- Chainlink surged by another 18.5% today to bring the price for the coin as high as $17.90.

- This move created a new ATH value for LINK and allowed it to claim the 5th ranked position according to market cap.

- Against Bitcoin, LINK also created a new ATH value as it reached as high as 153,000 SAT today.

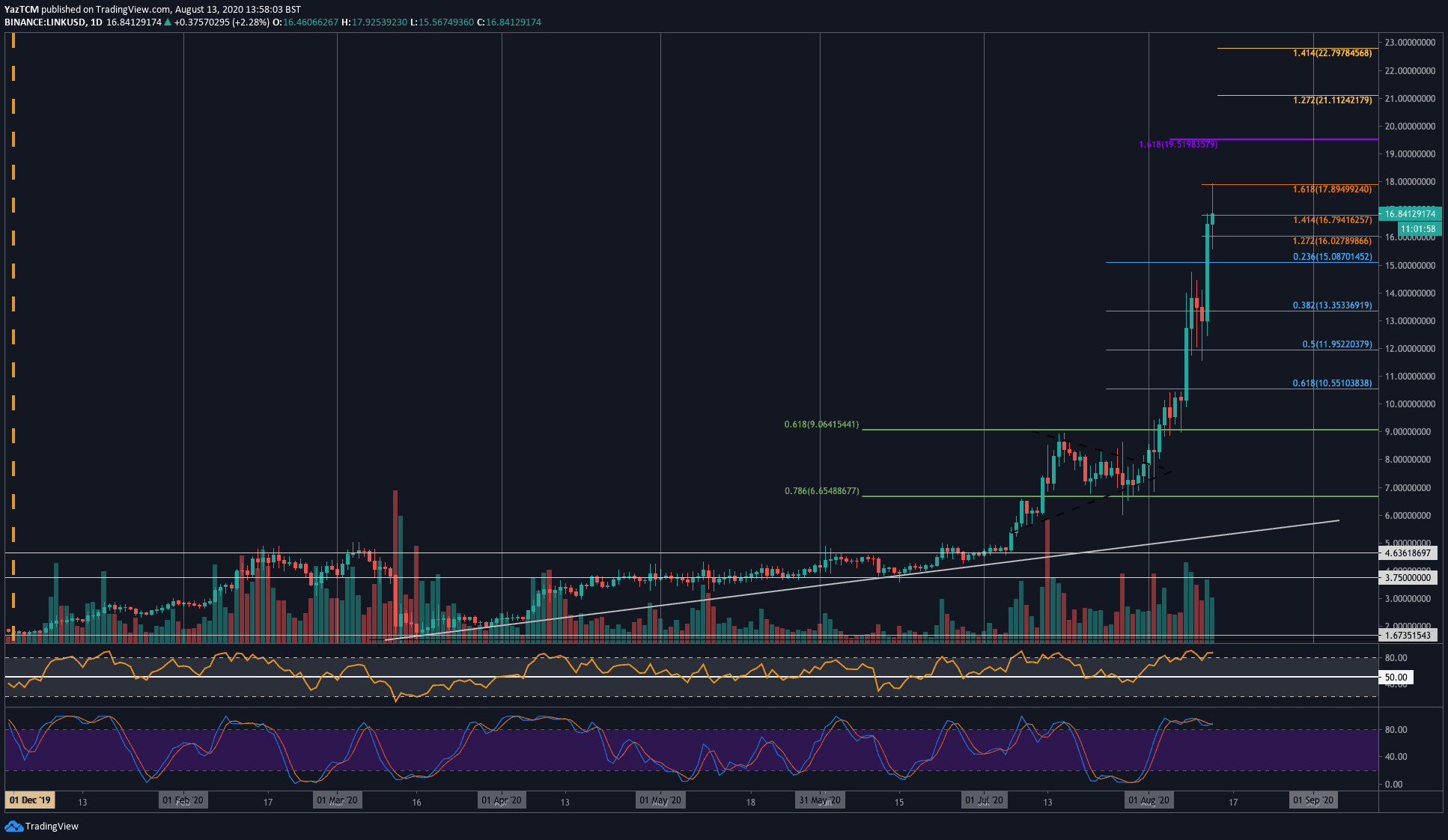

LINK/USD: LINK Pushes Into Fresh ATH at $17.90

Key Support Levels: $16, $15.10, $14.

Key Resistance Levels: $17.90, $19, $19.50.

Chainlink is showing zero signs of slowing its pace after it surged by a further 18.5% today to push the coin into $17.90. The move was likely propped by the YAM farming craze, as LINK was one of the tokens eligible for yield farming in the protocol.

At these levels, however, it met resistance at a 1.618 Fib Extension and headed lower toward $16.84.

Chainlink has been on a remarkable run as of recently. It climbed by a total of 75% in this past week alone, surpassing everybody’s expectations. Despite the parabolic increase, Chainlink’s intrinsic value stems from the fact that the entire DeFi ecosystem requires its decentralized pricing oracle.

The surge today also allowed Chainlink to flip Bitcoin Cash and claim the 5th ranked position as it currently holds a market cap of almost $6 billion.

LINK-USD Short Term Price Prediction

Looking ahead, if the bulls push higher again, the first level of resistance lies at $17.90 (1.618 Fib Extension – orange). Beyond this, resistance lies at $19, $19.50, and $20. If the buyers push further above $20, additional resistance is located at $21 (1.272 Fib Extension) and $22.80 (1.414 Fib Extension).

