XRP price is poised for a significant rally, despite gaining 6% upside momentum in the past four hours. It’s all thanks to the asset management giant Grayscale. On September 12, 2024, the firm announced its latest single-asset crypto investment product, Grayscale XRP trust.

Grayscale’s XRP Trust Takes the Spotlight

This announcement on X (previously Twitter) went viral and attracted significant attention from the crypto community. This post garnered 350K impressions in less than two hours and the number is still rising rapidly.

With Grayscale’s latest investment product, investors will gain the exposure to tap into XRP, a token powering the XRP Ledger, a distributed, peer-to-peer network created to help cross-border financial transactions.

Current Price Momentum

At press time, XRP is trading near $0.56 and has experienced a price surge of over 6% in the last 24 hours. Meanwhile, its trading volume has skyrocketed by 75% during the same period, indicating traders’ and investors’ bullish views following Grayscales’ announcement.

XRP Technical Analysis and Upcoming Levels

According to the expert technical analysis, XRP appears bullish after a week-long downturn, as it is now trading above the 200 Exponential Moving Average (EMA) on the daily time frame. However, the recent price surge has pushed XRP’s Relative Strength Index (RSI) into over-bought territory, suggesting a potential price reversal.

Based on the historical price momentum, XRP is facing strong resistance near the $0.58 level. If XRP’s daily candle closes above the $0.58 level, there is a high possibility it could soar by 10% to the $0.632 level.

On-Chain Metrics: Bulls in Control

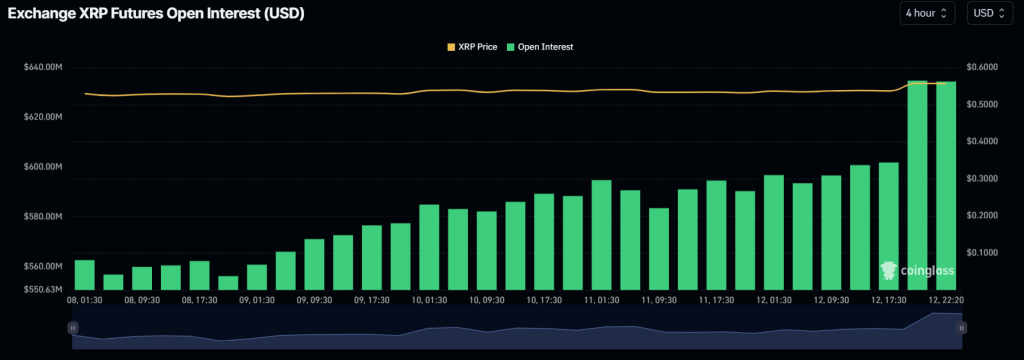

This bullish outlook is further supported by on-chain metrics. CoinGlass’s XRP long/short ratio currently stands at 1.0886, which indicates trader bullish market sentiment. Additionally, XRP’s future open interest has skyrocketed by 7.3%, suggesting that are increasingly betting on long positions.

Furthermore, Long/Short data shows that 52.12% of top XRP traders hold long positions, while 47.88% hold short positions.

The post appeared first on Coinpedia