(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Some of y’all be like:

“The crypto bull market is over.”

“I need to launch my token now because we are in the downswing of the bull market.”

“Why is Bitcoin not rising in tandem with large-cap US tech companies index in the Nasdaq 100?”

This chart of the Nasdaq 100 (white) vs. Bitcoin (gold) shows that both assets moved in tandem, but Bitcoin has stalled out since hitting a new all-time high earlier this year.

But then the same folks spout the following talking points:

“The world is moving from a unipolar US-ruled world order to a multipolar world order that contains leaders such as China, Brazil, Russia, etc.”

“In order to fund government deficits, savers must be financially repressed, and central banks must print even more money.”

“WW3 already started, and wars are inflationary.”

Some opinions about the current stage of the Bitcoin bull market vs. their opinion on the geopolitical and global monetary situation confirms my view that we are at a turning point. We are moving from one geopolitical and monetary global arrangement to another. While I don’t know the exact end of steady state vis-a-vis which nations will rule and what the trade and financial architecture will specifically look like, I do know what it will resemble.

I want to zoom out from the current vicissitudes of the crypto capital markets to focus on the broader cyclical trend reversal in which we are immersed. I want to break down the three major cycles from the 1930s Great Depression until today. This will focus on Pax Americana because the entire global economy is a derivative of the financial policies of the ruling empire. Pax Americana did not suffer a political revolution as a result of the two world wars, unlike Russia in 1917 and China in 1949. And most importantly, for this analysis, Pax Americana was the best place to hold capital on a relative basis. It has the deepest equity and bond markets and the largest consumer market. Whatever Pax Americana does is emulated and reacted against by the rest of the world, which results in good and bad outcomes relative to the flag on your passport. Therefore, it is important to understand and predict the next major cycle.

There have historically been two types of periods: Local and Global. In a Local period, the authorities financially repressed savers to fund past and present wars. In a Global period, finance is deregulated, and global trade is promoted. A Local period is inflationary, while a Global period is deflationary. Any macro theorist you follow will have a similar taxonomy to describe the major cycles of the 20th century and beyond historical periods.

The purpose of this history lesson is to invest wisely throughout the cycles. Over a typical 80-year life expectancy, I better get more time due to the stem cells I’m injecting; you can expect to experience two major cycles on average. I boil down our investment choices into three categories:

If you believe in the system but not those governing it, you invest in stonks.

If you believe in the system and those governing it, you invest in government bonds.

If you believe in neither the system nor those governing it, you invest in gold or another asset that doesn’t require any vestiges of the state to exist, like Bitcoin. Stocks are a legal fantasy upheld by courts that can dispatch men with guns to force compliance. Therefore, stocks require a strong state to exist and hold value over time.

In a Local inflationary period, I should own gold and eschew stocks and bonds.

In a Global deflationary period, I should own stocks and eschew gold and bonds.

Government bonds generally do not preserve value over time unless I’m allowed to infinitely leverage them at low to no cost or am forced to own them by my regulator. Primarily, that is because it is too tempting for politicians to pervert the government bond market by printing money to fund their political objectives without resorting to unpopular direct taxation.

Before delineating the last century’s cycles, I want to describe a few key dates.

5 April 1933 – On this day, US President Franklin Delano Roosevelt signed an executive order banning the private ownership of gold. Subsequently, he defaulted on America’s promise under the gold standard by devaluing the dollar-gold price from $20 to $35.

31 December 1974 – On this day, US President Gerald Ford reinstated the ability for Americans to privately own gold.

October 1979 – US Federal Reserve (Fed) Chairman Paul Volker changed American monetary policy to target the amount of credit rather than the level of interest rates. He then proceeded to starve the American economy of credit to slay inflation. In the third quarter of 1981, the 10-year US Treasury hit a yield of 15%, which holds the belt as the all-time high in yields and all-time low in bond prices.

20 January 1980—Ronald Regan was sworn in as the US President. He went on to aggressively deregulate the financial services industry. His other notable and subsequent financial regulatory changes were making the capital gains tax treatment of stock options more favourable and repealing the Glass Steagall Act.

25 November 2008—The Fed started printing money under its quantitative easing (QE) program. This was in response to the global financial crisis, which was started by subprime mortgage losses on financial institutions’ balance sheets.

3 January 2009 – Lord Satoshi’s Bitcoin blockchain published the genesis block. I believe that our Lord and Saviour is here to save humanity from the evil clutches of the state by creating a digital crypto currency that can compete with digital fiat.

1933 – 1980 Pax Americana Ascending Local Cycle

1980 – 2008 Pax Americana Hegemon Global Cycle

2008 – Present Pax Americana vs. the Middle Kingdom Local Cycle

1933 – 1980 Pax Americana Ascending Cycle

Relative to the rest of the world, America exited the war physically unscathed. Considering US casualties and property losses, WW2 was less deadly and physically destructive than the Civil War fought in the 19th century. As Europe and Asia lay in ruins, American industry rebuilt the world and reaped enormous rewards.

Even though the war went well for America, it still needed to pay for it via financial repression. Starting in 1933, the US banned gold ownership. In the late 1940s, the Fed combined with the US Treasury. This allowed the government to engage in yield curve control, which resulted in the government being able to borrow at below-market rates because the Fed printed money to buy bonds. To ensure that savers couldn’t escape, bank deposit rates were capped. The government used the marginal dollar saved to pay for WW2 and the Cold War with the Soviet Union.

If gold and fixed-income securities that paid interest at least at the inflation rate were outlawed, what could savers do to beat inflation? The stock market was the only game in town.

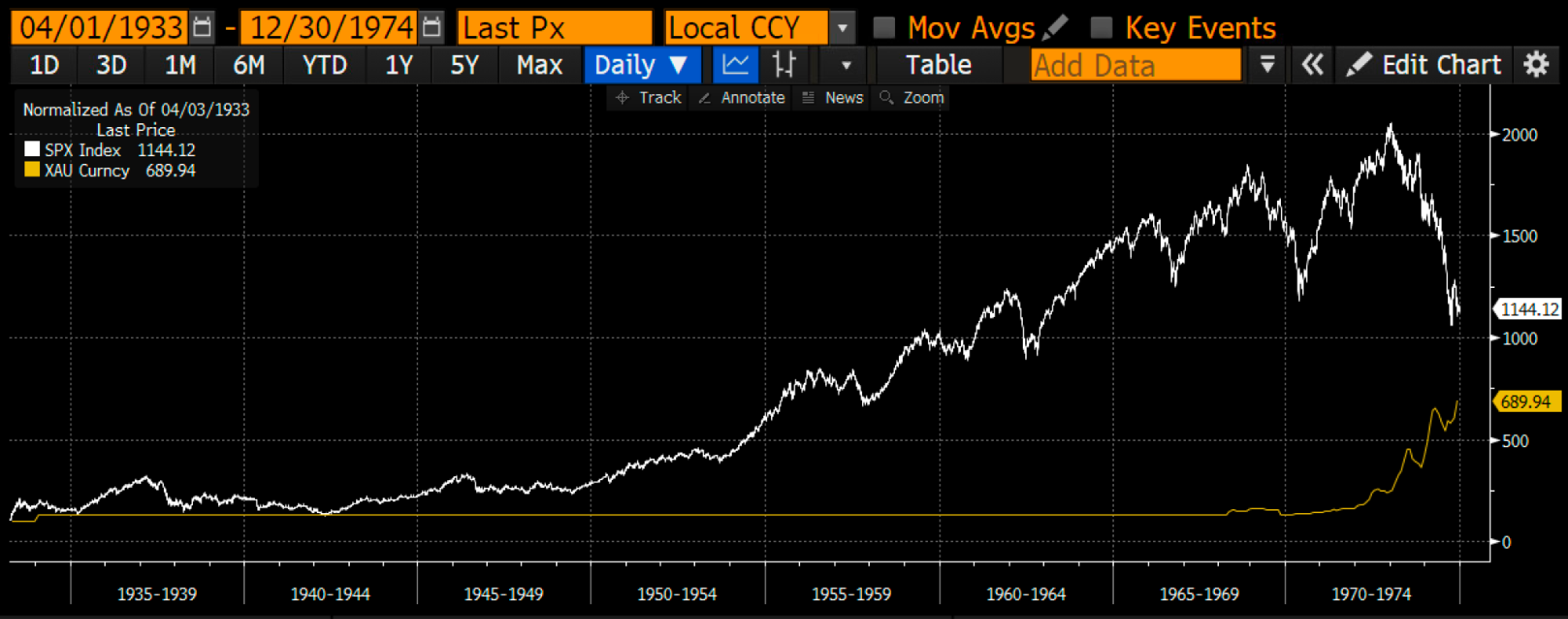

The S&P 500 Index (white) vs. Gold (gold) indexed at 100 starting on 1 April 1933 to 30 December 1974.

Even as gold rose following US President Nixon’s ending of the gold standard in 1971, it still did not eclipse the returns of stocks.

But what happened when capital was free to bet against the system and the government once more?

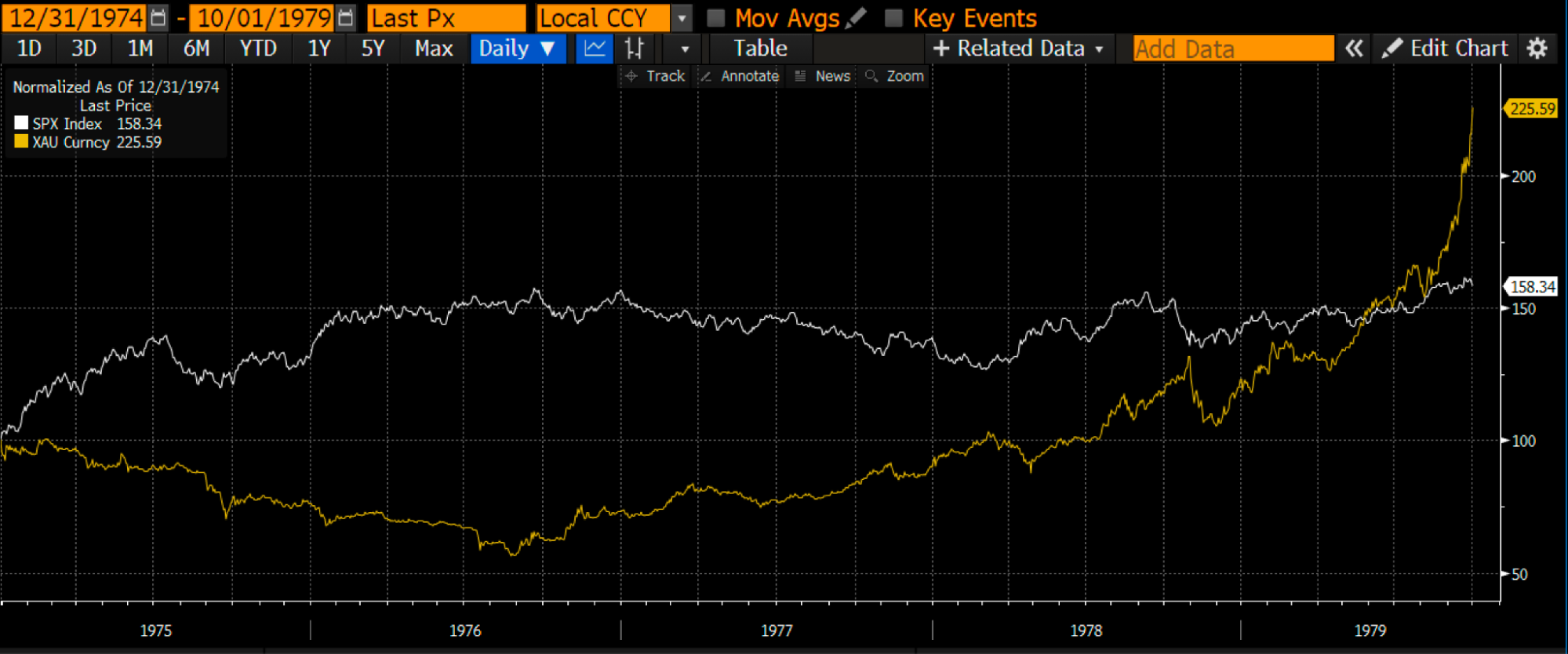

The S&P 500 Index (white) vs. Gold (gold) index at 100, from 31 December 1974 to 1 October 1979.