On the other side, the first level of support lies at $16. Beneath this, additional support is found at $15.10 (.236 Fib Retracement), $14, and $13.35 (.382 Fib Retracement).

Both the RSI and Stochastic RSI are in overbought conditions, which could suggest the market may be overextended. However, it is essential to note that when a coin is surging, the RSI has been known to remain overbought for extended periods.

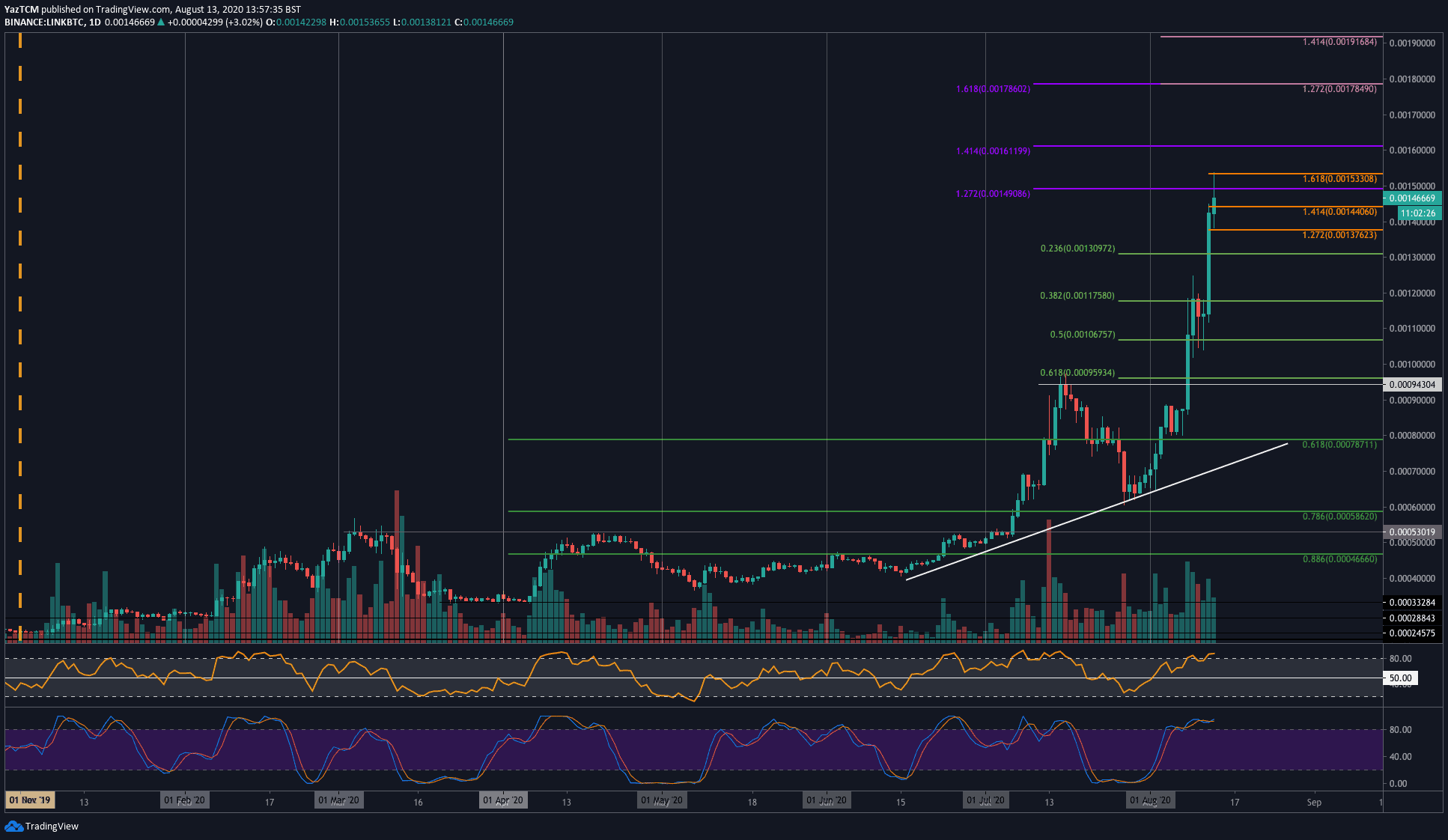

LINK/BTC: Bulls Reach As High As 153,000 SAT For The First Time

Key Support Levels: 140,000 SAT, 131,000 SAT, 117,600 SAT.

Key Resistance Levels: 153,300 SAT, 161,200 SAT, 170,000 SAT.

Against Bitcoin, LINK also surged further higher this week as it broke the previous resistance at 117,600 SAT and pushed higher to reach the 153,300 SAT resistance today (1.618 Fib Retracement).

The coin has since dropped slightly as it trades at 146,700 SAT, but the momentum appears to be in favor of the bulls.

LINK-BTC Short Term Price Prediction

Looking ahead, if the buyers push above 150,000 SAT again, the first level of resistance lies at 153,300 SAT (1.618 Fib Extension). Above this, additional resistance is located at 161,200 SAT (1.414 Fib Extension – purple), 170,000 SAT, and 178,600 SAT (1.618 Fib Extension – purple).

On the other side, the first level of support lies at 140,000 SAT. This is followed by support at 131,000 SAT (.236 Fib Retracement), 117,600 SAT (.382 Fib Retracement), and 110,000 SAT.

Likewise, both the RSI and Stochastic RSI are extremely overbought, which suggests that the market may need to retrace slightly.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato