Stablecoins are hotter than ever, with Tether’s trade volume surpassing Bitcoin’s by 55% in the past 24 hours. Led by surges in the USDC and USDT, the total number of stablecoin daily active addresses has topped 265K.

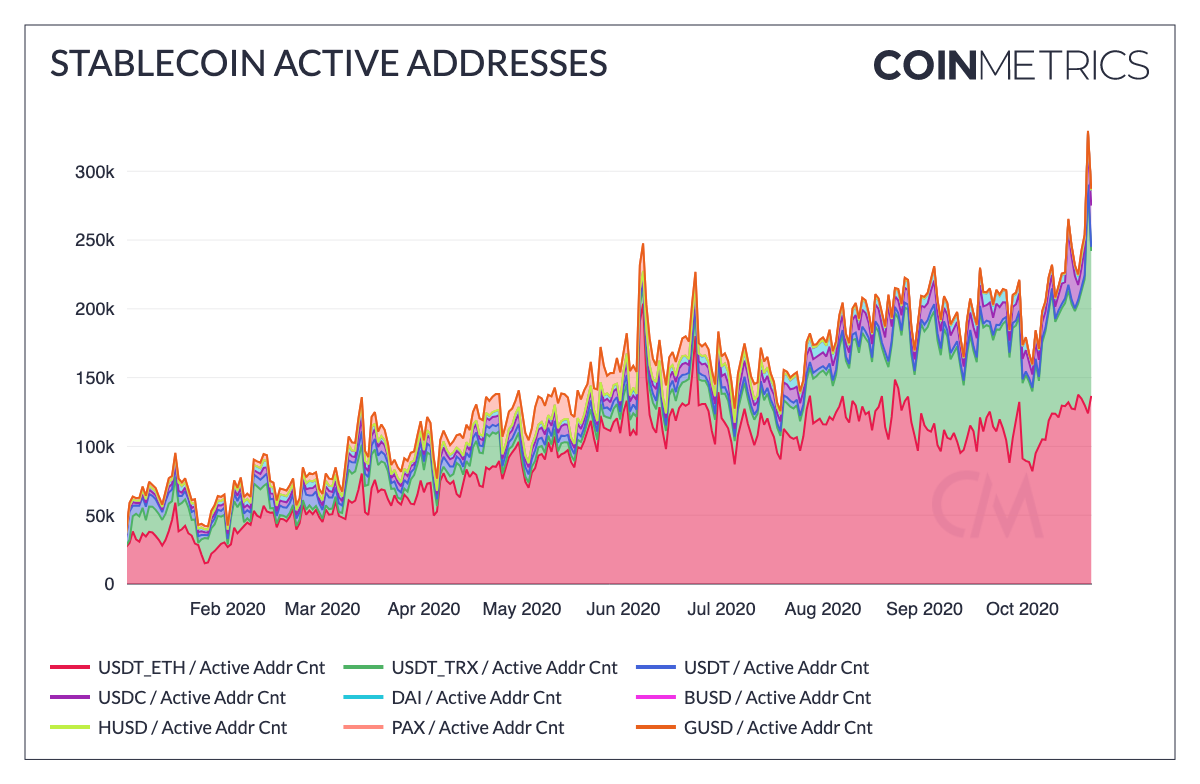

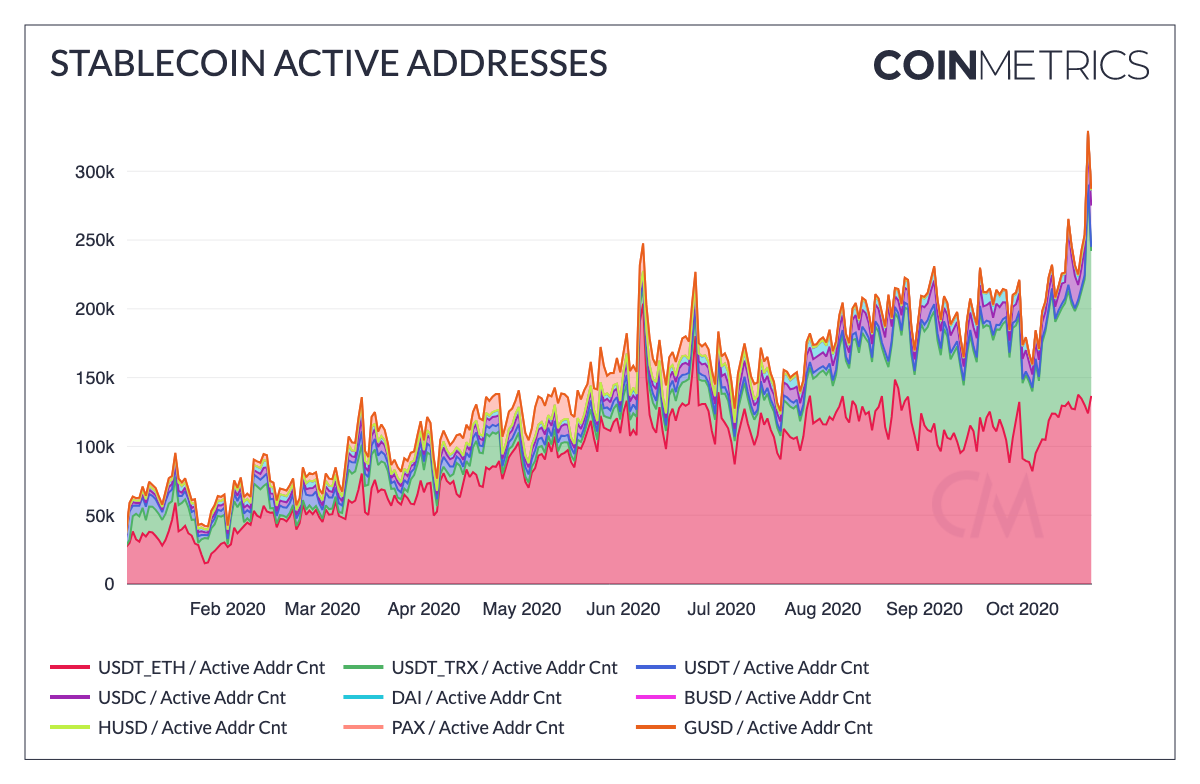

Stablecoin Active Address || Source: Coinmetrics

The above chart by Coinmetrics is smoothed using a 7-day rolling average. Total active addresses for Tether hit a new ATH earlier this week. Though the number has dropped from the peak, it is 500 times higher than where it started in January 2020. In light of recent developments in the crypto market, the burning question is, what’s the impact of CBDCs on Stablecoins?

The USP of stablecoins is their price stability, as they are pegged to underlying fiat currencies like the USD or EURO. However, if fiat currencies are offered digitally, there may no longer be a need for stablecoins. Traders can possibly exchange their cryptocurrency assets to CBDCs and hold them in their wallets, rather than add another step to the process and HODL in stablecoins. Additionally, stablecoins are used for transferring funds from one exchange to another, and between wallets. The ease of use and low transaction cost makes it a lucrative and popular choice. However, CBDCs may be used for the same, and except for overseas or crossborder transactions, the use case for Stablecoins may cease to exist. There are alternative cryptocurrencies like Ripple and Tron, that are currently being used for settling such transactions. Stablecoins may need another utility, or the dominance could drop from 5.89% to nearly 0.

The current stablecoin market capitalization is $21.48 Billion and dominance is 5.89% and this may move to CBDCs and drop the overall crypto market capitalization. Exchanges are already choked for funds and liquidity is at its lowest in the past 180 days. This may further have a negative impact on the inflow to exchanges.

