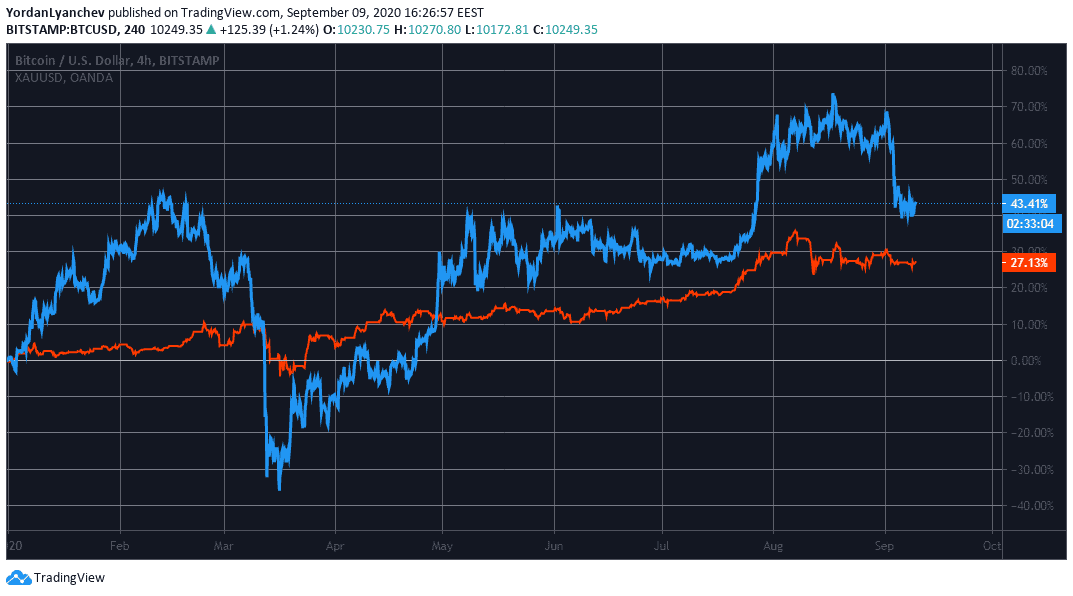

Macro-scale data reveals that the correlation between gold and Bitcoin has surged in 2020, registering a new all-time high.

Although both assets are in the green year-to-date, Bitcoin is still outperforming the precious metal, despite the recent price drop.

BTC-Gold Correlation At ATH

According to data from the analytics company CoinMetrics, the 60-day correlation between Bitcoin and gold has reached a new all-time high at over 0.5. After the metric bottomed at below -0.3 during the mid-March sell-offs when BTC plummeted to $3,700, the 60-day correlation has been gradually increasing.

The positive correlation surged sharply at the start of July when the US dollar started losing substantial chunks of value. As such, it appears that during these times of uncertainty for the global reserve currency, investors are turning to scarce assets such as gold and Bitcoin.

The US-based veteran exchange Kraken also examined the correlation between the two assets but on a micro scale. The report confirmed that it skyrocketed in the summer of 2020 and reached a “near 1-year high of 0.93 on July 31st,” and it advanced to an ATH of 0.97 on August 10th.

However, the smaller scale observed by Kraken suggests that Bitcoin has decoupled from the precious metal in the last few weeks.

“Bitcoin’s rejection from an intra-month high of $12,480 on August 17th put Bitcoin in a 10-day correction that caused price action to deviate away from gold’s sideways trading,” Kraken added.

YTD Price Performance: Gold Vs. Bitcoin

Another resemblance between the two comes from their price developments during 2020. Gold and Bitcoin are among the best performing assets since the start of the year.

Typically regarded as a safe-haven instrument, gold’s price has jumped by 27% since the start of the year. Its impressive performance even led to an ATH of nearly $2,100 per ounce in early August.

In fact, perhaps to demonstrate the mentioned above high correlation between gold and Bitcoin, the bullion’s surge preceded that of the primary cryptocurrency. Shortly after the precious metal, BTC reached its yearly high of $12,480.

The similarities continued as both assets have retraced since then. Nevertheless, gold is up by 27% year-to-date, while Bitcoin has gained more than 40%.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato