect that could potentially hurt 3 Arrows – the definition of “Accredited investor”. As of August 26, SEC changed how it defines Accredited Investor – the SEC will now allow those with professional credentials and licenses to qualify as accredited investors to invest in startups, pre-IPO stock, venture companies, and even risky investments like GBTC.

Although this change will take place in late October here are two implications this might have,

- A wider and more generalized implication on how the retail investors are going to trade/invest.

- A crypto-centralized implication with regard to Grayscale, in particular, which could potentially reduce the premium.

Since the pandemic, a lot has changed, especially in the way capital is flowing from the retail side. Robinhood has become a go-to app for investment, especially from the millennials and GenZ.

An example to back this statement was the sudden spike in Hertz stock price after it dropped 97% in four months followed by a sudden surge of 1462%. Not just that millennials are taking an interest in making money using stocks and other methods, especially, since investing has become easy. Now that SEC’s definition for an accredited investor has changed, a lot of the retail money will flow into pre-IPO stocks or other risky investments like GBTC, or ETHE.

This brings us to the next implication, at the center of which is Grayscale Investments. With the “wealth limit” out of the way, people with necessary qualifications can now invest in GBTC. Due to GBTC’s dual ownership structure, individual investors can now create GBTC at NAV using BTC or cash.

Although not by a lot, investors will increase over time and so will the GBTC created at NAV, hence, the demand from the retail side will most likely reduce, thus endangering 3 Arrows’ humungous position. Considering that investors cannot dump their GBTC shares for six months, this might hurt a lot of these institutional investors, who, by the looks of it, are in GBTC largely due to its premium.

Side notes

It should also be considered that SEC’s change to the definition of “Accredited Investors” has changed but there are still plenty of rules that will prevent an en masse investment from the retail.

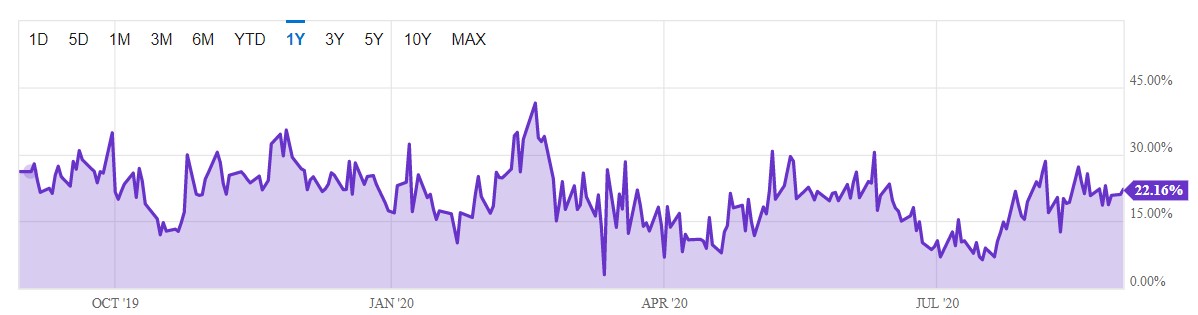

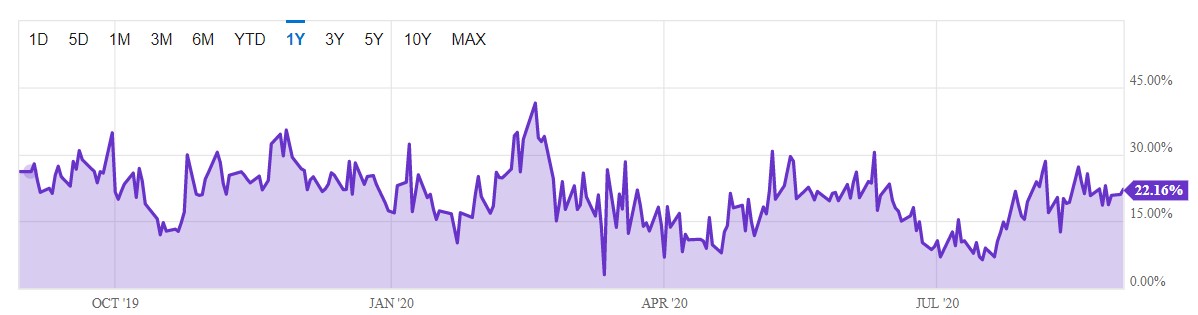

Source: Ychart

However, it should also be noted that this might potentially reduce the premium on GBTC that now stands at 22.16% with a 1-year average of 39.13%. Additionally, companies like MicroStrategy have taken a large position in Bitcoin considering how it performed during the recent Black Swan event.

The SEC’s decision to change the definition of Accredited Investors combined with the onslaught of large corporations investing bitcoin will reduce the premium seen on Grayscale’s investment tools like GBTC and ETHE.

The post appeared first on AMBCrypto