Gold outperformed stocks. I stopped the comparison in October 1979, as Volker announced that the Fed would start severely contracting outstanding credit, thus restoring faith in the dollar.

1980 – 2008 Peak Pax Americana Global Cycle

As confidence that the US could and would defeat the Soviet Union, the political winds changed. It was now time to transition out of a wartime economy, unshackle financial and other regulations of the empire, and let those animal spirits frolic.

Under the new petro-dollar monetary architecture, the dollar was backed by the oil sales surpluses of Middle Eastern oil producers such as Saudi Arabia. To maintain the dollar’s purchasing power, it was necessary to raise interest rates to crush economic activity and, by extension, inflation. Volker did just that, allowing interest rates to soar and the economy to dive.

The early 1980s marked the beginning of the next cycle, during which Pax America spread its wings to trade with the world as the sole superpower, and the dollar strengthened due to monetary conservatism. As expected, gold did poorly against stocks.

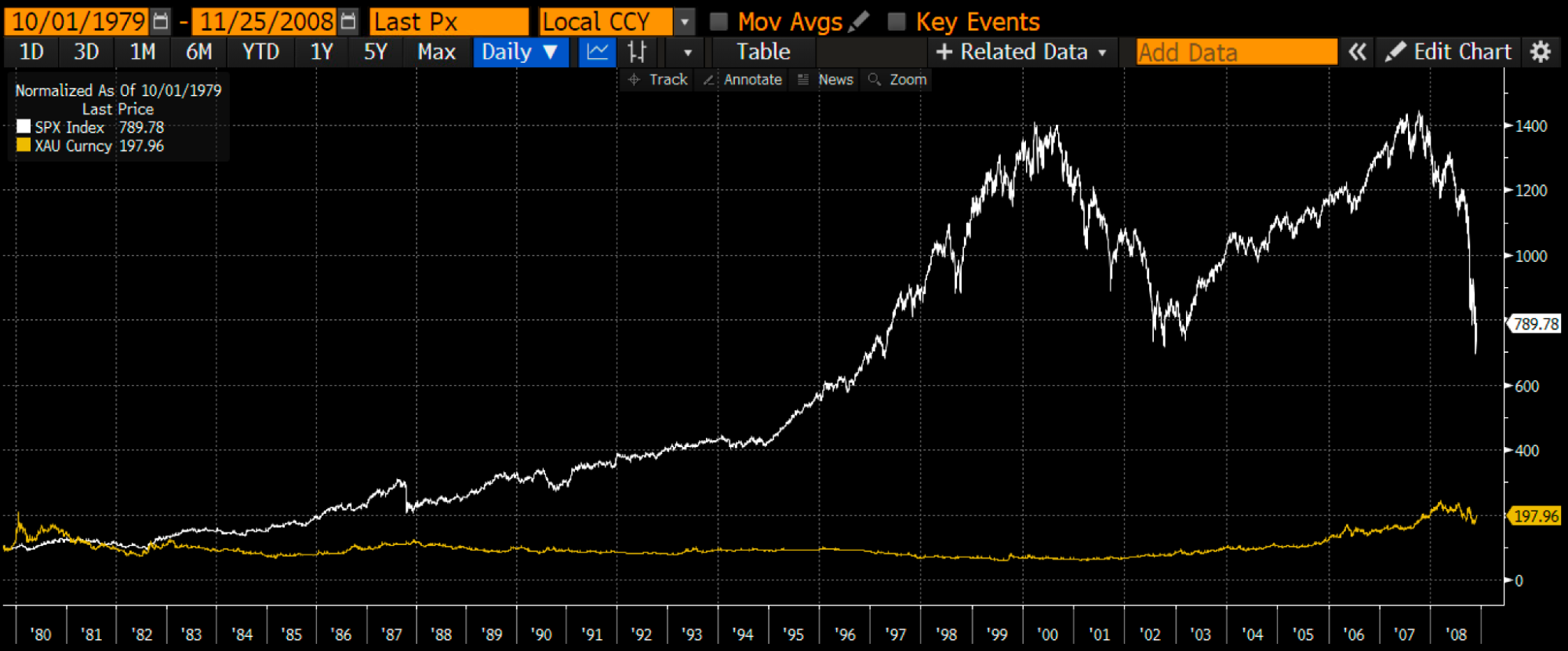

The S&P 500 Index (white) vs. Gold (gold) index at 100 starting on 1 October 1979 to 25 November 2008.

Apart from bombing some Middle Eastern nations back to the Stone Age, America didn’t face any war against a peer or near-peer military. Confidence in the system and the government wasn’t shaken even after America wasted over $10 trillion fighting and losing to cave dwellers in Afghanistan, kinda-cave dwellers in Syria, and guerilla insurgents in Iraq. After Jesus sliced and diced his way to glory a millennium ago, Allah is inflicting some serious damage this time around.

2008 – Present Pax Americana vs. the Middle Kingdom Local Cycle

Faced with another deflationary economic collapse, Pax Americana defaulted and devalued again. This time, instead of banning the private ownership of gold and then devaluing the dollar vs. gold, the Fed decided to print money and buy government bonds, which is euphemistically called quantitative easing. The amount of dollar-based credit in both situations expanded rapidly to “save” the economy.

Proxy wars between the major political blocs began in earnest again. A major turning point was the Russian invasion of Georgia in 2008, which was in response to the North Atlantic Organisation’s (NATO) intent to grant Georgia membership. Halting the advance and encircling of the Russian homeland by a nuclear-armed NATO was and is priority number one for the Russian elite led by President Putin.

Currently, there are hot proxy wars between The West (Pax American and her vassals) and Eurasia (Russia, China, Iran) in Ukraine and the Levant (Israel, Jordan, Syria, and Lebanon). Either of these conflicts could escalate to a nuclear exchange between the two sides. In response to what appears to be an inexorable march toward war, nations are turning inwards and ensuring all facets of the national economy are ready to support the war effort.

As it pertains to this analysis, that means savers will be called upon to finance their nation’s wartime expenditures. They will be financially repressed. The banking system will allocate the majority of credit in the state’s direction to accomplish certain political goals.

Pax Americana defaulted on the dollar again to stop a deflationary bust similar to the Great Depression of 1930. Subsequently, protectionist trade barriers were erected, just like from 1930 to 1940. All nation-states are looking out for themselves, which can only mean experiencing financial repression while suffering from ripping inflation.

The S&P 500 Index (white) vs. Gold (gold) vs. Bitcoin (green) indexed at 100 starting 25 November 2008 to the present.

This time, capital was free to leave the system as the Fed devalued the dollar. The wrinkle is that at the start of the current Local cycle, Bitcoin offered another stateless currency. The key difference between Bitcoin and gold is that in Lynn Alden’s terms, the ledger for Bitcoin is maintained through a cryptographic blockchain, and money moves at the speed of light. In contrast, gold’s ledger is maintained by nature and moves only as fast as humans can physically transfer gold. When paired against digital fiat, which also moves at lightspeed but can be printed in infinite quantities by governments, Bitcoin is superior, whereas gold is inferior. That is why Bitcoin stole some of gold’s thunder from 2009 until the present.

Bitcoin has outperformed to such a massive extent that you can’t decipher the difference in returns between gold and stocks on this chart. Gold underperformed stocks by almost 300% as a result.

The End of QE

As incredible as I believe my contextualization and description of the past 100 years of financial history is, it doesn’t assuage concerns about the end of this current bull market. We know we are in an inflationary period, and Bitcoin has done what it’s supposed to: outperform stocks and fiat debasement. However, timing is everything. If you bought Bitcoin at the recent all-time high, you might feel like a beta cuck because you extrapolated past results into an uncertain future. That being said, if we believe that inflation is here to stay and wars, whether cold, hot, or proxy, are on the horizon, what does the past tell us about the future?

Governments have always repressed domestic savers to fund wars and past cycle winners and maintain systematic stability. In this modern age of the nation-state and large integrated commercial banking systems, the primary way governments fund themselves and key industries is by dictating how banks allocate credit.

The problem with QE is that the market takes free money and credit and invests it in businesses that do not produce the real stuff a wartime economy needs. Pax Americana is the best example of this phenomenon. Volker started the age of the omnipotent central banker. Central bankers created bank reserves by buying bonds, which lowered the cost and increased the amount of credit.

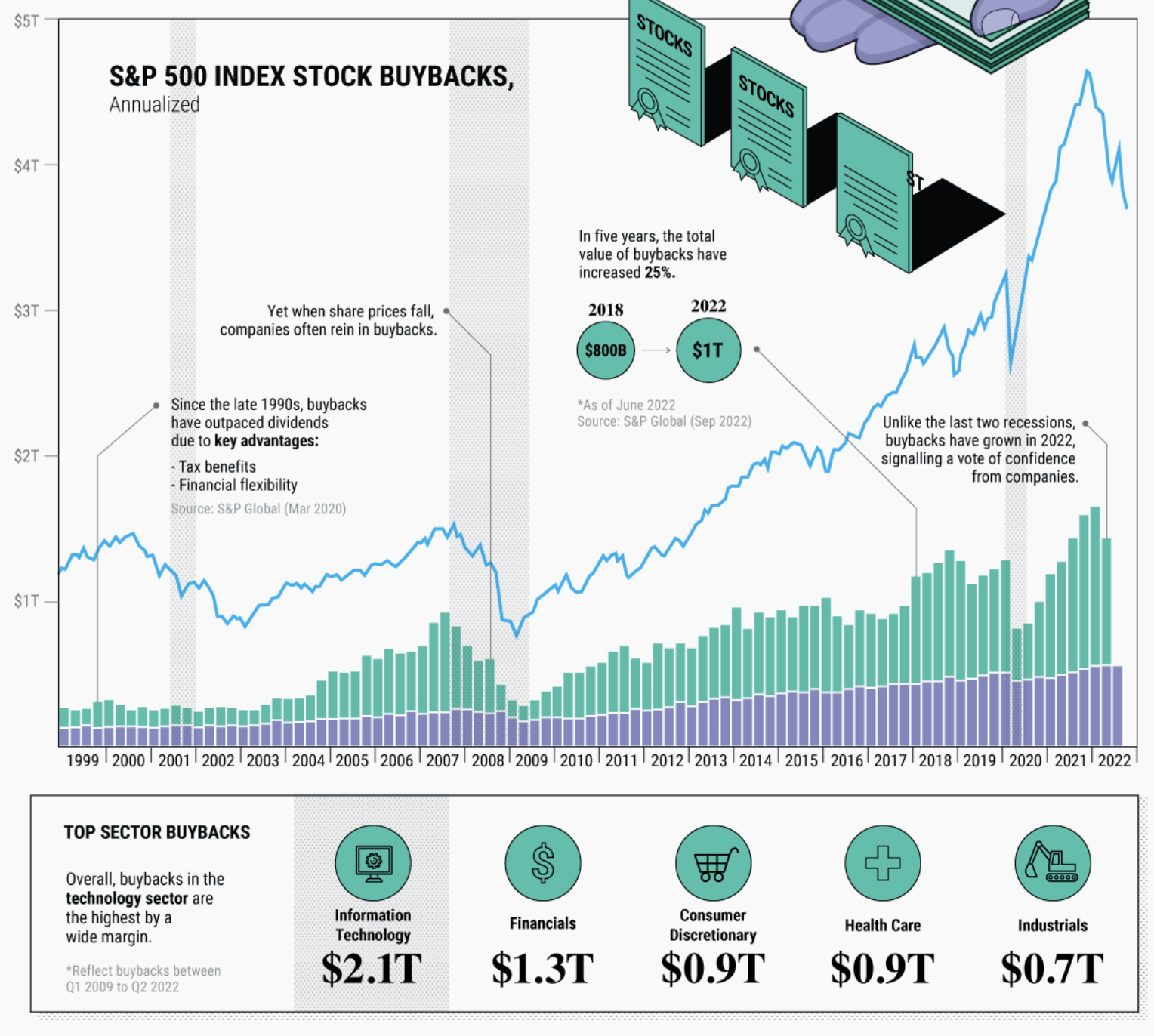

In private capital markets, credit was allocated to maximise shareholder returns. The easiest way to juice the stock price is to reduce the float by engaging in buybacks. Companies that can access cheap credit, borrow money, and buy back their stock. They do not borrow money and increase capacity or improve their technology. Bettering your business in the hope it leads to more revenue is challenging, and is not assured to pump the stock. But mathematically, by reducing the float, you raise the stock’s price, which has happened since 2008 for large-cap companies with access to cheap and plentiful credit.

Source: Link

The other low-hanging fruit is to increase profit margins. Thus, the stock price is not used to build new capacity or invest in better technology but to lower input costs of labour by sending jobs to China and other low-cost countries. The US manufacturing sector is so crippled that it could not produce enough ammunition to defeat Russia in Ukraine. Also, China is such a better place to manufacture goods that the US Department of Defense has a supply chain riddled with critical inputs produced by Chinese firms. These same Chinese firms, in most cases, are state-owned enterprises. QE, combined with shareholder-first capitalism, rendered the US military “juggernaut” dependent on the nation’s “strategic competitor” (their words, not mine), Choyna. Fucking hilarious!

