By Dmitriy Gurkovskiy, author at RoboForex Blog

On Friday, June 26th, the XRP positions remain weak. The cryptocurrency is generally trading at 0.1818 USD, and the attempts of bounces look too timid to turn out productive.

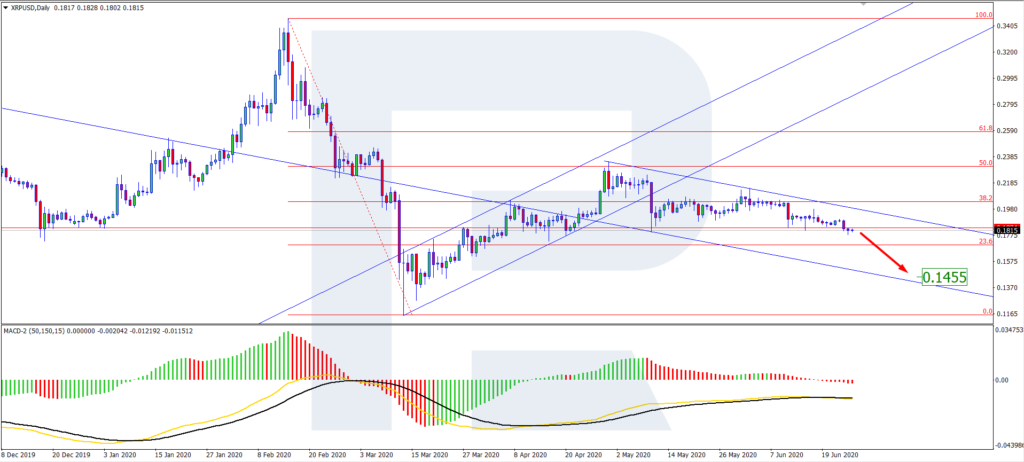

On D1, XRP/USD keeps forming a downtrend. After a bounce off 32.8% Fibo, the quotations are heading for 23.6%, which currently may indicate further declining. If this level is broken away, the pair has all chance to reach the next level of 0.0%. The only possible growth is a minor correction inside the descending channel. The MACD histogram is below zero, while the signal lines have formed a Golden Cross, giving an additional signal of a further decline. The aim of falling is 0.1455 USD.

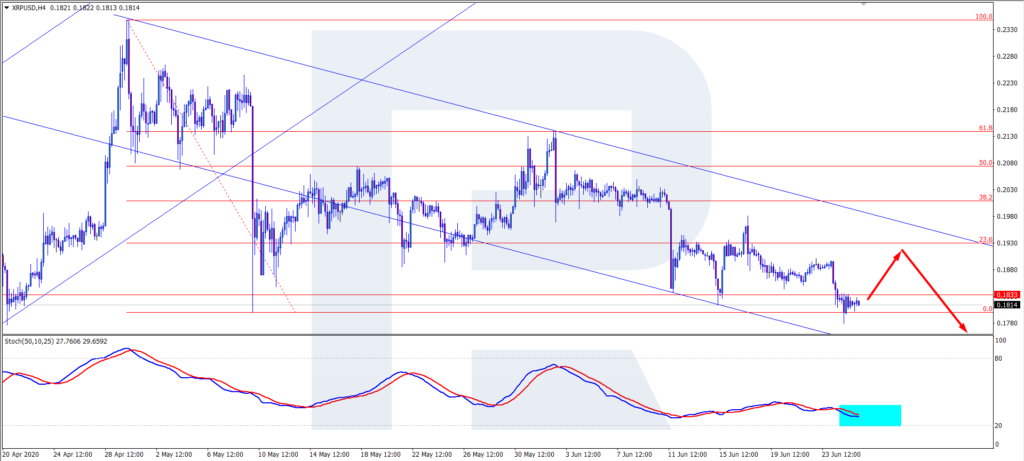

On H4, the pair keeps declining inside the descending channel. It is currently testing 0.0% Fibo. If the quotations break this level away, this will mean a further decline. The Stochastic is forming a Golden Cross, which may predict a minor correction in the overall decline. The aim of the pullback will be 23.6% Fibo.

The USA desperately needs to sort out the regulations for cryptocurrencies and blockchain, as well as accompanying technology, otherwise, the States will face a disaster. At least, this is the opinion of Chris Larsen, the co-founder of Ripple. According to him, decentralization and the developments based on it are already becoming the locomotive of the world’s financial system, and in the future, the trend will become global. It would be unwise to stay away from such a massive process.

Several years have passed since the overall agitation and noise around cryptocurrencies, and the USA has already lost a lot of time. By Larsen, the country needs to create the infrastructure and the blockchain industry to be able to compete with China. We must give credit to the latter country as it has reached a lot in the sphere of blockchain.

Such commentaries are likely to have been caused by Jerome Powell’s presumption that the US dollar might lose its status of the global reserve currency. The connection might be as follows: the positions of the dollar as the global protective currency may be supported by developing blockchain and creating a virtual analog of the dollar, which will be then promoted globally. Such a plan might open a lot of doors, including for the XRP.

Disclaimer

Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

The post appeared first on The Merkle