As the year comes close to an end, it is the time for retrospection and reflection: the same holds for XRP, which holds its position as the third-largest cryptocurrency. XRP has managed to retain its community despite its shaky track record when it comes to price performance.

This article takes a look back at XRP and its performance as another year dawns on the cryptocurrency ecosystem.

A Timelapse of XRP

XRP had one of the most historical surges during the 2017 bull run, it pumped to a staggering $3.62 from a measly $0.005 at the start of 2017. This surge, coupled with staunch believers in XRP made its community one of the most feared yet welcoming communities in all crypto-Twitter. XRP community was diverse, filled with so-called jesters and developers flocking to build use-case for XRP. The community flourished and so did the use cases, XRP’s TipBot created by Wietse Wind took the XRP community by storm and helped ideate the same for other cryptocurrencies as well.

The cryptocurrency that was purpose-built to be an efficient and radical tool for cross-border payment had everything, never-ending support from its community and developers. There were, however, long-standing rumors about the inception of Ripple and doubts about the core idea behind the decentralization of XRP.

The community fought back against these rumors but there was another event that shook the supporters’ belief. XRP’s historic rise had an equally historic collapse, as the price tumbled down from $3.62 to $0.24 by the end of 2018. Then again, so did Bitcoin and a lot of other cryptocurrencies. Other cryptos witnessed a mini bull run in early 2019 but XRP did not mimic the trend. As of December 18, it hit a low of $0.17, the likes of which were seen in September 2017.

Rumors Revamped

By the end of December 2018 and early 2019, the rumors that XRP is being manipulated kept gaining traction. Perhaps, the first prominent person to address it on Twitter was Peter Brandt.

Will Ripple be able to manipulate the market to keep $XRP above .2400? A serious breakdown at this level, and .020725 is in the cards. pic.twitter.com/QAyfMcwaZd

— Peter Brandt (@PeterLBrandt) August 14, 2019

Brandt even mentioned that “Ripple has manipulated the price of XRP to hold support” and that breaching this support would trigger a dump in a “major way”. Ripple’s escrow release of XRP and its supposed effect on the price decline of XRP became the main cause of concern.

The rumor gained enough traction for Ripple to address it, in Q3 of 2019 Ripple stated:

“Last quarter, there was an uptick in FUD (fear, uncertainty and doubt) and the spread of misinformation about XRP, especially around topics such as purported XRP dumping and price manipulation by Ripple.”