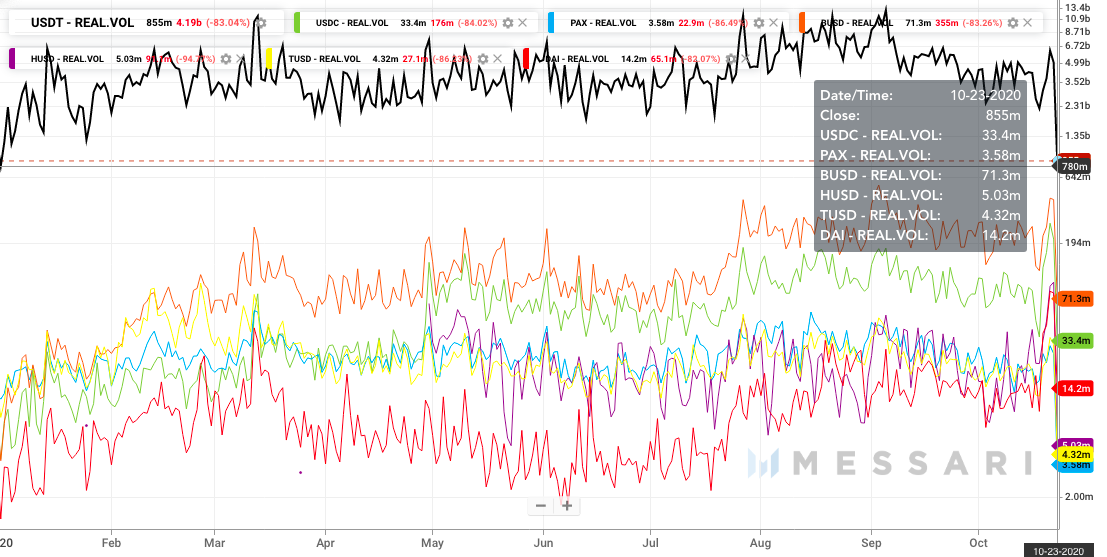

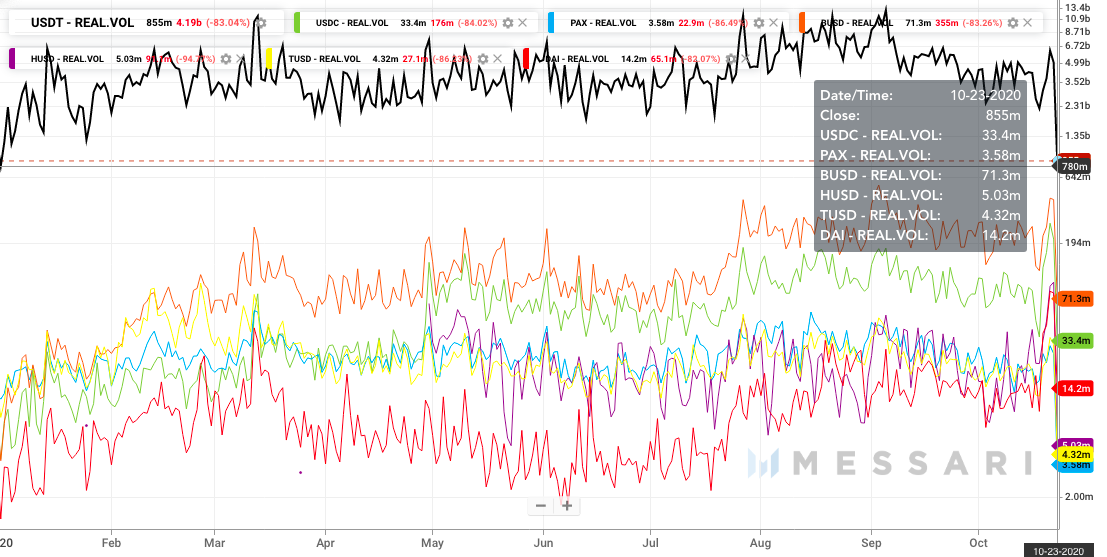

Volume of Stablecoin Transactions || Source: Messari

The current volume of stablecoin transactions is nearly the same as the beginning of 2020, however, there is a recent drop in Tether transactions. Since inflow to exchanges has dropped, this is anticipated. The volume of top stablecoin transactions is sensitive to exchange and transfer of funds in the market and a continued drop in inflow may drop this to the lowest level YTD.

Exchanges are already choked for funds when it comes to Bitcoin and Ethereum reserves. If stablecoin market capitalization is wiped out, the inflow of funds may drop further. The launch of CBDCs may prove to be a game-changer for the crypto market, however so far the impact on stablecoins is skewed towards negative.

The post appeared first on AMBCrypto