A favorable week for Bitcoin in which the coin witnessed a price hike of 7% at press time. While Ethereum’s price hasn’t set the market on fire, its on-chain numbers were better over the past week in comparison to Bitcoin.

Coinmetrics’ recent report suggested that Bitcoin’s active addresses were down by 2.7% and its transaction decreased by 3.1%. Ethereum on the other hand recorded a 27% week-over-week active addresses spike, registering over 600k addresses for at least 3 consecutive days; the first time since January 2018.

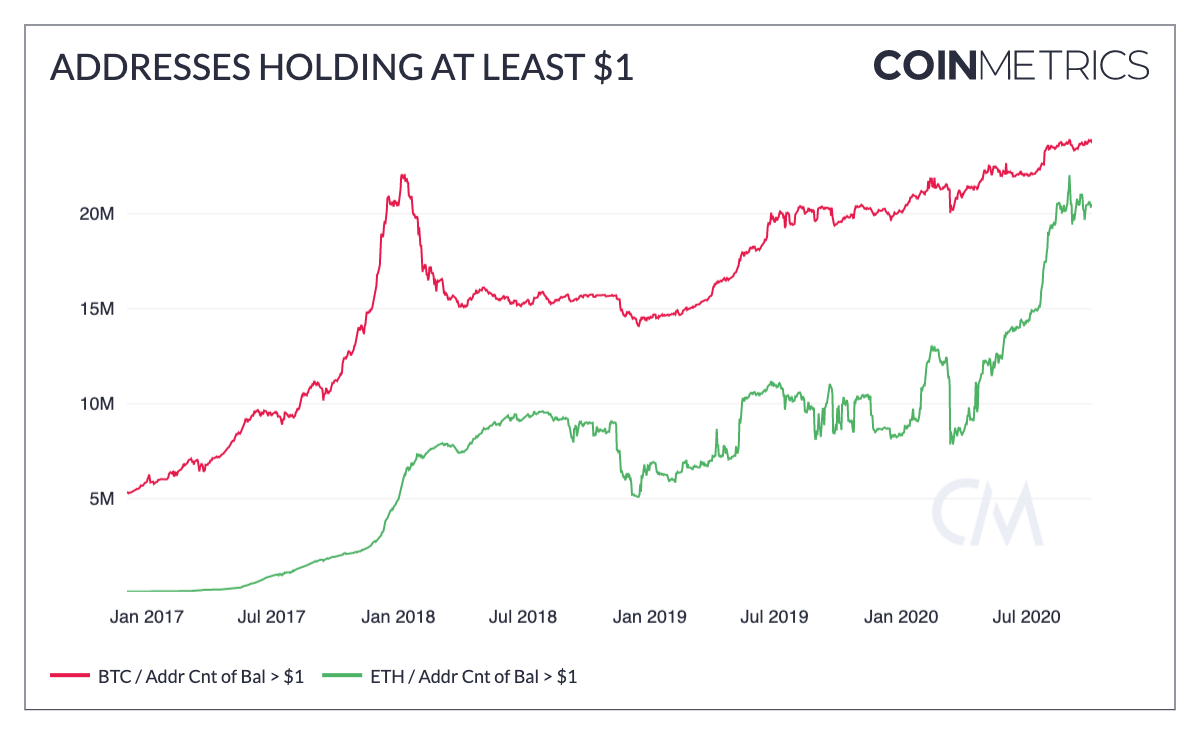

Additionally, further analysis also indicated another rising trend with regards to addresses.

Ethereum addresses lead Bitcoin in terms of value density

Source: Coinmetrics

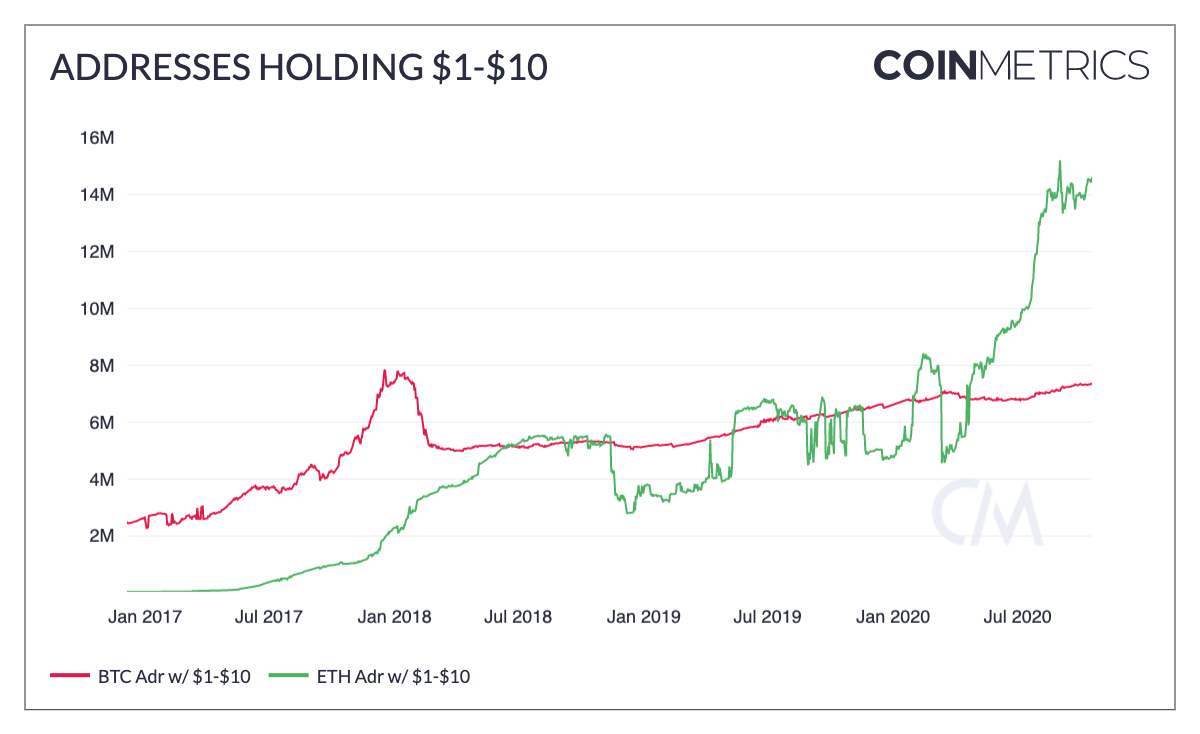

Source: Coinmetrics

The above two charts represent the number of Bitcoin and Ethereum addresses that hold at least $1 and between $1-$10. Bitcoin led the number of addresses holding a minimum of $1 with 24 million addresses. However, Ethereum lagged only a little with around 21.2 million addresses.

However, comparing the addresses holding a specific range of $1-$10, Ethereum was ahead by a country mile. The report added,

“There are about 16.45M BTC addresses holding at least $10 vs about 6.51M for ETH. This means there are close to 15M ETH addresses holding between $1 and $10 compared to about 7.55M for BTC.”

While it can be inferred from the above on-chain data that Ethereum is outrightly leading in terms of widespread adoption at the moment, there is further clarification required for the ‘asset’ that is actually held by these addresses.

Bitcoin addresses hold only BTC; Ethereum addresses are different

While Ethereum addresses did spike more than Bitcoin over the past week, data suggested that it coincided with the growth of stablecoin supply. Stablecoin active addresses hit a new-all time high during October 15th, and Ethereum addresses holding USDT, USDC led the way.

To break it down, while Bitcoin addresses are strictly holding BTC, Ethereum addresses interoperability allows it to hold stablecoins as well. Such a condition might have pumped the number of ETH addresses holding between $1-$10.

Now, here is the issue. Ethereum addresses carrying USDT, USDC have been under scrutiny lately as in July 2020, Centre had blacklisted 100,000 USDC stored in Ethereum addresses, and right after that Tether red-flagged 39 ETH addresses holding $46 million worth of USDT.

Going back to the earlier discussion, adoption superiority for Ethereum addresses goes right out of the window. Considering ETH‘s active addresses are vulnerable to illicit storage of value, it doesn’t really help Ether or Ethereum’s adoption.

In comparison, Bitcoin addresses appear more safe and credible, as they carry transparency in terms of value held in their BTC entities.

The post appeared first on AMBCrypto