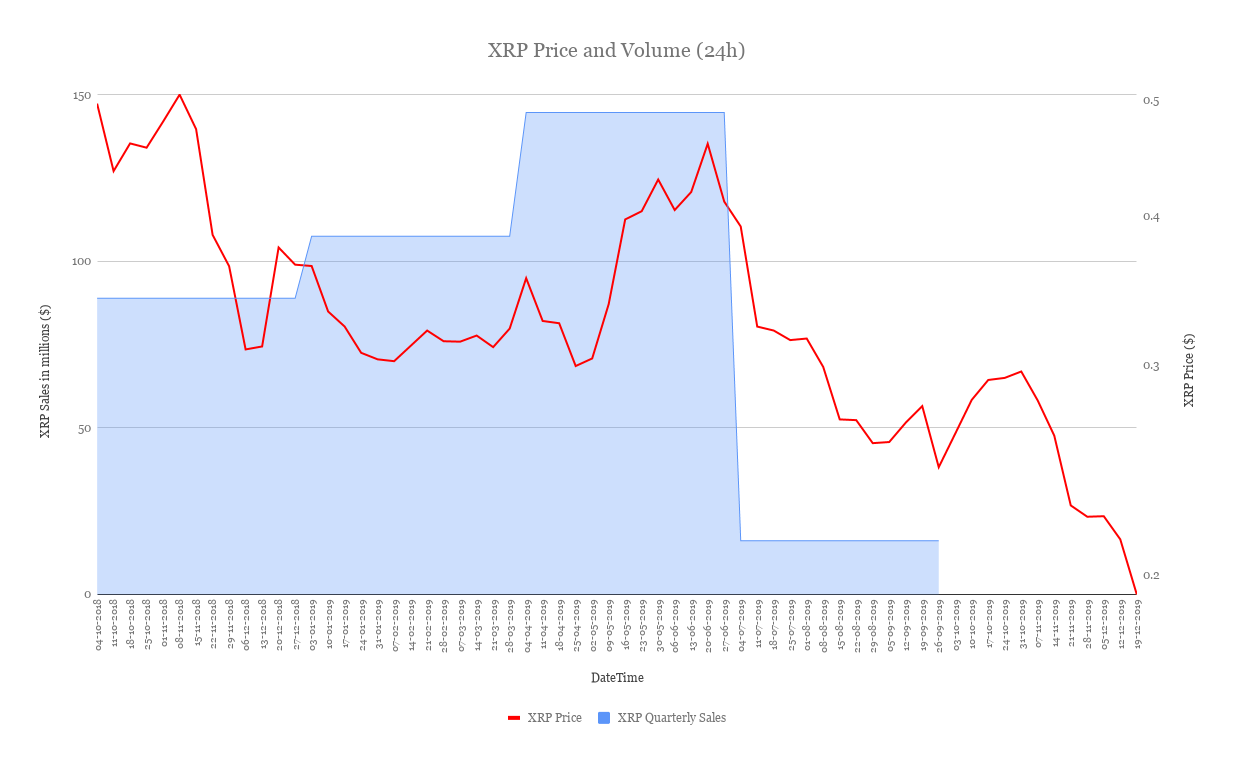

Ripple further added that it had a limited role and does not control the price of XRP. It also mentioned that XRP is “traded on a fully functioning and independent digital asset market.” FUD or not, XRP’s release out of escrow reduced by a massive 88.8% from Q2 to Q3.

Source: CoinPaprika, Ripple

In addition to Ripple, members of the XRP community abstained from answering questions related to the price manipulation FUD/rumors.

XRP’s Dumping Allegations

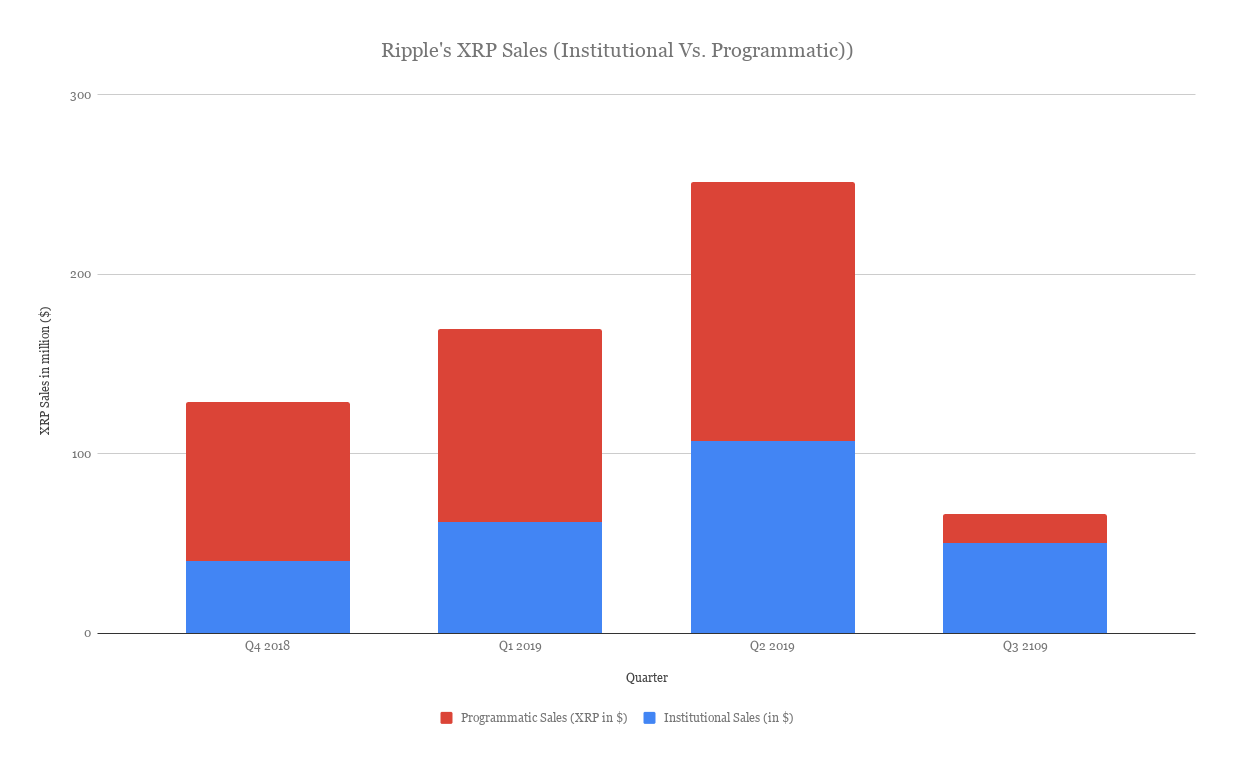

Source: CoinPaprika, Ripple

As seen in the above picture, the price of XRP has been on a constant decline since the Q4 of 2018. However, the price managed to briefly rise higher in mid-2019 before continuing to dip. The programmatic sale of XRP reduced by 81.86% since Q4 of 2018 and 85% since Q1 of 2019. Although Q4 report is yet to be released, there is still a conflict when it comes to the collapse of XRP’s price.

The narrative of Ripple controlling XRP’s price could have two definitive outcomes,

- Since the price of XRP has reduced radically in the last two months, the rumor or fud would gain more tractions if the Q4 report of 2019 shows an increase in programmatic sales of XRP.

- The narrative would be forgotten if there is a reduction in programmatic sales and that XRP’s price collapse is the natural path of correction.

Another step taken by Ripple to reduce manipulation by exchanges was to set a new ‘volume benchmark‘ to reduce misreported, falsified and inflated reported trading volumes.

XRP’s Adoption & Regulation

In terms of adoption, XRP-listed exchanges rose from 120 to 140 until Q3 2019. According to quarterly reports, Ripple’s ODL [On-Deman Liquidity] for xRapid transactions has increased, especially since MoneyGram began cross-border payments. MoneyGram’s partnership with Ripple marked a new phase for both Ripple and XRP as it has improved the xRapid adoption and addition of new partners – a 30% increase in partners using xRapid.

Xpring side of XRP adoption saw an equal rise in partners. Bolt, Agoric, Robot Ventures, Coinmine, and many others have received support and/or funding from Ripple’s Xpring initiative. Additionally, Coil, a platform that rewards content creators using XRP’s micro-payments ability and ILP [Inter Ledger Protocol] partnered with Mozzila and Creative Commons to launch Grant for the Web. In terms of using XRP as payments, Xpring also partnered with Bitpay that will allow thousands of businesses to accept XRP for payments.

SEC announced that they would establish nodes on certain open-source, permissionless ledgers, such as the XRP Ledger, to help inform its policymaking. Additionally, UK’s Financial Conduct Authority analogized XRP to ETH, which, it recognized as a hybrid utility/exchange token, not a security token. In Q3 of 2019, the UK’s Financial Conduct Authority released guidance to clarify definitions and domains for different crypto assets.

Speaking with AMBCrypot, Tezos’ executive board member of Tezos South East Asia, stated:

“There’s a huge potential in payment settlements, especially cross-border payments. Ripple is doing a fantastic job tackling Swift transfers. Once you start having someone agitate the space, you can see it trickle down to people like payment gateways. When the end merchants start seeing that they can get better rates and support for different currencies.”

The Beginning of the End of a Decade: XRP

Ripple recently raised a whopping $200 million to boost XRP’s adoption. If XRP adoption rises exponentially, this could potentially cause the price to surge higher.

With a backing of $200 million, XRP will definitely make headway in terms of adoption. However, Ripple’s Asheesh Birla spoke to AMBCrypto, about crypto exchange trends for 2020 as he stated:

“In 2020, the exchange market will consolidate and the remaining exchanges will expand from regional to more established global players to stay competitive. For smaller exchanges, the costs of keeping up with security, regulatory compliance and modern technology becomes difficult when you’re up against the Binances of the world – which has grabbed up several exchanges in the latter half of 2019.”

The post appeared first on AMBCrypto