Except for Digibyte, both XRP and IOTA indicate mild to strong bullish indications. Digibyte shows a clear downtrend possibility, however, not to a huge extent.

XRP

Source: XRPUSD TradingView

XRP has seen a good surge in the last week, with price surging by almost 9% in the last 12 hours. This surge might soon come undone as the price is stuck at the top side of an ascending parallel channel.

There are two possibilities for XRP, one slightly bearish, and the other very bearish. The former involves price heading down to $0.2436 or a 2% decline from the current level. The latter involves price undoing its recent 9% surge.

The MACD indicator also looked toppy and ready to reverse.

IOTA

Source: IOTAUSD TradingView

Like XRP, IOTA has also formed a parallel channel, however, the price has broken out of it. At press time, however, IOTA looks to be moving into a consolidation pattern. Hence, we can expect IOTA to move sideways with little volatility in the near future.

The RSI indicator is a mirror of the price movement, and there seem to be no divergences between the price and RSI. Hence, we can expect the price to move higher as RSI approached the overbought level.

If the price breakout is supported by the bulls, we can expect IOTA to head to the next resistance level at $0.28 and $0.30.

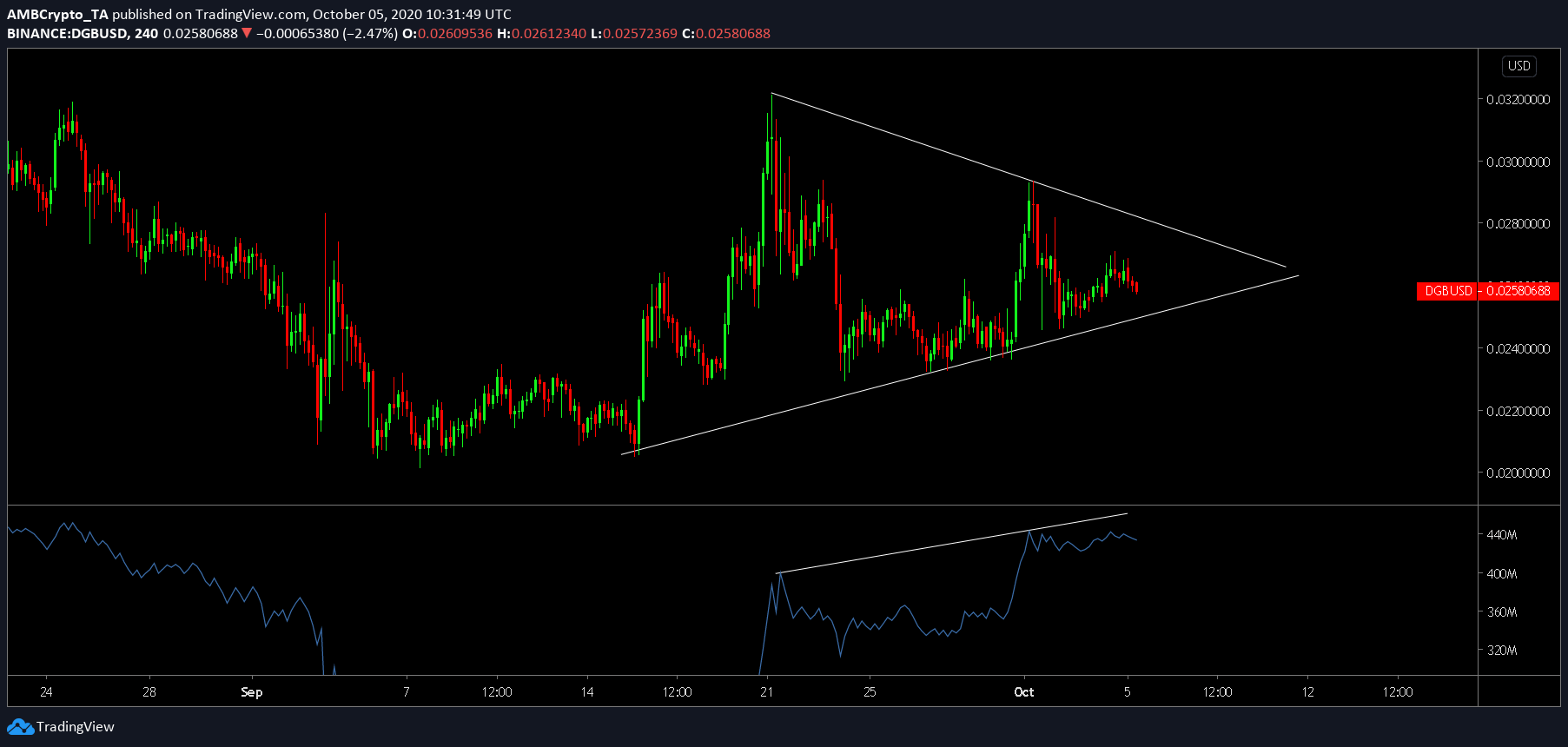

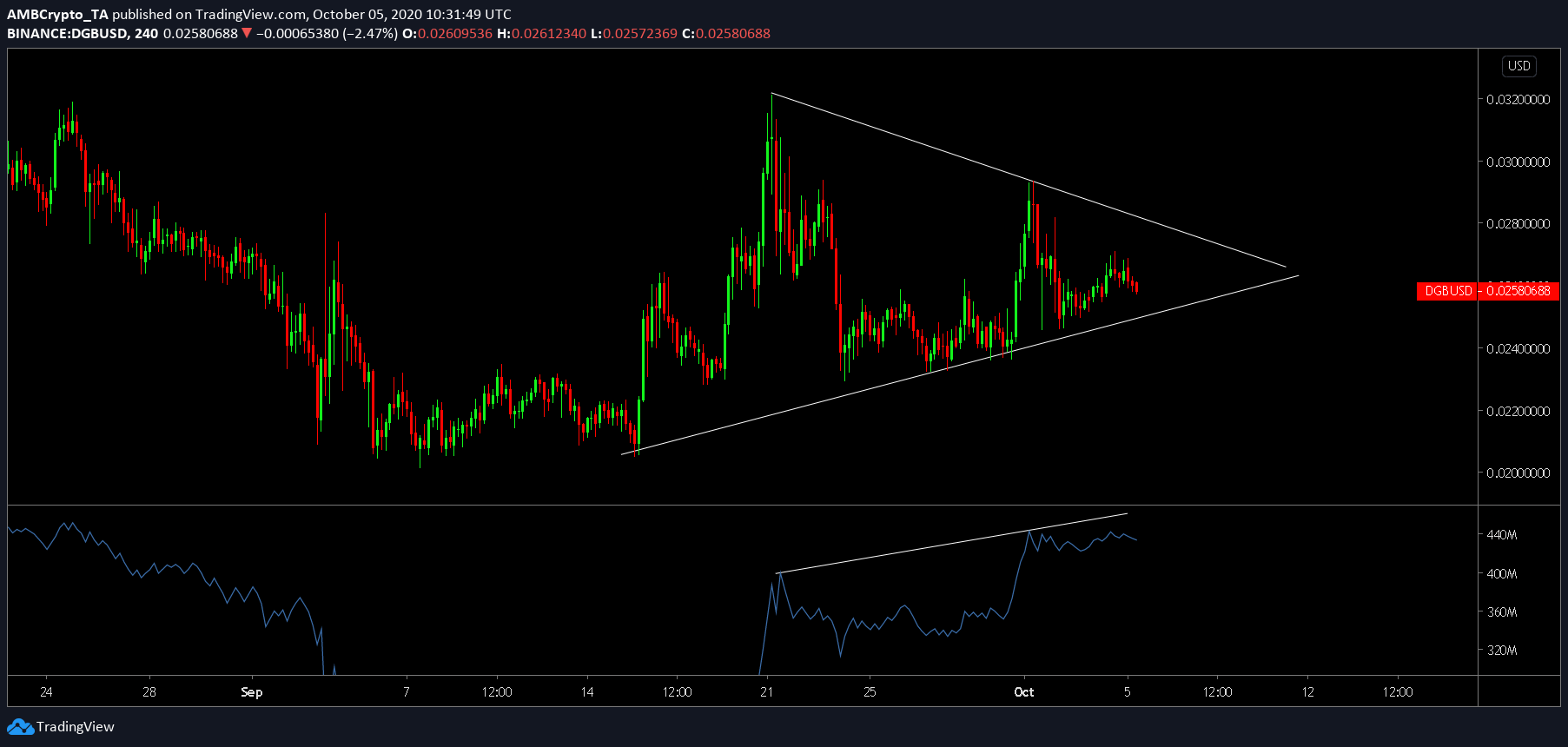

Digibyte [DGB]

Source: DGBUSD TradingView

Digibyte, unlike XRP or IOTA, is stuck in a massive consolidation pattern that has spanned more than 2 weeks. At press time, the price is in a bearish downtrend and by the looks it, this trend might continue.

The symmetrical pattern shows price consolidation and range-bound movement, hence, this is a haven for scalpers. At press time, DGB has seen a 17% from October 1 to 2, however, in the last two days, the price has surged by 4%, yet without establishing a clear uptrend.

Going forward we can expect DGB to head lower and test the lower part of the symmetrical triangle, which is a 2-3% drop. This is due to the bearish divergence between the price and OBV.

The post appeared first on AMBCrypto