Cryptocurrency exchange Huobi Global revealed plans to launch Bitcoin Options. The plan for this launch comes at a time when Bitcoin has been coiling-up and in an extended bear market, awaiting a bull run.

Huobi Global’s entry into Bitcoin Options isn’t a surprise especially considering how successful its Futures were. At press time Huobi’s 24-hour Bitcoin Futures volume is by far the highest [$1.89 billion]. Even BitMEX, the derivatives pioneer comes in at fourth rank and Binance comes in at the third place.

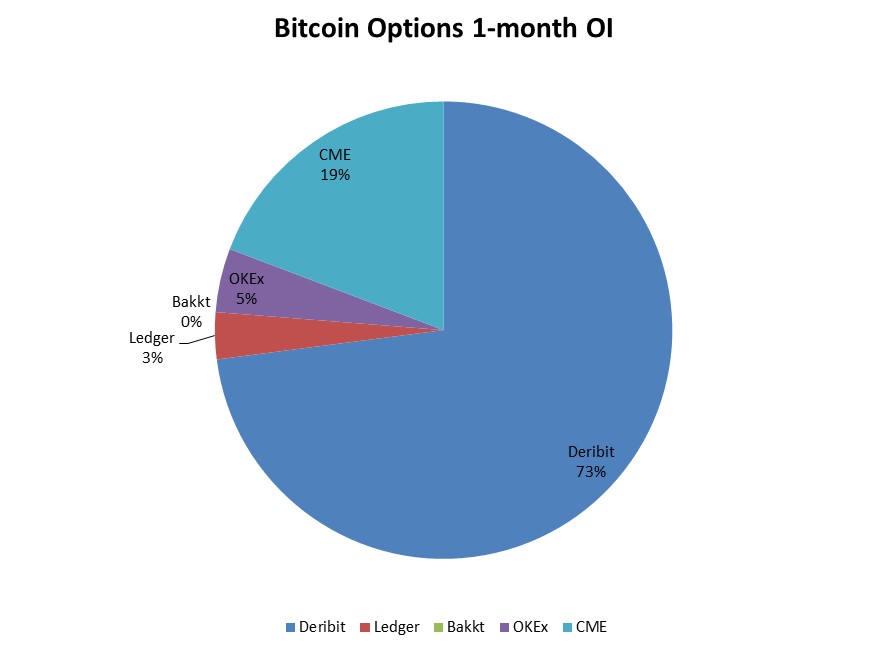

At press time, the options market seems to be saturated with Deribit and CME grabbing the biggest pieces of the Options pie. Deribit exchange’s OI has a gargantuan share of 73% while that of CME’s is 19%.

Source: Skew

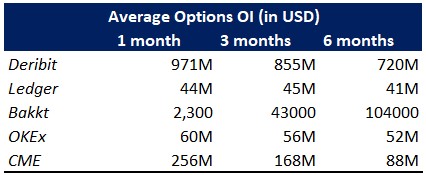

Furthermore, the below table shows how Deribit owns and has been owning a large share of the Bitcoin Options market, despite regulated players like CME and Bakkt’s existence.

Source: Skew

Even six months ago, Deribit had the highest Bitcoin options OI of $720 million while CME had a mere $88 million. Bakkt and other players seem to not make a dent when it comes to the options market.

While Binance has the biggest volume when it comes to spot trading, its futures volume has, on some days, managed to surpass that of Huobi’s. However, in the long run, Huobi’s volume has consistently been at the top. With its decision, Huobi has a chance to either make it big or lose out on an already saturated market with strong players.

Bitcoin Options

Ciara Sun, VP of Huobi Global Markets stated,

“Our entry into the derivatives market has been incredibly successful. Huobi Futures has been sitting at the top of many metrics regarding trading volume, and has rocketed to the top in Perpetual Swaps in just a few months.”

Additionally, Huobi will offer their options in the European style with a minimum position of 0.001 BTC. This will allow users with low initial capital [of $10] to invest and trade BTC options contracts.

While options trading is usually for traders with high initial capital or institutions, this low position size combined with the first USDt-quoted options and low trading fees might appeal to a large number of users. Furthermore, the addresses holding Bitcoin from 0 to 0.01 constitute about 72% of the entire addresses, hence, making it very alluring to this large user base.

The post appeared first on AMBCrypto