How Pax Americana and the collective West allocate credit will resemble how the Chinese, Japanese, and Koreans do it. Either the state will directly instruct the banks to lend to this or that industry/company or banks will be forced to buy government bonds at below-market yields so that the state can hand out subsidies and tax credits to the “right” businesses. In either case, the return on capital or savings will be lower than nominal growth and or inflation. The only way to escape, assuming no capital controls are erected, is to buy a store of value outside of the system like Bitcoin.

For those of you obsessively observing the change of the major central banking balance sheets and concluding that credit is not rising fast enough to power another leg up in crypto prices, you now must obsessively observe the amount of credit created by commercial banks. Banks do this by loaning money to non-financial businesses. Fiscal deficits also emit credit in that the deficit must be funded by borrowing in the sovereign debt markets, which the banks will dutifully purchase.

To simplify, in the past cycle, we monitored the size of the central bank’s balance sheet. In this cycle, we must monitor fiscal deficits and the total amount of non-financial bank credit.

Trading Tactics

Why am I confident that Bitcoin will regain its mojo?

Why am I confident that we are in the midst of a new mega-local, nation-state first, inflationary cycle?

Feast your eyes on this nugget:

The U.S. budget deficit is projected to surge to $1.915 trillion in fiscal 2024, exceeding last year’s $1.695 trillion and marking the highest level outside the COVID-19 era, according to a federal agency that attributed the 27% increase compared to its earlier forecast to higher spending.

That’s for those who worried that Slow Joe Biden wouldn’t ram through more spending to keep the economy humming along before the election.

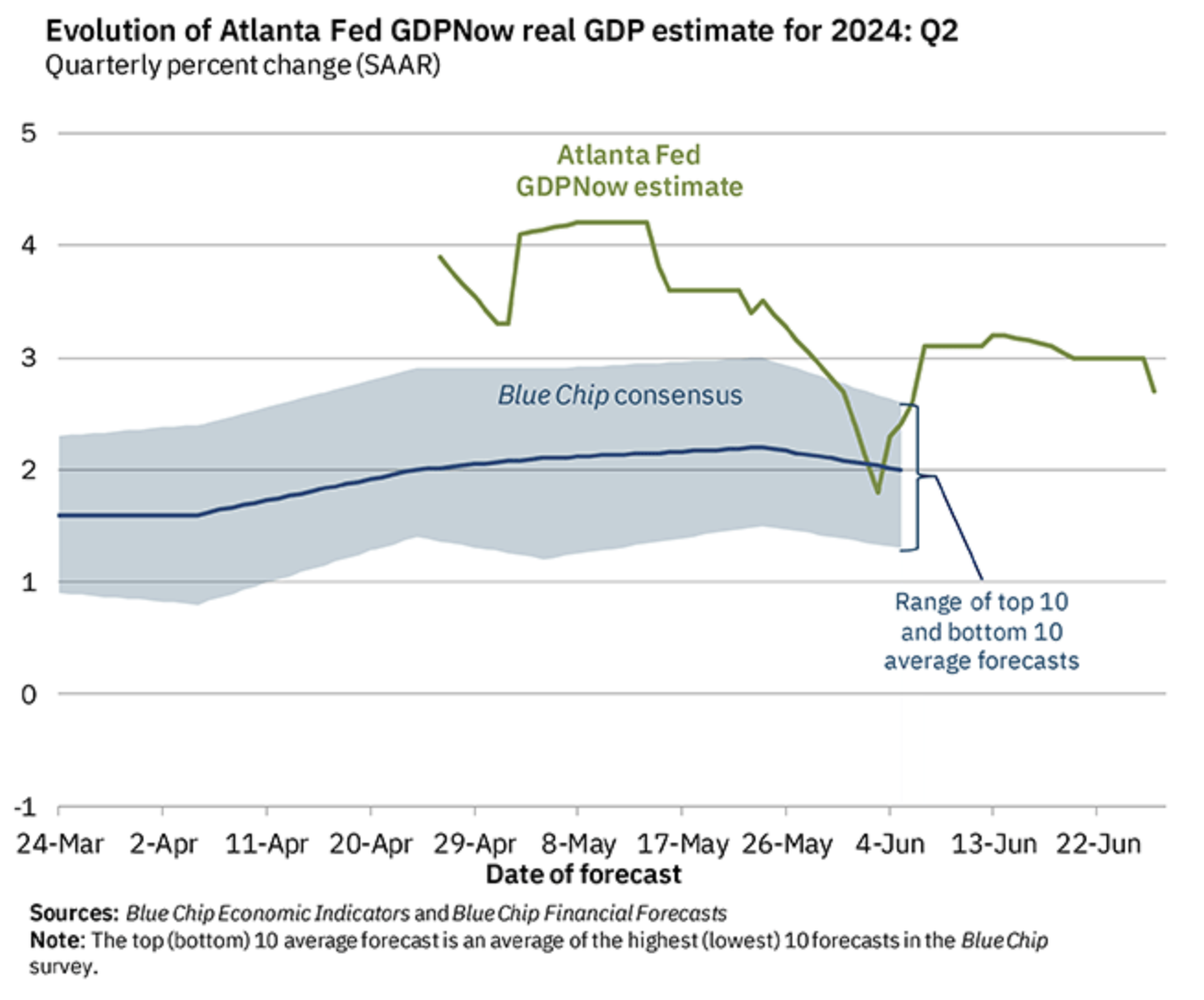

The Atlanta Fed is projecting 3Q24 real GDP growth at a stonking +2.7%.

For those worried about a recession in Pax Americana, it is mathematically extremely difficult to experience a recession when the government is spending $2 trillion in excess of tax receipts. This represents 7.3% of the 2023 GDP. For context, US GDP growth fell by 0.1% in 2008 and 2.5% during the Global Financial Crisis in 2009. If another GFC happened this year at a similar severity to the last one, the fall in private economic growth would still not exceed the amount of government spending. There ain’t going to be a recession. That doesn’t mean a large swath of plebes won’t be in dire financial straits, but Pax Americana will chug along regardless.

I’m pointing this out because I believe fiscal and monetary conditions are loose and will continue to be loose, and therefore, hodl’ing crypto is the best way to preserve wealth. I am confident that today will rhyme with the 1930s to 1970s, and that means, given I can still freely move from fiat to crypto, I should do so because debasement through the expansion and centralisation of credit allocation through the banking system is coming.

Related

The post appeared first on Blog BitMex